The US annual inflation rate has surged under President Joe Biden, hitting a 40-year high of 7.9% in February. The personal consumption expenditure (PCE) price index, the Federal Reserve’s preferred inflation gauge, climbed 6.4% year-over-year. The producer price index (PPI) hit 10%. The White House will repeatedly claim that this is “Putin’s price hike,” although the data show that this had been a problem even before Russia’s invasion of Ukraine. So, who is to blame anyway?

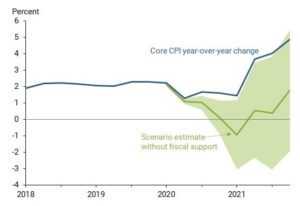

The San Francisco Fed Bank recently published its Economic Letter, exploring why inflation is higher than the average rate in other Organisation for Economic Co-operation and Development (OECD) countries, such as Canada, France, Germany, and the United Kingdom. One of the report authors’ conclusions was that federal fiscal support added to the current inflationary environment.

“Specifically, the two peaks in US disposable personal income reflect the CARES Act, signed into law on March 27, 2020, and the American Rescue Plan (ARP) Act of 2021, signed about a year later,” research authors stated. “Both Acts resulted in an unprecedented injection of direct assistance with a relatively short duration. In contrast, real disposable personal income for our OECD sample increased only moderately during the pandemic.”

Indeed, when the US government is injecting trillions of dollars into the economy, particularly when there are fewer goods, there is too much money chasing a scarcity of products. But the central bank cannot be left off the hook since it was the institution that facilitated this injection with more than one-third of all US dollars ever created in American history in less than two years. The administration and Congress spent like drunken sailors, but the Fed supplied Washington with the hooch.

Indeed, when the US government is injecting trillions of dollars into the economy, particularly when there are fewer goods, there is too much money chasing a scarcity of products. But the central bank cannot be left off the hook since it was the institution that facilitated this injection with more than one-third of all US dollars ever created in American history in less than two years. The administration and Congress spent like drunken sailors, but the Fed supplied Washington with the hooch.

Remember, despite the tightening of monetary policy, conditions are still highly accommodative. The real interest rate remains negative, the Eccles Building only stopped purchasing assets last month, and the balance sheet is still more than $9 trillion. The Fed can raise rates by 50 basis points at the two-day Federal Open Market Committee (FOMC) in May, but the benchmark fed fund rate would still be historically low when inflation is historically high.

A Sizzling Labor Market

The US economy returned 431,000 jobs in March, falling short of the market estimate of 490,000. The unemployment rate slipped to 3.6%, better than the consensus of 3.7%. Average hourly earnings rose 0.4% to $31.73, average weekly hours dipped to 34.6, and the labor force participation rate jumped 62.4%.

Leisure and hospitality led the gains again, gaining 112,000 positions. Professional and business services advanced 102,000. Education and health care increased by 43,000, and the retail trade added 49,000. Construction and manufacturing contributed 38,000 and 19,000, respectively, to the Bureau of Labor Statistics (BLS) report. Utilities lost 1,200 jobs, while transportation and warehousing shed 500.

Economists and market analysts were pleased by the numbers, although they concede that the labor force is smaller than it was prior to the coronavirus pandemic. Still, the labor front could be the only positive aspect of this inflationary environment that some strategists refer to as a “cost of living crisis.”

Economists and market analysts were pleased by the numbers, although they concede that the labor force is smaller than it was prior to the coronavirus pandemic. Still, the labor front could be the only positive aspect of this inflationary environment that some strategists refer to as a “cost of living crisis.”

“The March jobs report shows employment remains the best part of the economy, especially for lower-wage workers,” said Robert Frick, corporate economist at Navy Federal Credit Union, in a note. “These show an economy accelerating as the pandemic diminishes, and job levels probably reaching pre-pandemic levels this summer.”

Current conditions are still tilted in favor of workers. The number of job openings totaled 11.266 million, and job quits inched higher to 4.352 million. Unfortunately, despite hourly wages soaring over the last 12 months, real wage growth is -2.6% amid skyrocketing inflation. The Great Resignation is still true.

Hurling a Yield Curve on The Street

It’s here! It’s here! The yield curve inversion – short-term rates are higher than longer-term bond yields – has returned. The end is nigh, so dive into your bunkers and keep your Robinhood trading app open. It is time for a recession, a financial crisis, or an economic collapse. Is this hyperbole? Why, yes, of course. But everyone is giddy again because the two-year Treasury yield topped the ten-year rate twice this week. Plus, the five-year and 30-year yields inverted for the first time since 2006.

Bespoke Services notes that when the curve inverts, “there has been a better than two-thirds chance of a recession at some point in the next year and a greater than 98% chance of a recession at some point in the next two years.” Moreover, MUFG Securities reported that the yield curve inverted 422 days before the 2001 downturn, 571 days prior to the Great Recession, and 163 days before the 2020 COVID-induced crash.

(Photo Illustration by Thiago Prudencio/SOPA Images/LightRocket via Getty Images)

Indeed, more Wall Street titans have been raising their recession odds over the last month. Goldman Sachs increased the chances to 35%, while Evercore ISI revised the probability of a recession upward to 25%. Many analysts note that rampant inflation and removing fiscal and monetary support and relief measures could plunge the United States into an economic contraction sometime over the next 24 months.

However, as Liberty Nation noted in 2019: “One of the reasons it might not be such a trusted measurement is that the panoply of quantitative easing (QE) programs implemented by central banks around the world have eviscerated the dependability of inversions as a forecasting tool.” Trillions in liquidity and historically low interest rates have eroded the efficacy of this recession indicator.

Stagflation – a blend of stagnating growth and sizzling inflation – might be more of a possibility. But with investors already pricing in a rate cut by the Fed in the second half of 2023, perhaps Chair Jerome Powell will be lucky enough to avert a recession. Whatever the case, Americans are living in strange times where nothing is normal.