The Nasdaq Composite Index slipped into a bear market a couple of months ago, plummeting nearly 32% year-to-date. The S&P 500 recently fell into bearish territory, adding to its 2022 decline of more than 23%. Is the Dow Jones Industrial Average next? This is the next domino to fall as the benchmark index is down about 18% on the year. The equities arena showed proof of life during the June 17 trading session, but these relief rallies are short-lived as investors catch falling knives.

Now that the Federal Reserve is raising interest rates, unwinding its $9 trillion balance sheet, and essentially conveying to Wall Street that everyone is on their own, the stock market is proving that the last two years were nothing more than a fugazi. Retail traders are also sitting on their hands for one of three reasons: they continually bought the dip and now their brokerage accounts are empty, their accrued pandemic-era savings have been exhausted, or they are waiting for a stimulus check from President Joe Biden.

[substack align=”right”]The US central bank’s quasi-third mandate – supporting stocks by any means necessary – has been abandoned in pursuit of stabilizing prices and busting inflation. Chair Jerome Powell told a Fed-sponsored conference, “The Federal Reserve’s strong commitment to our price stability mandate contributes to the widespread confidence in the dollar as a store of value. To that end, my colleagues and I are acutely focused on returning inflation to our two percent objective.”

Investors are now pricing in a more hawkish central bank, a recession, and potentially higher inflation. The June consumer price index (CPI) report will be must-see television next month because it could hammer the final nail in the US economy’s coffin.

The euphoria is gone. The mirage has been eviscerated. The unrealized capital gains have been wiped out. What is left for the average American? Well, at least they have a strong labor market in case they need cash to cover the light bill and fill up the gas tank, right? Right?

Cooling Down the Hot Jobs Market

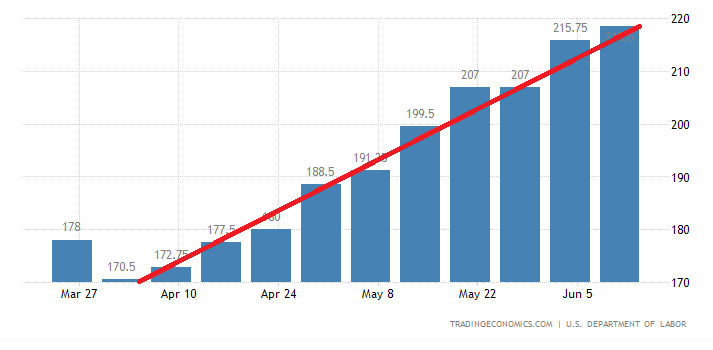

The number of Americans filing for unemployment benefits totaled 229,000 in the week ending June 11, according to the Bureau of Labor Statistics (BLS). This was higher than the market forecast of 215,000. Continuing jobless claims advanced to 1.312 million, while the four-week average, which removes week-to-week volatility, edged up to 218,500.

While the May jobs report recorded better-than-expected employment gains, the latest weekly BLS data are showing a steady boost in out-of-work folks. Since the beginning of April, soon after the Fed raised the benchmark Fed funds rate by 25 basis points, the four-week jobless claims average started inching higher and higher.

In the first week of April, there were 170,500 jobless claims. Today, there were nearly 219,000. This is a concerning trend because the labor market had been the only ounce of hope in an ailing economy. Of course, it is not entirely surprising since higher rates typically equate to greater joblessness. The reason is that a rising-rate environment will diminish business activity, increase borrowing costs, and force economic participants to scale back their expansion plans.

Republicans Ditch Fiscal Responsibility – Again

Republicans Ditch Fiscal Responsibility – Again

Sen. Rand Paul (R-KY) has repeatedly attempted to reignite fiscal conservatism in Washington. Despite lamenting President Joe Biden and the Democrats’ free-spending ways, Republicans were not too thrilled over Sen. Paul’s “Six Penny Plan.” This federal budget proposal aimed to balance the books in five years by returning to 2019 spending levels. Back then, politicians’ outlays were already out of control, so it would not be too much to ask the greedy Gretchens to at least try to return to spending $4.4 trillion instead of more than $6 trillion.

However, it turned out to be too much to endure for Democrats and Republicans, as the legislation was voted down 67-29. All Democrats and 17 Republicans opposed the measure, including Sens. Susan Collins (R-ME), James Inhofe (R-OK), Mitch McConnell (R-KY), and Ben Sasse (R-NE). Following the vote, Paul issued a statement:

“Washington’s addiction to spending is hurting our economy and depleting our currency. Inflation is stealing every American’s purchasing power and financial security. And yet, no democrat or republican has produced a federal budget; my Six Penny Plan is the only one. My plan provides a commonsense solution for fiscal sanity. It puts our nation on track to balance the federal budget in the next five years, and it solves this inflationary and spending crisis that Congress created.”

This was not Paul’s first attempt at resuscitating fiscal sanity. In 2011, his colleagues shot down a budget resolution that would have frozen – not cut – spending for five years. In 2018, senators rejected Paul’s “Penny Plan” that would have balanced the budget in five years by simply trimming a mere one cent out of each non-Social Security dollar for five straight years. A year later, esteemed representatives were against his “Pennies Plan” which recommended two cents-per-dollar cuts for five years.

This was not Paul’s first attempt at resuscitating fiscal sanity. In 2011, his colleagues shot down a budget resolution that would have frozen – not cut – spending for five years. In 2018, senators rejected Paul’s “Penny Plan” that would have balanced the budget in five years by simply trimming a mere one cent out of each non-Social Security dollar for five straight years. A year later, esteemed representatives were against his “Pennies Plan” which recommended two cents-per-dollar cuts for five years.

Under current law, the Biden administration forecast that the US government will record approximately $14 trillion worth of deficits over the next decade. At a time when interest rates are rising, and the White House is presenting subdued interest-rate projections in this span in the FY 2023 budget, the federal deficits will intensify, and the national debt will accelerate.

Here is a warning from the Committee for a Responsible Federal Budget (CRFB):

“As a result, net interest will comprise a larger and larger share of federal spending, increasing deficits and crowding out other important priorities. Policymakers should work to reduce budget deficits and put debt on a sustainable path through a combination of entitlement reforms, spending reductions, and revenue increases.”

This is what happens when there is a bipartisan blitzkrieg to determine who can outspend and add to Uncle Sam’s credit card that will need to be repaid by future generations. As the 45th president would routinely tweet: Sad!