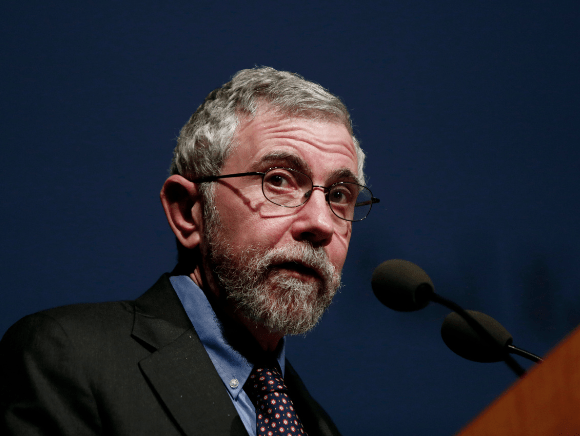

The it-girl of Keynesian economics, Paul Krugman, has done the unthinkable: He admitted that he got it wrong on inflation. While the concession is welcomed, it is perhaps eight months too late as the usual suspects in today’s plethora of economic troubles have already confessed to how badly they misjudged or misread the situation. But this is not the first time that Krugman has failed to knock it out of the ballpark, be it the permanent effects of the internet or purporting that price inflation only affects the wealthy. Considering the number of establishment figures who completely dropped the ball over the last two years, maybe Krugman is attempting to conceal his apology and incorrect forecasts in a haystack of misinformation.

Paul Krugman: Then, Now, Forever

In a recent New York Times blog post, titled “I Was Wrong About Inflation,” Krugman explained that “an intense debate” unfolded in early 2021 in the aftermath of President Joe Biden’s $1.9 trillion American Rescue Plan (ARP). While others sounded the alarm about the inflationary dangers, Krugman was on “Team Relaxed,” which “as it turned out, of course, that was a very bad call.”

He alluded to conventional interventionist thinking: Government stimulus would facilitate demand. But, according to Krugman, “Team Inflation was right for the wrong reasons,” adding that the common expectations among academics, bureaucrats, and public policymakers were defied by consumers. He acknowledged the various disruptions that have transpired, whether it is Russia’s invasion of Ukraine or China’s lockdowns in response to fresh coronavirus outbreaks. Krugman now expects inflation to have already peaked or is on the cusp of peaking.

“In any case, the whole experience has been a lesson in humility,” he wrote. “Nobody will believe this, but in the aftermath of the 2008 crisis standard economic models performed pretty well, and I felt comfortable applying those models in 2021. But in retrospect I should have realized that, in the face of the new world created by Covid-19, that kind of extrapolation wasn’t a safe bet.”

What made this op-ed a fascinating read was two-fold. The first was the paucity of understanding of the diagnosis. The second was not realizing that shutting down an entire economy and giving people free money would strain the system worldwide. These are our supposed intellectual superiors who should know better. Once again, Paul Krugman applies a lesson in the fatal conceit, thinking that wise men and women can pull the levers and dictate the public’s subjective value.

Indeed, Krugman does not exactly possess a winning record in his field of study, despite holding a Nobel Prize in Economics for geography. For the uninitiated, let’s take a walk down memory lane to see his forecasts and commentary. But for the initiated, you will be as entertained by Krugman’s wild take on everything.

Lost in Krugmanistan

In 1998, Krugman was convinced that the internet would have as much of an impact on the economy as the fax machine. Years later, the bestselling author suggested that the Federal Reserve needed to replace the dot-com bubble with the housing bubble. Krugman demanded that former President Barack Obama “end this depression!” despite the money supply expansion supporting anemic economic growth for eight years. But Krugman’s comments from the last few years have been some of the most fascinating to read.

It was a challenging period for Krugman in late 2016. In October of that year, he encouraged Hillary Clinton, who he thought would win the election, to ignore “the debt scolds” and continue the 21st-century policy of deficit-financed spending. A month later, shortly following the election of Donald Trump, he declared that “Deficits Matter Again.” Two months later, Krugman lambasted the Republicans for presenting stimulus proposals, although he recommended the same strategies.

This is the same gentleman who contends that House Speaker Nancy Pelosi (D-CA) is one of the best in recent history, and “Democrats make big efforts to balance the budget” while the Tea Party “was basically about race.”

Krugman’s takes on Bitcoin and gold are laughable, too, averring that any support for these two assets is “libertarian derp.” He also believed that customers bought automobiles with gold ingots rather than certificates backed by the yellow metal. This is not entirely surprising because he blamed the endorsement of sound money for the rise of Adolf Hitler.

A funny March 2021 blog post in the newspaper repeated the socialist nonsense that too much choice exists in the United States and is bad for the country. He wrote at the time: “And in the real world, too much choice can be a big problem. … I’d suggest that an excess of choice is taking a psychological toll on many Americans, even when they don’t end up experiencing disaster.”

Ostensibly, the panacea is an economy with less choice and centralized decision-making. Although he has railed against monopolies and oligopolies, Krugman, Sen. Bernie Sanders (I-VT), and the plethora of other leftists who think Americans should not have six different options of deodorant or two-dozen pairs of sneakers. Of course, these same people should also own multiple residential properties.

Understanding Bidenflation

In summary, today’s red-hot 9.1% inflation reading occurred because Washington spent several trillion dollars and the Federal Reserve injected $9 trillion into the economy in just two years, effectively creating new units of currency that chased too few goods. There have been many other variables, too, from the supply chain crisis to the military conflict in Eastern Europe. But the money-printing crusade was the chief culprit for everything that ails the global economy. While Fed Chair Jerome Powell, Treasury Secretary Janet Yelle, and Paul Krugman have finally realized that inflation is not transitory, Liberty Nation had anticipated the inflation threat since the first stimulus and relief package in March 2020.