On Aug. 15, 1971, the U.S economy was jolted by the Nixon Shock. Fifty years ago, then-President Richard Nixon introduced a series of measures in response to deteriorating economic conditions, from soaring inflation to rising unemployment. While these consequential policy mechanisms were designed and instituted to grapple with the problems of the early 1970s, the 37th president’s proposed interventionist panaceas enabled the nation to flirt with various hallmarks of socialism and permanently alter the country’s fabric. Did this shock resolve the costs associated with the guns and butter of the 1960s, or did it pave the road to financial repression and enhanced statism?

The Nixon Shock: A Primer

Nixon attempted to turn around the 6% jobless rate and the 4.4% inflation level. He instituted a 90-day freeze on prices and wages, the first of its kind since World War II. In addition, Nixon slapped a 10% surcharge on all imports subject to a duty to ensure American goods remained competitive in the increasingly global marketplace. The man famous for uttering “I am not a crook” also suspended the dollar’s convertibility into gold, effectively shutting down the gold window that stopped foreign governments from converting their dollars for the yellow metal.

Nixon attempted to turn around the 6% jobless rate and the 4.4% inflation level. He instituted a 90-day freeze on prices and wages, the first of its kind since World War II. In addition, Nixon slapped a 10% surcharge on all imports subject to a duty to ensure American goods remained competitive in the increasingly global marketplace. The man famous for uttering “I am not a crook” also suspended the dollar’s convertibility into gold, effectively shutting down the gold window that stopped foreign governments from converting their dollars for the yellow metal.

According to the president, this new economic policy would “create a new prosperity without war,” telling a televised audience:

“The third indispensable element in building the new prosperity is closely related to creating new jobs and halting inflation. We must protect the position of the American dollar as a pillar of monetary stability around the world.

“In the past seven years, there has been an average of one international monetary crisis every year …

“The effect of this action, in other words, will be to stabilize the dollar.”

At first, this was a celebrated maneuver to stimulate the economy, leading to political and financial adulation. The press was ebullient, while the financial markets recorded the biggest single-session gain in history (at the time). But did it lead to a prosperous era, or did it snowball everything wrong with Keynesian orthodoxy and transition to an economy dependent on perpetual stimulus and relief?

How Nixonomics Changed the Economy

The United States was no stranger to these measures.

At the start of the Great Depression, the Smoot-Hawley Tariff Act of 1930 was enacted and raised tariffs on more than 20,000 imported goods. Conservative and libertarian economists purport this bill exacerbated the economic collapse and left the Land of the Free in tatters longer than it needed to be. The U.S. government started confiscating gold four years later, arguing that hoarding the precious metal worsened the Depression. In 1942, then-President Franklin Delano Roosevelt signed the Emergency Price Control Act, an instrument of quasi-socialist tenets that targeted agricultural commodities (beef, lamb, mutton, and veal), real estate, and voluntary agreements.

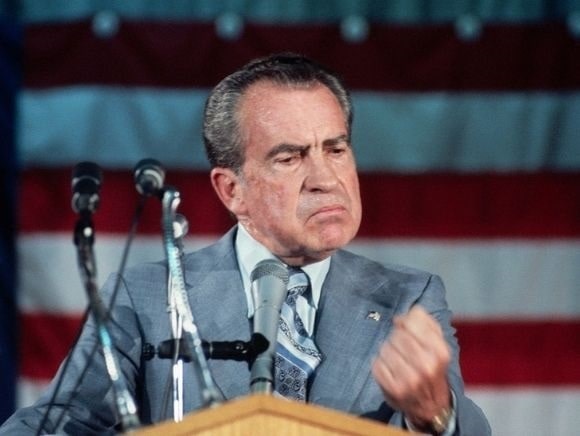

Richard Nixon

(Photo by © Wally McNamee/CORBIS/Corbis via Getty Images)

However, as every financial crisis or violent conflict highlights, the leviathan never concedes this weaponry any time the government accumulates more and greater power. Instead, the Swamp not only maintains this political might, but presidents and lawmakers build upon it any time a downturn or war unfolds. But while price controls and tariffs were temporary efforts, abandoning gold for fiat was permanent and ignited an era of unsound money and unlimited central bank capacity.

Indeed, there is a reason why a Treasury official exclaimed to Chair of the Council of Economic Advisers Herb Stein and Nixon speechwriter William Safire “oh my god!” when he was told that the White House would be slamming the gold window shut. It would turbocharge federal spending, increase budget deficits, and facilitate debt accumulation. The Nixonians essentially planted the seeds of disregard and mendacity among today’s ruling class that sound money reverses economic calamities.

As Ralph Benko, the senior economic adviser to the American Principles Project, wrote in Forbes: “How ironic that the most staunch defenders of a pure paper standard, the sole remnant of Nixonomics, are a few influential ‘progressives’ such as Paul Krugman, Joseph Stiglitz and Thomas Frank.”

But there was another bystander that the central planners defeated: the Bretton Woods System.

The End of Bretton Woods

Soon after World War II, the United States, Canada, Europe, Australia, and Japan erected the Bretton Woods System. The agreement would force signatories to establish a monetary policy that kept the exchange within a fixed value of gold. Put simply, acquiring the currency would reduce the money supply and boost its value. The objective was comparable to every centrally controlled monetary endeavor: promote economic growth and stability and keep the lid on inflation, achieving neither.

So, was it a superior and efficacious system? Lew Rockwell, author and founder and chairman of the Mises Institute, opined: “As with all government plans, Bretton Woods was dealing with symptoms rather than causes and treating those symptoms in a way that enables and even encourages the disease.”

So, was it a superior and efficacious system? Lew Rockwell, author and founder and chairman of the Mises Institute, opined: “As with all government plans, Bretton Woods was dealing with symptoms rather than causes and treating those symptoms in a way that enables and even encourages the disease.”

It laid the groundwork for many of the Keynesian schemes unleashed on developed and developing economies today, creating bailout mechanisms and nudging politicians to approve astronomical spending plans. Bretton Woods was a Faustian bargain that freed chief executives, bureaucrats, and legislators the constraints of a gold standard, allowing free rein over the printing press. It could be professed that Bretton Woods spawned the “money go brrr” blitzkrieg of 2020 and 2021, lending credibility to the idea that printing cash births eternal affluence.

You Won’t Have Nixon to Kick Around Anymore?

The spirit of Nixon has haunted the U.S. economy for decades, eventually possessing the international economy by pushing governments to implement price controls and import taxes to promote growth. From the cost ceilings of Latin America to the tariffs in Europe to the evisceration of sound money across the globe, the fingerprints of Nixonomics can be uncovered in every corner of the planet.

However, considering that the Nixon Shock was devised by the likes of then-Fed Chair Arthur Burns and incoming Treasury Secretary John Connally, the president was merely a cheerleader who parroted the talking points of the expert class, much like elected officials regurgitating the tommyrot emanating from the lips and pens of The New Science disciples in 2021. It has been five decades since the top Republican at the time sent shockwaves throughout the American economic landscape. At this point, critics may no longer have Nixon to kick around anymore, leaving this bombardment of criticisms and finger-wagging to the modern-day experts who still champion the archaic and asinine principles of the Keynesian and the post-Keynesian doctrines. But, be it Trumponomics or Bidenomics, there is always a hint of Nixonomics to be found.

~

Read more from Andrew Moran.