We’ve seen it a million times: Fresh out of high school and on their own for the first time, many a new adult receives that first credit card – the ability to spend money they’ve yet to earn – well before learning how to manage what little they do have. How many, mad with the power of it all, max it out immediately, go thousands of dollars into debt, and wreck their financial lives and credit ratings for years to come? Why is it that our federal government – well into its third century of managing its own finances – shows without fail this exact same behavioral pattern every time the debt limit is increased?

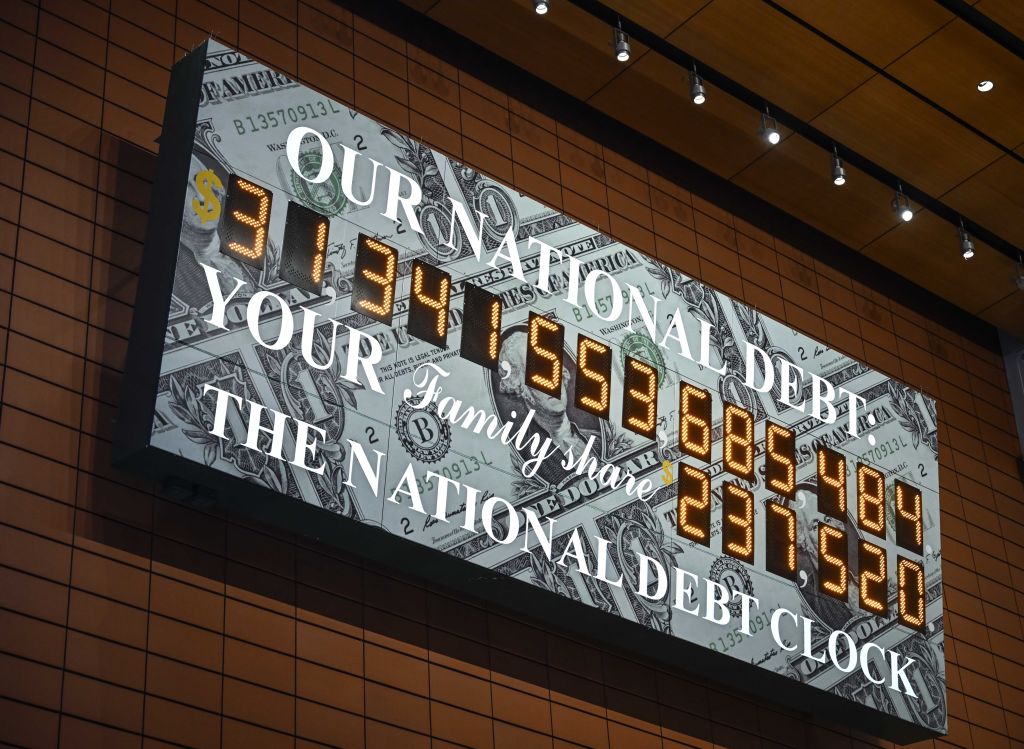

Like that out-of-control teen or 20-something, the powers that be seem incapable of bearing any amount of unspent money – or available credit – without it burning a hole in their pockets. When the reckless spender is the world’s largest economy, it has the power to borrow more to pay for the loans it already has simply because the creditors can’t afford to say no. But whether it takes a year, a decade, or even a generation or two, the day will come when the interest alone becomes more than the nation can bear. If the House GOP and President Biden don’t reach an agreement soon, however, that day may come a lot sooner. Still, no deal appears on the horizon, and the clock is ticking.

Like that out-of-control teen or 20-something, the powers that be seem incapable of bearing any amount of unspent money – or available credit – without it burning a hole in their pockets. When the reckless spender is the world’s largest economy, it has the power to borrow more to pay for the loans it already has simply because the creditors can’t afford to say no. But whether it takes a year, a decade, or even a generation or two, the day will come when the interest alone becomes more than the nation can bear. If the House GOP and President Biden don’t reach an agreement soon, however, that day may come a lot sooner. Still, no deal appears on the horizon, and the clock is ticking.

Senate Sitting Out

For any deal to work, it likely has to come from Speaker of the House Kevin McCarthy (R-CA) and the president working in concert. Anything that manages to survive the 60-vote hurdle in the Democrat-led Senate seems unlikely to pass muster in the GOP’s House, so whatever arrangement comes, it’s on McCarthy to make it happen. Senate Minority Leader Mitch McConnell (R-KY) said as much to reporters, and Senate Majority Leader Chuck Schumer (D-NY) agrees.

“I can’t imagine any debt ceiling provision passed out of the Senate with 60 votes could actually pass this particular House,” McConnell explained. “So I think the final solution to this particular episode lies between Speaker McCarthy and the president.” And so, it seems, the Senate is largely sitting this one out for now.

Down With the Debt Limit

The answer, according to Rep. Bill Foster (D-IL), is to do away with the debt limit entirely. “Weaponizing the debt ceiling and using it as a pawn in partisan budget negotiations is dangerous and repeatedly brings our nation to the brink of default, which would be disastrous to the U.S. economy – something we’ve witnessed as recently as 2011 when Republicans created a debt ceiling crisis that resulted in the first ever downgrade to the U.S. credit rating,” he said.

The 2011 numbers were child’s play, compared to today’s, of course. Between 2008 and 2010, Congress raised the national debt limit from $10.6 trillion to $14.3 trillion, and by 2011, negotiations had to begin anew as we reached that already vaulted ceiling. The debt is well over twice that now, and only growing. But rather than truly entertain discussions on a balanced budget – nevermind one geared toward aggressively digging out of the hole – Rep. Foster and his colleagues in the Swamp hope to “solve the problem” by removing the borrowing cap entirely.

The 2011 numbers were child’s play, compared to today’s, of course. Between 2008 and 2010, Congress raised the national debt limit from $10.6 trillion to $14.3 trillion, and by 2011, negotiations had to begin anew as we reached that already vaulted ceiling. The debt is well over twice that now, and only growing. But rather than truly entertain discussions on a balanced budget – nevermind one geared toward aggressively digging out of the hole – Rep. Foster and his colleagues in the Swamp hope to “solve the problem” by removing the borrowing cap entirely.

“The government has an obligation to pay its bills,” Foster said. “Threatening to default on our debt is the same as ordering an expensive meal at a restaurant, eating it, and skipping out without paying. We can and should have a real conversation about overall spending , but the full faith and credit of the United States must never be compromised.”

One Expensive Dinner

According to USdebtclock.org, the national debt is over $31.5 trillion, which comes out to about $94,000 per citizen compared to less than $14,000 per citizen in tax revenue collected. The debt per actual taxpayer, of course, is far worse: Roughly $246,000 and climbing. That’s one expensive dinner we’re talking about. And that’s the flaw in Mr. Foster’s fable. He’s correct in saying that it’s irresponsible to order an exorbitantly expensive meal then skip out on the bill. But how can we begin to consider it responsible to spend hundreds of dollars on a full course meal at a Michelin-starred restaurant when we can barely afford a fast food combo?

It’s an interesting moral high ground for the Democrats to take, saying, essentially, “sure, we can talk about cutting spending, but you wanted this too, now you gotta help pay for it.” Especially after taking any advantage available to force through progressive spending and debt limit increases – often without so much as a single Republican vote.

The annual interest payment on the national debt is one of the nation’s largest expenses. The top four are, in order: $1.5 trillion to Medicaid and Medicare, $1.25 trillion to Social Security, $775.9 billion in defense spending, and $523 billion in interest on the national debt. When Liberty Nation covered the debt limit increase in October of 2021, the interest payment was $378 billion. It quickly jumped to nearly $420 billion by December of that same year. If the ceiling is raised once again – or knocked out entirely, as the Democrats would like – the interest on America’s debt could very well overtake defense spending for third greatest expense this year!

Stonewall Biden’s Non-negotiable Terms

(Photo by Kevin Dietsch/Getty Images)

The US reached its technical borrowing limit of about $31.4 trillion last week, but the Treasury Department managed to employ some “extraordinary measures” to stave off disaster for a while. Still, June 5 isn’t that far away. It certainly seems to be approaching much faster than any possible solution or even worse-in-the-long-run band aid to kick the can down the road yet again.

The White House said last week that President Biden looks forward to sitting down with Speaker McCarthy to discuss a wide range of topics – including the debt limit – but thus far, no invitation has been extended. Instead, the administration doubled down on the assertion that Joe “I can work with anybody” Biden will entertain no policy concession in exchange for lifting the limit. “Like the president has said many times, raising the debt ceiling is not a negotiation; it is an obligation of this country and its leaders to avoid economic chaos,” White House Press Secretary Karine Jean-Pierre said in a statement Friday, Jan. 20. “Congress has always done it, and the president expects them to do their duty once again. That is not negotiable.”

Will McCarthy back down from his demands to cut spending? Will the Freedom Caucus, to whom he owes so much of his current power, let him? Whether this year or next – or ten years from now – the wasteful spenders will be forced to acquiesce to a balanced budget or bear the blame for what inevitably follows.