President Joe Biden is reminding the American people that he respects the Federal Reserve and its independence. Despite the central bank getting nearly everything wrong since the early days of the coronavirus pandemic, the White House is encouraging the public to have faith in the institution to combat rampant price inflation successfully. Like the Biden administration, the Jerome Powell-led Fed has lost any and all credibility by insisting that inflation was not happening and then that high prices were transitory. Fast forward to the present, quantitative tightening is the only panacea out of this mess, according to the smartest men and women at the Fed. At the same time, perhaps the president is biding his time until he adds the Eccles Building to the list of scapegoats for his failures.

Biden Mandate: ‘Respect the Fed’

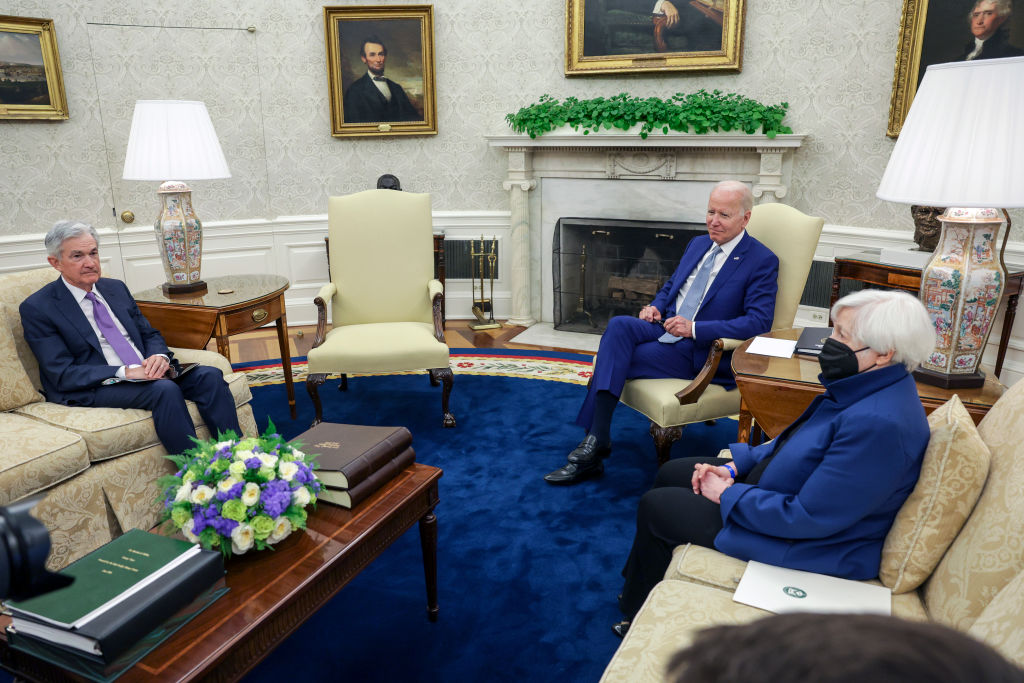

President Biden met with Fed Chair Jerome Powell and Treasury Secretary Janet Yellen on June 1 to discuss the economy and inflation. Biden noted that a chief component of his plan to address inflation is to “respect the Fed and respect the Fed’s independence” since it possesses two mandates: full employment and stable prices. This was President Biden’s third in-person meeting with Powell in the last 18 months, sharing the same urgency as the powwows between former President Ronald Reagan and former Fed Chair Paul Volcker.

President Biden met with Fed Chair Jerome Powell and Treasury Secretary Janet Yellen on June 1 to discuss the economy and inflation. Biden noted that a chief component of his plan to address inflation is to “respect the Fed and respect the Fed’s independence” since it possesses two mandates: full employment and stable prices. This was President Biden’s third in-person meeting with Powell in the last 18 months, sharing the same urgency as the powwows between former President Ronald Reagan and former Fed Chair Paul Volcker.

“My job as president is not to nominate highly — not only nominate highly — highly qualified individuals for that institution, but to give them the space they need to do their job. I’m not going to interfere with their critically important work,” Biden said at the White House.

Over the weekend, the president published an op-ed in The Wall Street Journal, stressing the Fed’s active role in trimming four-decade high inflation. He also accused former President Donald Trump of demeaning the institution, adding that “past presidents have sought to influence its decisions inappropriately during periods of elevated inflation.”

Powell and the Federal Open Market Committee (FOMC) will hold their monthly monetary policy meeting later this month. It is widely expected that the central bank will pull the trigger on a 50-basis-point rate hike at the June and July gatherings and then potentially slow down the quantitative tightening to quarter-point rate hikes to achieve the “softish landing” that Powell believes can be engineered.

WASHINGTON, DC – MAY 31: U.S. President Joe Biden, Jerome Powell and Janet Yellen (Photo by Kevin Dietsch/Getty Images)

The White House meeting comes one day after Yellen told CNN that she got it wrong on inflation. “I think I was wrong then about the path that inflation would take,” she said in an interview with the longtime cable news network personality Wolf Blitzer. “There have been unanticipated and large shocks that have boosted energy and food prices, and supply bottlenecks that have affected our economy badly that I … at the time, didn’t fully understand.”

Broken Clocks Are Right Twice a Day

President Biden has been gradually shifting the inflation blame onto the US central bank. On the one hand, this is another example of the administration refusing to accept an ounce of culpability over a problem that it is overseeing. On the other, it is absolutely correct that the Fed is responsible for soaring consumer and producer prices, thanks to its $9 trillion expansion in about two years and a zero-interest-rate policy.

The Federal Reserve manufactured this inflationary environment after slashing interest rates to near zero, injecting the economy with trillions of dollars without an equal supply of goods, and enabling the federal government – both Trump and Biden – to approve immense fiscal expansion endeavors. Indeed, it was Powell who testified in front of Congress that lawmakers need to keep spending to cushion the economic blows from the fallout of the coronavirus pandemic. And this is what they did.

Meanwhile, Biden emphasized the Fed’s independence while also suggesting that previous administrations had attempted to influence monetary policy during elevated bouts of inflation. But how can it be independent if the executive branch is nudging one of the world’s most powerful bodies? Indeed, there has been no evidence yet that Biden is pushing Powell to act in a certain direction, probably because he does not understand how the Fed functions. Still, most of the Fed’s century-old history highlights a concerning track record of collusion between the Oval Office and the bank, which is something that Trump had brought up on multiple occasions when he was first running for president in 2016. Liberty Nation documented this decades-long relationship in May 2018:

“The Fed’s partnership with Washington commenced in the 1930s, when Marriner Eccles, the seventh chairman of the Fed, ‘coordinated’ monetary policy with President Franklin Delano Roosevelt’s administration policies. Ostensibly, like so many Americans back then, Eccles immensely admired FDR and he evidently wanted the Keynesian prescription to cure the nation’s woes. Unfortunately, the Great Depression went on longer than it needed to, thanks to FDR and the Fed.”

The Washington, DC Joke

Despite access to volumes of economic data and analytics, the Federal Reserve and the Treasury Department could not foresee that a cost-of-living crisis was brewing. They had initially dismissed inflation as even happening before trying to convince everyone that it was a temporary phenomenon. Be it mendacity or incompetence, the nation’s capital dropped the ball on one of modern history’s most important developments. Nobody needed a degree in economics to understand that printing and spending trillions and shutting down an economy would generate an inflation tsunami. If the Fed could not anticipate an inflationary crisis, then why does it exist? Perhaps former Rep. Ron Paul (R-TX) was right after all: End the Fed. At least Biden and Yellen did not blame Vladimir Putin for inflation!