“Who are you going to believe?” Chico Marx asks in Duck Soup. “Me or your own eyes?” The Federal Reserve insists that stubbornly persistent high inflation, clocking in at its highest level since 1990, is transitory. After 18 months of the largest monetary expansion in U.S. history and trillions of dollars in new and old spending from the Biden administration, the hidden tax is likely to linger as an annoying pest longer than the Washington establishment had initially anticipated. This, according to one prominent market strategist, threatens the Eccles Building’s credibility. But did the Fed even have any credibility in the first place?

One of the Worst Calls Ever?

Mohamed El-Erian, the chief economic adviser at Allianz, recently sat down for an interview with CNBC’s Dan Murphy at the ADIPEC energy industry forum in Abu Dhabi, the United Arab Emirates. He presented the case that the world’s most powerful institution is shredding its credibility over insistence that inflation is transitory. El-Erian urged the Fed to “re-establish a credible voice” on the matter because the status quo stance possesses “massive institutional, political and social implications.”

“We are in this transition of central banks mischaracterizing inflation. The repeated narrative: ‘It is transitory, it is transitory, it is transitory.’ It is not transitory.

“We have ample evidence that there are behavioral changes going on. Companies are charging higher prices [and] there’s more to come. Supply disruptions are lasting for a lot longer than anybody anticipated. Consumers are advancing purchases in order to avoid problems down the road — that of course puts pressure on inflation. And then wage behaviors are changing.”

The well-known market expert noted that the numbers lead to a single conclusion: Inflation will be here for a while. His policy prescription? The Fed can accelerate its tapering and prepare for higher interest rates a la the Bank of England (BoE). Earlier this month, the rate-setting Federal Open Market Committee (FOMC) voted to trim its monthly asset-buying by $15 billion, but Fed Chair Jerome Powell told reporters at the post-powwow news conference that the policymaking body can remain “patient” on rate hikes. The financial markets appear to be penciling in a rate hike earlier than what the central bank is forecasting.

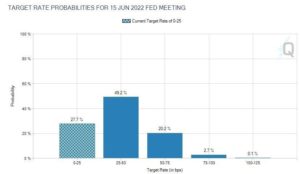

According to the CME FedWatch Tool, the FOMC is likely to move on rates by June 2022, which would be a year ahead of schedule. Other surveys of economists show that the central bank could be getting ready for multiple rate hikes beginning in the second half of next year. Markets could garner a better outlook as the Federal Reserve is scheduled to release its dot-plot, which highlights members’ predictions for interest rate movements, at next month’s FOMC policy meeting.

Didn’t the Fed Already Kill Its Credibility?

The Federal Reserve System has been billed as an upstanding institution independent of politics. During the 2016 presidential election, when then-candidate Donald Trump purported that the central bank is a political tool exploited by presidents and lawmakers, the mainstream media had an apoplectic seizure. However, history shows that the Fed has partnered and collaborated with administrations, immediately canceling any suggestion that the omnipotent body is credible because it is autonomous.

The Federal Reserve System has been billed as an upstanding institution independent of politics. During the 2016 presidential election, when then-candidate Donald Trump purported that the central bank is a political tool exploited by presidents and lawmakers, the mainstream media had an apoplectic seizure. However, history shows that the Fed has partnered and collaborated with administrations, immediately canceling any suggestion that the omnipotent body is credible because it is autonomous.

As Liberty Nation has documented, the Fed and the White House have functioned as a formidable tag team, dating back to the Great Depression when President Franklin Delano Roosevelt and Marriner Eccles, the seventh chairman of the Fed, coordinated monetary policy. In the following decades, Republican and Democratic presidents, from Richard Nixon to Barack Obama, have used the power of the printing press to their advantage.

“The Fed operates for the benefit of its executive branch controllers, the banking industry, and Fed employees themselves, at the expense of the rest of society which suffers from the economic instability it creates,” opined economist and historian Thomas DiLorenzo.

Moreover, when the Fed bailed out domestic and foreign banks and Wall Street during the 2008-2009 financial crisis, essentially socializing losses and privatizing profits, the entity diminished its integrity. When the central bank unleashed a tidal wave of newly created money into the financial system in the early days of the COVID-19 pandemic and then immediately averred that there would be little to no inflation, it eviscerated its reputation.

(Photo by Mario Tama/Getty Images)

For now, many Fed officials project that inflation will eventually normalize in the next few years and return to its target rate of about 2%. After printing one-third of all U.S. dollars ever created in history in less than two years, how could anyone utter this prognostication with a straight face? Even some of the bulls and bears of Wall Street predict inflation to run hot for a few more years, including top Bank of America strategist Michael Hartnett. He explained in a research note this past summer that it was “fascinating so many deem inflation as transitory when stimulus, economic growth, asset/commodity/housing inflations (are) deemed permanent.”

Who Believes the Swamp Anymore?

The University of Michigan’s consumer index readings released on Nov. 12 were telling for various reasons. The Consumer Sentiment Index fell to 66.8, while inflation expectations were close to 5%. Consumers also believe inflation will run around 3% over the next five years. But everyone in the Swamp, from the Oval Office to the Eccles Building, avers it is transitory. Perhaps one day they will be correct, leading to its biggest cheerleaders telling the talking heads on CNBC and Bloomberg, “I told you so.” But, of course, another financial crisis likely will ensue by then, igniting another round of monetary and fiscal stimulus, leading to rampant inflation and currency dilution.

~ Read more from Andrew Moran.