President Joe Biden, Democrats, and activists in the Fourth Estate marketed the Inflation Reduction Act as an inflation- and deficit-fighting piece of legislation that would transform the US economy. It was a bill that many consider the hallmark of the current administration. As skeptics warned when it was proposed, the legislative crusade would likely add to the budget deficit while failing to ease price pressures. Now it turns out that it will benefit the most powerful interests in the United States today, a new congressional study found.

The Inflation Reduction Act Grift

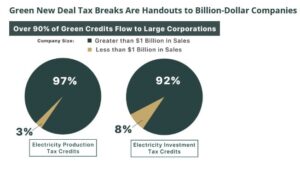

Are the American people prepared for one of the greatest wealth transfers in the nation’s history? A new study by the non-partisan Joint Committee on Taxation (JCT) found that corporations and big banks will be the primary beneficiaries of the plethora of tax breaks in the bill. Businesses that generate more than $1 billion in sales will receive a majority of special interest green energy subsidies, and financial institutions will get most of the green energy tax breaks.

The JCT report examined two specific green energy tax credit categories. The first is the Electricity Investment Tax Credits: 97% will be allocated to billion-dollar corporations. The second is the Electricity Production Tax Credits: 92% of the credits will be given to banks and insurance firms. This is more than what utility companies will claim.

“While House Republicans are fighting for working families struggling to pay their gasoline and utility bills, House Democrats are prioritizing foreign nations and sending as many taxpayer-funded handouts to corporations as possible,” said Ways and Means Committee Chairman Jason Smith (R-MO) in a statement. “With big banks pocketing three times more of these special interest tax breaks than any other industry, it’s clear Democrats are rewarding their friends on Wall Street that push their partisan ESG [environmental, social, and governance] agenda.”

The report also determined that the bill would further enrich China because foreign companies are partnering with US businesses to take advantage of these green tax credits. In addition, as Rep. Smith noted, the legislation fails to end Beijing’s control of critical mineral supply chains to manufacture equipment crucial to advance the green economy, such as batteries, solar panels, and wind turbines.

The report also determined that the bill would further enrich China because foreign companies are partnering with US businesses to take advantage of these green tax credits. In addition, as Rep. Smith noted, the legislation fails to end Beijing’s control of critical mineral supply chains to manufacture equipment crucial to advance the green economy, such as batteries, solar panels, and wind turbines.

It is no secret that environmental policies have mainly benefited wealthy Americans. So, it is unsurprising that the Inflation Duction Act (as President Biden called it in a recent speech) is still helping affluent households in Beverly Hills, CA, or Greenwich, CT.

Last year, JCT projected that the $745 billion Inflation Reduction Act would result in $16.7 billion in tax hikes for families earning less than $200,000. President Biden has repeatedly claimed that Americans earning under $400,000 would not see a penny in tax hikes. However, the highly cited report also noted that there would be $362 billion worth of tax increases and hundreds of billions of dollars worth of subsidies.

What About the Deficit?

Democrats claimed that the climate bill would tackle the federal deficit, with Biden trying to convince the public that his party pays for its spending. It turns out, however, that corporations trying to trim their tax bills would be a popular strategy. In addition, The Wall Street Journal published an article that suggested green tax credits are becoming more popular than expected and are costlier than initial estimates.

Jason Furman (Photo by Zach Gibson/Getty Images)

Jason Furman, chairman of the White House Council of Economic Advisers under President Barack Obama, told the newspaper that the Inflation Reduction Act would, at minimum, be budget-neutral rather than the promises of helping plug the budget holes.

John Bistline of the Electric Power Research Institute, Neil R. Mehrotra of the Federal Reserve Bank of Minneapolis, and Catherine Wolfram of Harvard University (on leave from the University of California-Berkeley) published a recent paper entitled “Economic Implications of the Climate Provisions of the Inflation Reduction Act.” The researchers projected that tax credits in Biden’s plan would cost $780 billion by 2031, roughly three times what even the Congressional Budget Office (CBO) and JCT estimate, mainly because most of the credits are uncapped.

The Brookings Institution then examined four alternative scores to the Inflation Reduction Act to find out how much it will increase or reduce the deficit:

- CBO: +$26 billion from 2022 to 2026 and -$264 billion from 2027 to 2031.

- Administration: +151 billion from 2022 to 2026 and -$341 billion from 2027 to 2031.

- CBO with BMW Climate*: +177 billion from 2022 to 2026 and +$131 billion from 2027 to 2031.

- CBO with BMW Climate and Higher Raisers (White House’s forecast of IRS enforcement and 25% increase in revenue from buybacks and corporate annual minimum tax): +$131 billion from 2022 to 2026 and -$118 billion from 2027 to 2031.

In total, the CBO and the administration project that the legislation will reduce the budget deficit by as much as $238 billion by 2031. The two alternative CBO calculations expect the Inflation Reduction Act to add as much as $308 billion to the deficit by 2031. Interestingly enough, the deficit-to-GDP ratio is plus or minus a fraction of a percent.

A Climate Change Bill

The worst-kept secret in the nation’s capital is that the Inflation Reduction Act was nothing more than a climate change bill. It had little to do with inflation, the budget deficit, or growing the economy. The legislation was a Build Back Better-Green New Deal hybrid aimed to install a green utopia while enriching Corporate America. Some Democrats and members of the press are not even hiding it anymore. Even proponents concede that it will not do much to mitigate price pressures or tackle the deficit. Any realistic and rational individual knew this was the case from the beginning. Now that the growth rate in the consumer price index (CPI) is slowing – no thanks to the president’s policies – the left will proclaim flawless victory.

*BMW Climate refers to the paper authors’ names: Bistline, Mehrotra, and Wolfram.