During a dinner party in lower Manhattan, there were two bears talking about the market, a bull was passed out on the sofa, and Federal Reserve Chair Jerome Powell was pouring the spiked contents of the punch bowl down the sink. The U.S. central bank has informed Wall Street that it is unscrewing the training wheels from the bicycle and allowing hedge funds and institutional investors to ride off into the sunset or fall off their bikes and scrape their knees. In other words, the Eccles Building could be slowly deflating the air from the pandemic-era market bubble. So, brace yourselves, Robinhooders, bedlam is coming to The Street!

Powell Poppers

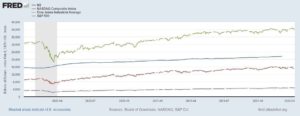

It has been a rough start to 2022 for the Nasdaq, the tech-heavy index dominated by Apple, Microsoft, Amazon, Meta, Tesla, and Alphabet. In the first few trading sessions of the new year, the benchmark index is down close to 5%. Over the last month, it has slumped approximately 3%. Still, the Nasdaq is up an astounding 14% over the last 12 months.

It has been a rough start to 2022 for the Nasdaq, the tech-heavy index dominated by Apple, Microsoft, Amazon, Meta, Tesla, and Alphabet. In the first few trading sessions of the new year, the benchmark index is down close to 5%. Over the last month, it has slumped approximately 3%. Still, the Nasdaq is up an astounding 14% over the last 12 months.

The Jan. 10 trading session was a wild one. The Nasdaq plunged as much as 2.68% before erasing its losses and turning out a tepid 0.05% gain. But is this the beginning of the end for the historic bull market in the Nasdaq and the broader financial markets? To answer that question, it is first important to understand why the equities arena is finding cracks in the infrastructure.

The Federal Reserve recently published the minutes from its December Federal Open Market Committee (FOMC) policy meeting. They revealed the extent of officials’ inflation worries, signaling that the institution could raise interest rates three times after winding down the pandemic-era quantitative- easing blitzkrieg. Put simply, the Fed could stop injecting the markets with easy money, something that traders have become addicted to over the course of the COVID-19 public health crisis, driving up asset prices to all-time highs.

Powell and Co. have already initiated the tapering phase by trimming the $120 billion-a-month asset-buying putsch. This has led to the Nasdaq essentially mirroring the money printing and the Fed’s balance sheet. If this is happening now, then a sharper drop could transpire if the central bank follows through on its acceleration efforts. Of course, when adding the Omicron variant and rampant price inflation to the toxic mix of uncertainty, it could be a year of flatlining or a meltdown.

Ultimately, this could be terrible news for investors who recently got in at the top. At this point, they are witnessing their portfolios deep in the red, potentially confused that the stock market is not trending upward. It could take a long time before their shares generate handsome returns again. This is the new normal in the financial colosseum: a lackluster performance.

Ultimately, this could be terrible news for investors who recently got in at the top. At this point, they are witnessing their portfolios deep in the red, potentially confused that the stock market is not trending upward. It could take a long time before their shares generate handsome returns again. This is the new normal in the financial colosseum: a lackluster performance.

Dude, Where’s My T-Bills?

In all of the red ink seeping into the streets surrounding the New York Stock Exchange, be it cryptocurrencies or precious metals, investors might surrender to the temptation of shelter and security. The benchmark 10-year Treasury yield is up about 16 basis points, flirting with 1.8%. Moreover, the one-year note is at a 20-month high of 0.47%, while the 30-year bond has kicked off 2022 by topping 2%. Why bother diving into risky assets when you can generate a positive return by pouring into the bond market? If the annual U.S. inflation rate matches the market estimate of 7%, and the Fed pulls the trigger on rate hikes, Treasury yields could continue inching higher.

The Austrians Have Been Vindicated

Indeed, economists who adhere to the Austrian School of Economics have been vindicated during the pandemic as the influence of the world’s most powerful institution has been exposed. After approving astronomical inflows of newly created money into the economy, the banking system, and the stock market, resulting in negative real interest rates, sky-high inflation has reared its ugly head. Now that the Fed has no other alternative but to “fight against inflation” by engaging in quantitative tightening, the gaping holes in the ship that were plugged with stacks of Federal Reserve Notes will begin to widen again.

~ Read more from Andrew Moran.