Is the United States alone when it comes to skyrocketing price inflation? As the saying goes, misery loves company. According to the International Monetary Fund (IMF), among a few dozen advanced economies, the United States is tied with Iceland for the top spot for inflation rates. After central banks pumped tens of trillions of dollars into the global economy to survive the coronavirus pandemic, and governments took on tens of trillions of dollars in fresh debt to cushion the blows from the public health crisis, the world is now paying dearly for these costly expenditures. When you add a global supply chain crisis to the mix, multi-decade-high inflation arrives at the post-pandemic scene. Is this a new norm or a temporary economic event?

Inflation – The Here and Now

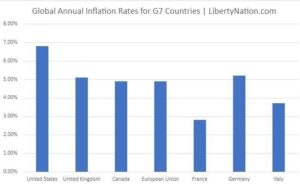

All over the world, price inflation is a problem for both advanced and developing nations. Be it a skyrocketing consumer price index (CPI) or a soaring producer price index (PPI), every measurement shows that inflation is sizzling without any respite in sight. Some countries had it worse than others in 2021, while some nations experienced a bout of deflation. Here is a look at the annual inflation rates of the G7 states as of November 2021:

- U.S.: 6.8%

- U.K.: 5.1%

- France: 2.8%

- Germany: 5.2%

- Canada: 4.9%

- Italy: 3.7%

- European Union: 4.9%

This year, food and energy prices have been the driving factors for blistering inflation. However, even when measuring the core rate, which removes the volatile food and energy sectors from the equation, the cost of living is still enormously high. For example, in the United States, the core inflation rate surged 4.9% in November from the same time a year ago.

This year, food and energy prices have been the driving factors for blistering inflation. However, even when measuring the core rate, which removes the volatile food and energy sectors from the equation, the cost of living is still enormously high. For example, in the United States, the core inflation rate surged 4.9% in November from the same time a year ago.

So, now everyone is wondering what will happen next. Soon after the Federal Reserve became the first developed central bank to retire the term “transitory” from the monetary policy lexicon, other institutions hopped on the bandwagon, from the Bank of Canada to the Bank of England, conceding that inflation is not a temporary phenomenon. Does this mean beef, gasoline, electricity, and men’s suits will still be more expensive next year?

Optimism Reigns Supreme in 2022

After the completion of its two-day December Federal Open Market Committee (FOMC) policy meeting, the Federal Reserve increased its inflation forecast for next year, raising its outlook for the personal consumption expenditure (PCE) price index from 2.2% to 2.6%. The U.S. central bank alluded to the growing list of price pressures impacting the marketplace, including the global supply chain crisis and escalating wage issues in many key markets.

But this might be considered a conservative estimate for some Wall Street experts and consumers. The consensus is that the CPI will end 2022 at around 3%, topping the Eccles Building’s 2% target rate. However, according to the Federal Reserve Bank of New York’s (FRBNY) monthly Survey of Consumer Expectations, the median one-year-ahead inflation projection climbed to 6% in November, up from 5.7% in October.

IMF Chief Economist Gita Gopinath recently warned at a World Health Organization (WHO) event that “we are seeing inflationary pressures building up around the world,” adding that new Omicron variant fears are presenting a “real risk” to both inflation and possibly stagflation. “We are now in the phase where countries around the world just don’t have the space to keep monetary policy very loose, to kind of keep interest rates extremely low,” Gopinath stated.

IMF Chief Economist Gita Gopinath recently warned at a World Health Organization (WHO) event that “we are seeing inflationary pressures building up around the world,” adding that new Omicron variant fears are presenting a “real risk” to both inflation and possibly stagflation. “We are now in the phase where countries around the world just don’t have the space to keep monetary policy very loose, to kind of keep interest rates extremely low,” Gopinath stated.

While uncertainty is the dominant theme in 2022, it is almost certain that an extensive list of countries in every pocket of the globe will suffer from intensifying price hikes. Turkey is easing policy, despite double-digit inflation. Afghanistan, Lebanon, and Venezuela are facing humanitarian crises. African countries are unlikely to emerge from the coronavirus pandemic stronger and more prosperous. The global economy is flooded with freshly created dollars, and this excess capital flow is exacerbating these inflation calamities.

Stop the Printing Presses

The most effective weapon that these institutions could employ is shutting off the printing presses. By doing this, central banks would begin to curtail the amount of money traveling through the economy and give businesses and consumers a breather from diminishing purchasing power and rising prices. By doing so, these policymakers could threaten the economic recovery since Main Street and Wall Street have turned into junkies, looking for their next fix of a Fed, Bank of England, or European Central Bank easy-money injection. Higher prices or anemic growth? Officials will need to pick one enemy to slay in 2022.

~ Read more from Andrew Moran.