All the inflation metrics – from the consumer price index to the personal consumption expenditure (PCE) price index – confirm the United States is suffering from a cost-of-living crisis. Everything in the marketplace has risen exponentially, effectively wiping out Americans’ exceptional wage gains and inevitably exhausting pandemic-era pent-up savings. But how did President Joe Biden, the Federal Reserve, and the rest of the Swamp not anticipate today’s inflationary dilemma? Liberty Nation had sounded the alarm following the first COVID-inspired fiscal stimulus and relief package was passed, pointing out that injecting trillions into an economy within a few months would initiate an inflationary tsunami and trigger a fiscal bomb that eviscerates Americans’ purchasing power. What went wrong?

The Keynesian Occupation

Be it the American Rescue Plan (ARP) or Build Back Better (BBB), Washington is entrenched in an ideology that the government is a Leviathan whose tentacles must stretch to every crevice of society. This dogmatic approach to public policy is heightened whenever there is a crisis, and then, spotlighting the ratchet effect, the government will expand its powers and refuse to concede its might.

Keynesians in the nation’s capital purport that politicians must stimulate the economy at the slightest hint of a downturn. Of course, conventional Keynesians argue that his policy support should be scaled back when conditions improve, which is a futile endeavor because this rarely transpires. If the federal budget is $5 trillion, it will hover around $5 trillion throughout the good times and then skyrocket during the bad days. Presidents and lawmakers are addicted to spending confiscated wealth from taxpayers.

This philosophical approach matters, too, because they do not understand the consequences of this policy pursuit. The White House, the US central bank, and the mainstream media repeatedly pontificated a panoply of mendacious or incorrect assertions: inflation is unlikely to happen, inflation will be slightly elevated but transitory, and inflation will be sizzling but for a short period. Today, the official line in Washington is that red-hot inflation will be the unwanted houseguest for the rest of the year and then ease heading into 2023.

“It’s always going to be an issue in any White House, how the policy and politics interact,” a former Fed official, speaking on the condition of anonymity, told CNBC. “I just think they miscalculated.”

Indeed, if this is the case, they are still miscalculating in this contentious and befuddling environment. In the president’s 2023 budget, inflation projections were lower than what the Eccles Building and private-sector economists forecast for the next couple of years. The excuse is that the numbers were locked in before Russia’s invasion of Ukraine, which is now the scapegoat for all of America’s problems and President Biden’s blunders.

But while it is possible they fumbled the ball, the way the administration and the central bank view economics is the chief factor. The principal notion is that astronomical money-supply expansion leads to recovery and growth because it allows the federal government to spend cash on a broad array of benefits, such as monthly child tax benefits, stimulus checks, and billions in politically-connected green energy projects. However, the Fed needs to slash interest rates or keep the effective benchmark fed funds rate at historic lows to achieve this aim. This not only contributes to currency debasement and price inflation, but also leads to a misallocation of capital, market distortions, artificial growth erected on top of an already fragile foundation, and the government growing faster than the private economy.

The global supply chain crisis, the Ukraine-Russia military conflict, and a wide range of market fundamentals are causes that have added to inflationary woes. These troubles unfold due to the acceleration of pumping more dollars, euros, loonies, and pounds into the international economy.

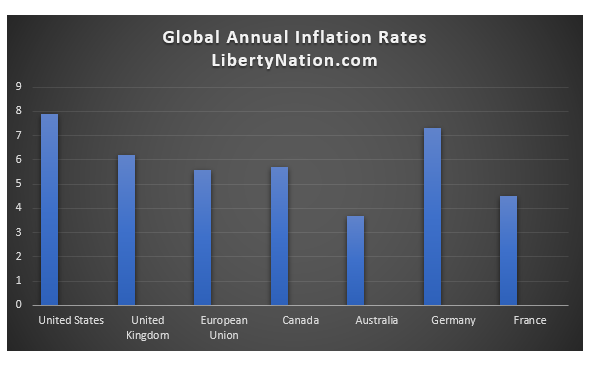

Shalanda Young, the Office of Management and Budget (OMB) director, recently told the House Budget Committee that inflation is a global problem, not centralized in the US economy. On the one hand, she is correct that inflation is everywhere. But on the other hand, Young’s assertion that trillions in new spending did not create inflation is asinine because countries everywhere prescribed comparable nostrums to cushion the blows from the coronavirus public health crisis.

Here is a look at inflation rates in advanced economies today:

So, if the Keynesians inside the corridors of power want proof that fiscal and monetary expansion manufactures an inflationary portrait, here is the evidence to dispel the doctrine.

So, if the Keynesians inside the corridors of power want proof that fiscal and monetary expansion manufactures an inflationary portrait, here is the evidence to dispel the doctrine.

Or the disciples of John Maynard Keynes can also read the words of the Federal Reserve Bank of San Francisco, which wrote: “…the higher rate of inflation in the United States may relate in part to its stronger fiscal response.”

Eternal Inflation?

Central banks worldwide are raising interest rates and beginning an initiative to scale back their balance sheets. The problem? A quarter-point rate hike when inflation is at a four-decade high does not go far enough to curb this post-pandemic calamity. The other issue is that monetary policy is still accommodative, something that St. Louis Fed Bank President James Bullard recently conceded, essentially saying the quiet part out loud. Remember, the last time inflation was this high, the Federal Reserve fired off the mother of all hikes, bringing the benchmark rate to around 12%. The federal government is not cutting much from the budget while the central bank is refraining from being too aggressive. This is not a normal economy. Nothing makes sense. Indeed, producing more than a third of all US dollars ever created in the nation’s history will create Frankenstein’s monster. But will the country shriek “it’s alive!” or will stagflation zombies take over?