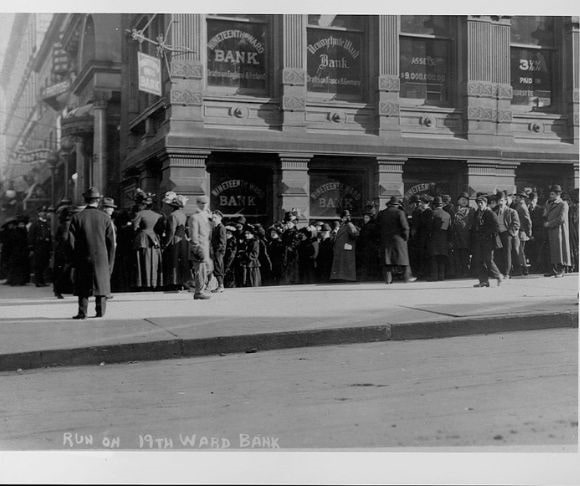

Ah, the good old days of 1907. Sure, smallpox and tuberculosis were all the rage back then, and President Theodore Roosevelt was speaking softly and carrying a big stick. But at least the banks were in good shape, right? Right? As the saying goes, the more things change, the more they stay the same. It does not matter if it is 1907, 1987, 2008, or 2023, the banking system always appears vulnerable to a crisis or turmoil emanating from incompetence, intervention, or iniquity. So, is it time to pull out our hair, or are policymakers learning from the Bank Panic of 1907?

Crisis in 1907

The Bank Panic of 1907, also known as the Knickerbocker Crisis, was a mid-October surprise in the form of a financial crisis caused by a coalition of speculators attempting and failing to corner the United Copper Company, resulting in a contagion event – at home and abroad. Banks failed, businesses went bust, and instability was as ubiquitous as typhoid. Finally, without a central bank to come to the industry’s rescue, a prominent 225-pound banker named J.P. Morgan stepped to the plate and organized a group of bankers who coalesced and injected liquidity into the marketplace to prevent further annihilation of the financial ecosystem.

In 1908 Congress formed the National Monetary Commission to study what happened and proposed suggestions for reform. Four years later, the conclusion was establishing a central bank so that a cartel of policymakers could regulate the money supply, supervise the financial sector, and intervene when a crisis occurs. This is precisely what Washington did in 1913 when lawmakers passed the Federal Reserve Act. Indeed, the 1907 event had long-lasting consequences for the US economy.

On the surface, this might seem like a success story: no taxpayer-funded bailouts and the market righted itself without the need for bureaucrats and politicians. However, others disagree, including former Fed Chair Ben Bernanke, who called it an “embarrassment.”

Over the years, many Austrian economists have weighed in on this subject. One of these was the legendary Murray Rothbard, who blamed the entire ordeal on fractional reserve banking, the basis of today’s system that involves institutions lending out more capital than they possess in their reserves, making them susceptible to bank runs. His other complaint was Morgan’s interventions, arguing that he prolonged the panic and shielded the special interests at the cost of the general public. Finally, like many of his peers, Rothbard was outraged by the creation of the Fed and purported that the Bank Panic of 1907 could have been resolved through a free banking arena and a gold standard.

Bank Panic of 2023

(Photo by Lokman Vural Elibol/Anadolu Agency via Getty Images)

Three of US history’s four largest bank failures have occurred since March. The most recent collapse was First Republic Bank, a California-based entity with more than $229 billion in assets and $103 billion in collateral. It suffered many of the same challenges as Silicon Valley Bank and Signature: Most deposits were uninsured, a majority of clients were high-net-worth account holders, and the investment portfolio mostly comprised long-duration bonds eviscerated by the Eccles Building raising interest rates. The difference this time was that JPMorgan rose from the dead and intervened.

Over the weekend, the Federal Deposit Insurance Corporation (FDIC) held an auction soliciting bids from banks to scoop up the First Republic carcass. One of these was JPMorgan Chase. America’s largest bank purchased the entity for about $10.6 billion. But CEO Jamie Dimon is confident that the worst of the storm is over, telling analysts on a call after the announcement that “there are only so many banks that were offsides this way. There may be another smaller one, but this pretty much resolves them all. This part of the crisis is over.”

J.P. Morgan ostensibly saved the financial system in 1907, so JPMorgan Chase might have averted a banking meltdown 116 years later. But data, market conditions, and performances of regional bank stocks may signal something different. So the question may not be: Is it over? The question might instead be: Who’s next?

Everything Is Fine?

For the past couple of months, everyone in Washington has reassured the American people, from President Joe Biden to House Republicans to the Federal Reserve leadership, that everything is fine. But each time they offer this assurance, another bank turns up on the cusp of extinction. Unsurprisingly, the polling data show that more US adults have lost confidence in the banking system. So what happens if another implodes? For now, the experts aver that this will not happen because even the most vulnerable banks have accessed the Federal Reserve’s emergency lending facilities (Bank Term Funding Program). Indeed, the worst-kept secret in Washington is that everyone’s deposits – the insured and uninsured – are shielded from the consequences of bad decision-making, be it by management or depositors. So, is it time to panic or keep calm and carry on? Perhaps it would be appropriate to sip on a gin rickey and sit back with a nice case of scurvy.