For decades, the United States economy has been addicted to government spending, from stimulus to subsidies, and this addiction is tough to kick, although nobody has gone cold turkey. In the immediate aftermath of the COVID-19 public health crisis, Congress accelerated spending, and the Federal Reserve ramped up the printing press, adding another layer to America’s substance abuse problems. Is there an end in sight? If Washington was bloated before the coronavirus pandemic, the Leviathan would only swell in size moving forward. This is not an economy on steroids – it is an economy on training wheels that is on the brink of teetering off a fiscal cliff. Rather than gaze into the abyss, the nation’s esteemed leaders are waiting to be spaghettified into a financial black hole.

A Fiscal Crutch

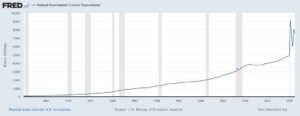

Since the 1960s, U.S. government spending has increased exponentially, with current expenditures skyrocketing from $92 billion to $7.472 trillion. There were a few years where spending had declined, but the long-term trajectory has been upward. Politicians like to spend; it is what justifies their positions in Washington. Without employing the public purse, there would not be much use for Republican or Democrat lawmakers. Even many of the most fiscally conservative individuals are seduced by the coquettish mistress of budget deficits.

Since the 1960s, U.S. government spending has increased exponentially, with current expenditures skyrocketing from $92 billion to $7.472 trillion. There were a few years where spending had declined, but the long-term trajectory has been upward. Politicians like to spend; it is what justifies their positions in Washington. Without employing the public purse, there would not be much use for Republican or Democrat lawmakers. Even many of the most fiscally conservative individuals are seduced by the coquettish mistress of budget deficits.

The private sector would not have it any other way, either. Whether it is enormous corporations or small businesses, the free-enterprise system thrives on these outlays, even though the government fleeces their books to cover some of these costs. Depending on what industry a company is based in, corporate welfare can be a lucrative revenue generator. Public policy over the last century has consisted of taking money from the left hand and transferring it to the right.

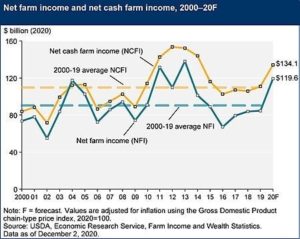

In 2020, for example, American farmers, on net, received 39% of their income from the federal government. This is the largest government representation of net farm income since 2013. Or, in the green economy, more than $100 billion had been given to renewable energy companies. Despite all three levels of governments pickpocketing small businesses, the Small Business Administration (SBA), at the same time, maintains a treasure trove of grant and relief programs to put more taxpayer-funded money in the pockets of entrepreneurs. The entire purpose of the Export-Import Bank (EXIM) is to subsidize American entities’ global trade operations by extending loans, loan guarantees, and insurance to foreign customers who would pay for U.S. exporting products.

One of the primary objectives of the three stimulus checks was to ensure money was floating to the retail sector. Now that these income-support payments have been exhausted, will the White House support the Democrats’ push to approve a fourth round?

One of the primary objectives of the three stimulus checks was to ensure money was floating to the retail sector. Now that these income-support payments have been exhausted, will the White House support the Democrats’ push to approve a fourth round?

Borrowing is instrumental to the U.S. economy. In 2019, Liberty Nation reported on a Bloomberg study that found the U.S. economy would collapse if private debt were eliminated. The report discovered that America’s per capita income would crater from $67,000 to -$4,857. The same would apply to much of the rest of the top 100 economies, too. Many households depend on credit to keep the lights on and the refrigerator full. Is this a way to grow an economy? The perpetual can-kicking is a chief driver of growth.

Now Do Wall Street

It had been Wall Street’s worst-kept secret for a long time that it survives and thrives on artificially suppressed interest rates and the printing press. It has recently become acceptable knowledge that the Fed is a dealer and the stock market is a junkie. Despite COVID, high unemployment, an economy on a standstill, and millions of people under house arrest, the U.S. stock market soared to all-time highs in the middle of the pandemic. Today, the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite Index are hovering near their highest levels on record.

With taper talk running wild – the idea that the Federal Open Market Committee (FOMC) would unwind its $120-billion-a-month asset purchases – the broader financial markets have hit the snooze button. The Street can only hope for more Delta, Lambda, and Mu cases and disappointing economic data because this would discourage Fed Chair Jerome Powell and his merry band of money-printers to diminish these ultra-aggressive quantitative easing measures. Well, at least the equities colosseum can rely on near-zero interest rates a bit longer.

Perhaps investors would be the biggest cheerleaders for another round of stimulus. One of the main beneficiaries of the $600 and $1,200 checks over the last 18 months had been stocks since many Americans poured these funds into their Robinhood accounts to purchase shares in index funds, meme stocks, and everything in between. Should the Swamp remove the spiked punch bowl from the table, the party would come to an end. Kids would cease dancing the jitterbug and the band would stop performing Sing, Sing, Sing. The only people left standing would be the neophyte retail traders who believe the music plays indefinitely.

Addictions and Training Wheels

In several of Sir Arthur Conan Doyle’s legendary Sherlock Holmes stories, the reader is informed of the eminent private detective and his dependency on cocaine, morphine, and opium. Holmes’ recreational consumption of these stimuli emanated from his desire to absquatulate from the “the dull routine of existence” and spark an “overactive” brain during periods when there are no cases to solve, as explained in The Sign of Four. Still, even with these addictions, Holmes was the world’s greatest detective, on par with the likes of Hercule Poirot, Philip Marlowe, and Miss Marple. But what would have happened should he take a respite from these drugs? Would the great Sherlock Holmes have crashed and burned without euphoriants, or would he have kicked the habit and continued to engage with Professor Moriarty in a kerfuffle of wits?

In several of Sir Arthur Conan Doyle’s legendary Sherlock Holmes stories, the reader is informed of the eminent private detective and his dependency on cocaine, morphine, and opium. Holmes’ recreational consumption of these stimuli emanated from his desire to absquatulate from the “the dull routine of existence” and spark an “overactive” brain during periods when there are no cases to solve, as explained in The Sign of Four. Still, even with these addictions, Holmes was the world’s greatest detective, on par with the likes of Hercule Poirot, Philip Marlowe, and Miss Marple. But what would have happened should he take a respite from these drugs? Would the great Sherlock Holmes have crashed and burned without euphoriants, or would he have kicked the habit and continued to engage with Professor Moriarty in a kerfuffle of wits?

In the case of the United States economy, the country will never truly learn what life is like without perpetual bailouts, interventions, stimulus, and subsidies. The U.S. might be the world’s greatest economy, but if President Biden or Chairman Powell unscrewed the training wheels even a little bit, the nation would fall, enduring more than a scrape to the knees. It is elementary economics, my dear Watson.

~

Read more from Andrew Moran.