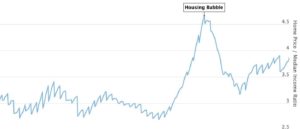

Any time there is a bull run in any asset class, the bears who posit that the upward momentum cannot be sustained and that a crash is coming are regularly informed that this time it is an entirely different animal. Be it the dot-com bubble or the subprime mortgage boom, those who saw the writing on the wall were lambasted, scorned, and mocked by the establishment press as nothing more than perma-bears and kooks. Today, there is renewed debate over another bubble forming in the real estate sector. Are fears justified more than a decade removed from the meltdown that shocked the system, or is it paranoia? It may be a little bit of both in this post-pandemic inflationary environment.

The House of Cards

Prospective homeowners or sellers wishing to list their humble abodes on the open market will see how hot the industry is right now. Realtor.com’s April national median listing price for active listings surged 14.2% year-over-year to a record high of $425,000. The S&P/Case-Shiller Home Price Index advanced at an annualized pace of more than 20%, while the Federal Housing Finance Agency (FHFA) Housing Index climbed to an all-time high of $381,400. Whatever your source, prices are the highest they have ever been in the nation’s history.

The industry has been in liftoff mode for the last couple of years, buoyed by historically low interest rates, pent-up savings, and an immense supply-demand imbalance. At this point, since new housing construction activity is failing to keep up with demand, the only component that could douse the sizzling boom is higher interest rates. And the data do show that a slowdown is approaching fast.

With the 30-year mortgage rate at around 5.5%, according to the Mortgage Bankers Association (MBA), it is becoming more expensive to borrow to achieve the American Dream of homeownership. Moreover, as interest rates grow higher, lending standards begin to tighten, adding more layers to the rigorous approval process. But the $425,000 question is: Will rising rates lead to lower prices?

Industry observers agree that a rising-rate environment is typically brutal for growth. At the same time, inventory levels could continue to keep costs elevated. New residential listings tumbled 0.9% from the same time a year ago, and demand volumes have moderated. The US housing market will likely stay hot, experience a modest cooling-off phase, and continue to prevent too many families from getting their feet in the door.

Does this mean a housing bubble 2.0 will result in the same chaos that began to unfold in 2006?

Many are pointing to the House Price/Median Income Ratio chart showing an intensifying gap between the cost of housing and the public’s earnings. If a single-family property or a condominium unit is accelerating faster than the pace of income gains, how can anyone afford homeownership? Economists at the Federal Reserve Bank of Dallas accepted that borrowing levels to buy residential units and strong household finances make this “abnormal US housing market activity” vastly different from what occurred more than a decade ago. Others purport that the Fed’s rate hikes, which generally have an indirect effect on mortgage rates, will lead to a debt crisis for millions of homeowners across the country. This is a real concern, but many industry professionals aver that increasing rates will impact only new borrowers rather than households that maintain a fixed rate.

“The mortgage market is mostly fixed-rate, so raising rates won’t raise the monthly payment on current owners, but instead will disproportionately impact first-time homebuyers,” Morgan Stanley analysts wrote in a recent research note. “Robust mortgage underwriting should keep foreclosures limited, preventing the forced selling that would weigh on home prices.”

“The mortgage market is mostly fixed-rate, so raising rates won’t raise the monthly payment on current owners, but instead will disproportionately impact first-time homebuyers,” Morgan Stanley analysts wrote in a recent research note. “Robust mortgage underwriting should keep foreclosures limited, preventing the forced selling that would weigh on home prices.”

It might feel like the inevitable decay of a frenzy, especially as the era of easy money policies starts to wind down, courtesy of the US central bank’s quantitative tightening endeavors, but the data suggest it might not be hellfire and brimstone in one of the largest real estate markets in the world.

Is Debt the Real Bubble About to Pop?

Undoubtedly, everyone needs to keep an eye on the housing market since subprime mortgages have been on the rise, QE policies have distorted the industry again, and affordability is becoming a significant problem. But there is one aspect of US households that could trigger a crisis never seen before: debt. In the first quarter of 2022, US household debt soared by $266 billion to an all-time high of $15.84 trillion, driven by a $250 billion spike in mortgage obligations. Since credit is now the lifeblood of the world’s biggest economy, a debt crisis is the one main economic calamity the United States has not witnessed before, meaning that the country might be due for such a collapse. But are the American people and the federal government prepared? Nope. This is why they never want the taps to stop running and the Eccles Building is more frightened than President Joe Biden was of Corn Pop about channeling the spirit of Paul Volcker and dramatically raising rates.