Does anyone even have a modicum of confidence in US leaders to do what suits the national economy? It is hard to fault the American people for expressing doubt that the country’s top institutions can ignite a new era of prosperity. In the last few years, the government introduced crushing pandemic-era restrictions, ignited 40-year high inflation, fueled a banking crisis, facilitated widespread shortages, and forced millions of households to live paycheck to paycheck. But don’t panic! The mainstream media is holding President Joe Biden’s feet to the fire by asking him about his favorite ice cream flavors.

It’s the Economy, Stupid

Gallup released the results of its annual Economy and Personal Finance survey, and the findings were unsurprising. The poll discovered that US adults have little confidence in economic leaders to do or recommend the right thing for the economy.

President Biden topped the list, with 48% saying they had almost no confidence in him pertaining to the economy. This was followed by Democratic leaders in Congress (41%), Republicans in the nation’s capital (33%), Treasury Secretary Janet Yellen (31%), and Federal Reserve Chair Jerome Powell (28%). Gallup noted that trust in all leaders is lower than a year ago, especially for Biden and Powell.

Despite the poor records of the last few years, Democrats appear to have more faith in these leaders than Republicans and independents. Here is a breakdown of the percentages with a “great deal” or “fair amount” of confidence among Democratic voters:

- Biden: 77%

- Democrats in Congress: 74%

- Yellen: 67%

- Powell: 60%

- Republicans in Congress: 13%

“Americans’ growing concern about the economy is manifested in their views of the key government officials responsible for economic policy. None of these leaders engenders much confidence now, and Americans have similarly low confidence levels in each. In fact, many are at or near low points in the two-decade history of Gallup’s trend,” the polling firm stated in the report.

America’s Weakening Fiscal Picture

In April 2023, the US government recorded a $176 billion surplus, down from $308 billion a year ago and below economists’ forecasts of $235 billion, according to the Treasury Department’s latest Monthly Budget Statement. Revenues plunged 26% to $639 billion and outlays tumbled 17% to $463 billion. Indeed, this was a surprisingly weak figure, considering that this was the time of the year when substantial tax collections typically allowed Washington to take in more revenue and plug a small hole in the Titanic. So, in the first seven months of the current fiscal year, the federal government is running a $925 billion deficit.

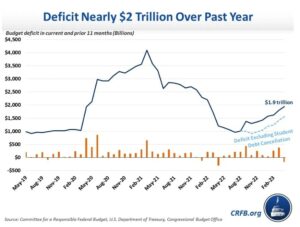

But the Committee for a Responsible Federal Budget (CRFB) performed a deeper dive into the numbers and found that the 12-month rolling deficit (from May 22 to April 2023) is $1.942 trillion, double the shortfall from before the coronavirus pandemic. Moreover, as a percentage of the GDP, the deficit is 7.5%, which is also 50% higher than prior to the COVID-19 public health crisis.

But the Committee for a Responsible Federal Budget (CRFB) performed a deeper dive into the numbers and found that the 12-month rolling deficit (from May 22 to April 2023) is $1.942 trillion, double the shortfall from before the coronavirus pandemic. Moreover, as a percentage of the GDP, the deficit is 7.5%, which is also 50% higher than prior to the COVID-19 public health crisis.

“Although we expect the 12-month rolling deficit to decline briefly in September when the one-time deficit effect of student debt cancellation is more than a year behind us (particularly if the Supreme Court rules it illegal), structural deficits will continue to trend upward,” the group noted, adding that rising deficits amplify inflation, slow the economy, produce geopolitical risks, and make it challenging to respond to new emergencies.

Addicted to Stocks?

Since armchair traders joined Robinhood and pumped their stimulus checks into the financial markets, they have been suffering from withdrawal symptoms between 4:01 p.m. and 9:29 a.m. Well, at least they can trade cryptocurrency at midnight. But do not fret because Robinhood has come to the rescue and provided a cure to the men and women in tights, which may or may not be a good thing for investors who have lost their pandemic earnings in the post-crisis rout.

(Photo by Lorenzo Di Cola/NurPhoto via Getty Images)

The company announced in its better-than-expected first-quarter earnings report that it will introduce 24-hour trading. “Today we are announcing Robinhood 24 Hour Market, which offers people unprecedented flexibility and access to the markets. Using 24 Hour Market, people can place limit orders to buy whole shares of 43 of the most traded ETFs and individual stocks– such as TSLA, AMZN, and AAPL– 24 hours a day, five days a week,” the company said in a statement.

The new product will be available to a few users on May 17 and then open to everyone in June.

Technically, participating in after-hours trading with electronic communication networks, or ECNs, is possible, connecting buyers and sellers without a conventional stock exchange. However, it can be volatile since trading volumes are thin and there are few active traders, leading to canyon-sized spreads between the bid and ask prices. Will this all change in the further democratization of the financial markets? It will be fascinating to watch how equities perform after the closing bell.