Let’s be honest: America’s finances will never be repaired, no matter what plan is presented by Republicans and Democrats to ostensibly rein in the budget deficit. Trillion-dollar shortfalls will be permanent, something the American people will have to live with for the rest of their lives. Case in point, the recent US Treasury data pointing to persistent fiscal mismanagement in Washington, despite promises from President Joe Biden and his administration that they are being responsible with the federal balance sheet.

Budget Deficit Soars in March

Last month, the budget deficit surged $378 billion, up from the $262 billion gap in February. This is also up $432 billion from the same time a year ago and totals $1.1 trillion in the first half of fiscal year 2023.

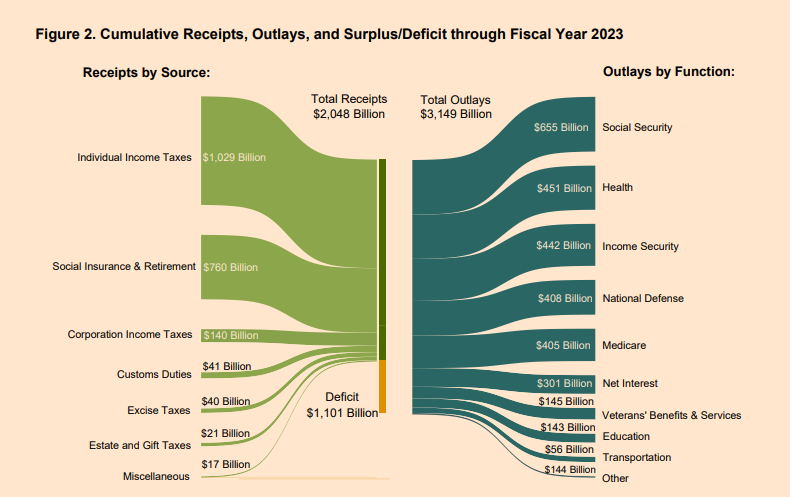

The ballooning deficit in the first half was caused by a 13% increase in government spending ($3.149 trillion) and a revenue decline of 3% ($2.048 trillion). Moreover, Social Security spending advanced amid a growing number of beneficiaries and higher average benefit payments, reaching $655 billion. Plus, net interest on the public debt surged 32%, topping $300 billion.

This comes soon after the White House released its 2024 budget, proposing to slash the deficit by $3 trillion over ten years, which was already questionable. The president projected more than $17 trillion of cumulative deficits by 2033, up from the previous year’s roughly $14 trillion estimate. So, where are the savings? Overall, the national debt is expected to spike to about $50 trillion in the next decade.

Only in Washington can more budget deficits and debt be equal to a reduction.

Yellen About De-Dollarization

The global de-dollarization campaign has shifted into overdrive, as a growing number of nations have accelerated their efforts to ditch the greenback or diversify their currency usage. Brazil, China, India, and Russia have led the way and more foreign states are making this consideration. What does the US say about these recent developments in the international reserve currency landscape?

Speaking in a CNN “Fareed Zakaria GPS” interview that aired on April 16, Treasury Secretary Janet Yellen was asked if the US government employing financial sanctions would diminish the dollar supremacy. Her answers? Maybe. Yellen told the cable news network:

“So, there is a risk when we use financial sanctions that are linked to the role of the dollar, that over time it could undermine the hegemony of the dollar, as you said. But this is an extremely important tool we try to use judiciously.”

Dollars are widely used. We have very deep capital markets and rule of law that are essential in a currency that is going to be used globally for transactions. And we haven’t seen any other country that has the basic infrastructure — institutional infrastructure — that would enable its currency to serve the world like this.”

In many regards, Yellen is correct. Despite China’s broad objective to expand the yuan’s role in cross-country transactions, investors might not be too quick to adopt the currency. One of the reasons is that Beijing has been prone to engage in currency manipulation, with the central government and the People’s Bank of China employing various policies that threaten the legitimacy of the yuan. In addition, the anti-dollar initiative began nearly ten years ago, but it has only garnered success in the last few months, meaning that this is possibly a long-term campaign rather than a fly-by-night operation.

Will the global economy see the dollar king ousted from its throne anytime soon? Nope. Is it an inevitability at this stage that will come to fruition in the coming decades? Most definitely.

Why Have Bank Deposits Crashed?

Why Have Bank Deposits Crashed?

In the aftermath of the Silicon Valley Bank and Signature Bank failures, deposits at commercial financial institutions cratered by approximately $400 billion. But taking a gander at specific Federal Reserve data reveals that commercial bank deposits have been tumbling a lot longer. According to the US central bank’s H.8 report, bank deposits have been on a gradual downturn since peaking at $18.158 trillion in April 2022, collapsing by approximately $900 billion, or roughly 5%.

Indeed, the H.8 numbers show that there was an uptick in bank deposits in the past week, but the year-long trend might raise some eyebrows and indicate that there is something else unfolding in the financial system. Meanwhile, in a signal that the US economy might be in the beginning of a credit crunch, Fed data highlighted that loans and leases at all banks decreased from $12.07 trillion to $12.06 trillion for the week ending April 5.

Minutes from the March Federal Open Market Committee policy meeting revealed that Fed economists expect a recession later this year. A broad array of data has also indicated that the country might be in the initial stages of a downturn. Will the country ever catch a break at this point?