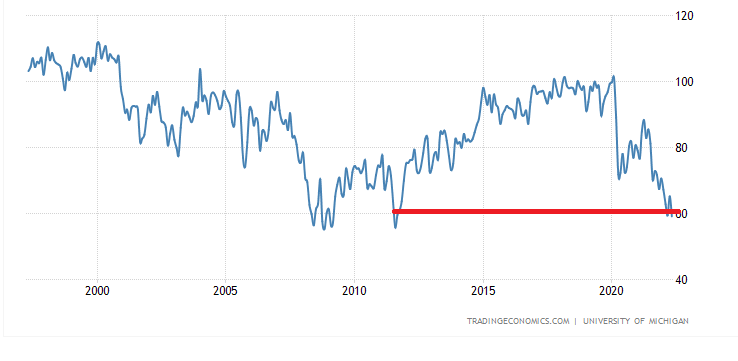

US consumer sentiment is the lowest it has been in 11 years, driven by the cost-of-living crisis and sour views on the current economy. But will Americans’ eroding confidence in the United States lead to fallout in critical data, such as consumer spending, retail sales, and the gross domestic product?

The University of Michigan Consumer Sentiment Index plunged to 59.1 in May, falling short of the median estimate of 64. Consumer expectations dropped to 56.3, below the market forecast of 63. Current conditions eased to 63.6, under the 70.5 estimate. Inflation expectations remained unchanged: 5.4% in the year ahead and 3% over the next five years.

Overall, the last time the university’s reading was this low was in August 2011. Also, the index for buying conditions for durable goods, like household appliances, cratered to the lowest level since the monthly series began. These multi-year lows were broad-based, too, says Joanne Hus, the Surveys of Consumers Director, in a statement.

“These declines were broad-based – for current economic conditions as well as consumer expectations, and visible across income, age, education, geography, and political affiliation – continuing the general downward trend in sentiment over the past year,” Hus stated.

This comes soon after the Federal Reserve Board of New York’s (FRBNY) Survey of Consumer Expectations reported a generally concerned public. Inflation expectations for the one-year horizon remained notably high at 6.3%. Nearly one-third of households think their financial situation will worsen over the next 12 months. Only 37% say the US stock market will be higher one year from now.

This comes soon after the Federal Reserve Board of New York’s (FRBNY) Survey of Consumer Expectations reported a generally concerned public. Inflation expectations for the one-year horizon remained notably high at 6.3%. Nearly one-third of households think their financial situation will worsen over the next 12 months. Only 37% say the US stock market will be higher one year from now.

Will NOPEC Trigger an Energy Disaster?

Once again, the US government is mulling legislation to rein in the Organization of the Petroleum Exporting Countries (OPEC). The US Senate Committee approved a new bipartisan bill, titled No Oil Producing and Exporting Cartels (NOPEC), with a 17-4 majority. The legislation attempts to shield US businesses and consumers from market manipulation of energy prices by the world’s largest energy cartel, allowing anti-trust lawsuits against OPEC members.

The next step is for the House and Senate to pass the bill, which is then shipped to President Joe Biden’s desk for his signature. White House Press Secretary Jen Psaki told reporters that the NOPEC bill requires additional study at a time of intense volatility in international energy markets.

The next step is for the House and Senate to pass the bill, which is then shipped to President Joe Biden’s desk for his signature. White House Press Secretary Jen Psaki told reporters that the NOPEC bill requires additional study at a time of intense volatility in international energy markets.

While these legislative efforts have occurred multiple times over the years, market analysts believe there are greater odds of this being approved by Washington. For months, OPEC and its allies, OPEC+, have been pushed by the Biden administration to ramp up production to curb soaring crude oil and natural gas prices. The 23-nation group has refused, choosing to maintain its modest output increases.

UAE Energy Minister Suhail Al Mazrouei recently told CNBC’s Dan Murphy during a panel at the World Utilities Congress in Abu Dhabi that this legislation could send prices up 200% to 300%.

“If you hinder that system, you need to watch what you’re asking for, because having a chaotic market you would see a 200% or 300% increase in the prices that the world cannot handle,” he said. “We, OPEC+, cannot compensate for the whole 100% of the world requirement. How much we produce, that is our share. And, actually, I would bet that we are doing much more.”

West Texas Intermediate (WTI) crude futures are trading at around $110 a barrel on the New York Mercantile Exchange, while Brent crude futures hover at $111 a barrel on London’s ICE Futures exchange.

A Soft Landing is Transitory

Federal Reserve Chair Jerome Powell is no longer confident that he and his merry central bankers can engineer a soft landing as the institution raises interest rates. Powell had previously stated he is optimistic that the Eccles Building could navigate the post-pandemic economy to a “soft or soft-ish landing,” leading to an environment of low inflation, strong growth, and a robust labor market.

“So a soft landing is, is really just getting back to 2% inflation while keeping the labor market strong. And it’s quite challenging to accomplish that right now, for a couple of reasons,” Powell said in an interview with Marketplace. “So, it will be challenging, it won’t be easy. No one here thinks that it will be easy. Nonetheless, we think there are pathways for us to get there.”

“So a soft landing is, is really just getting back to 2% inflation while keeping the labor market strong. And it’s quite challenging to accomplish that right now, for a couple of reasons,” Powell said in an interview with Marketplace. “So, it will be challenging, it won’t be easy. No one here thinks that it will be easy. Nonetheless, we think there are pathways for us to get there.”

The consensus on Wall Street is that it will be nearly impossible for the Fed to accomplish a soft landing, warning that it will more likely lead to a period of either stagflation or recession. Powell, who had been confirmed for a second term at the world’s most powerful institution, acknowledged that a rising-rate environment would lead to financial pain for many consumers and companies. But, he added, it will be critical to restore price stability.

The funniest part of the interview was when he conceded the Fed should have pulled the trigger on a rate hike sooner, but “we did the best we could.” Of course, the real question that Powell and his colleagues should be asked is: How did they blow it on inflation? Was it a case of mendacity or ignorance? Whatever the case, it appears that the soft-landing talk was also transitory.