In 2022, the financial markets were kind to investors only if they parked their money in commodities and the US dollar. As a result, many equities slipped into bear territory, including media stocks, and some market experts anticipate it could be another period of sour wine and rotten roses for the industry. Be it Netflix or Disney, the terrible performance last year was primarily driven by growing recession fears, the Federal Reserve’s tightening efforts, and negative sentiment throughout the sector. Don’t believe it? Look at some of the numbers.

Winter Comes for Media Stocks

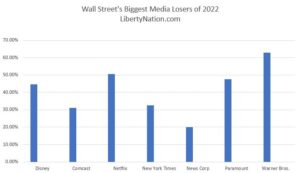

The Dow Jones US Media Index, which tracks the largest North American companies in the industry, recorded a 40.74% loss last year, slumping to 710.85. The Communication Services Select Sector SPDR Fund (XLC) and the Invesco Dynamic ETF (PBS) plummeted 37% and 36%, respectively. The Vanguard Communication Services Index Fund ETF also fell 40%. Some of the biggest businesses in US media posted significant losses in 2022. Here is a breakdown:

- Comcast Corporation (CMCSA): -31.08% to $34.97

- Netflix (NFLX): -50.64% to $294.88

- New York Times (NYT): -32.66% to $32.46

- News Corp (NWSA): -20.07% to $18.20

- Paramount Global (PARA): -47.64% to $16.88

- Walt Disney Company (DIS): -44.58% to $86.88

- Warner Bros Discovery (WBD): -62.82% to $9.48

In total, US media stocks lost more than $500 billion in value in 2022.

The media landscape has been rocked by layoffs, with many prominent brands implementing cost-cutting measures amid recession concerns and slowing ad spending. In the last year, CNN terminated hundreds of staffers, including on-air personalities such as Chris Cillizza, John Harwood, Robin Meade, Brian Stelter, and Jeffrey Toobin. Gannett, the largest US newspaper chain, handed out pink slips to 6% of its domestic media division staff. Disney and Paramount intend to employ job cuts soon. Other organizations, from NPR to Comcast, say they will implement a near or total hiring freeze.

As Liberty Nation’s Sarah Cowgill wrote recently: “NPR would then join a growing list of media giants stomping through corporate employee rosters as Godzilla would destroy a small city.”

In a rising-rate environment that encourages traders to focus on monitoring the dollars and cents – a complete reversal from 2020 and 2021 – investors are concentrating on these companies’ budgets. “Now there’s a new focus on these costs,” John Hodulik, an analyst at UBS, told CNBC. “I think Warner Bros. Discovery is leading the charge, but we’re going to see other companies pare back their ambitions in the streaming space over time.”

In a rising-rate environment that encourages traders to focus on monitoring the dollars and cents – a complete reversal from 2020 and 2021 – investors are concentrating on these companies’ budgets. “Now there’s a new focus on these costs,” John Hodulik, an analyst at UBS, told CNBC. “I think Warner Bros. Discovery is leading the charge, but we’re going to see other companies pare back their ambitions in the streaming space over time.”

But it can be challenging for businesses to improve their books without higher revenues generated from advertisers. Indeed, ad spending has been slowing considerably in recent months. Paramount, for example, missed its third-quarter forecasts after ad revenues dropped. This forced the company to trim its fourth-quarter expectations as ad sales are projected to tumble.

NBCUniversal CEO Jeff Shell noted that advertising has deteriorated in the last six to nine months, something that the data and recent 2023 estimates have supported.

Standard Media Index’s (SMI) October 2022 Core Data report found that ad spending contracted for the fifth consecutive month is sliding 3% year-over-year. Looking ahead, media investment firm Magna reduced its ad spending forecast growth for 2023. Analysts think ad revenues would increase only by 4.8% this year, down from the previous estimate of 6.3%.

What Could Change in 2023 – and Beyond?

(Photo by Wang Ying/Xinhua via Getty)

Many developments could happen in the next year that may help or hurt these entities. Activity in the media merger realm could be more robust. Consumers might have more of a presence in the offline world. Movie theaters might still be lagging pre-pandemic traffic. A change in ads may also accelerate.

The advertising landscape has dramatically evolved, especially in the era of Big Tech and Big Data. The coming years will be no different, especially as brands attempt to generate a better return on investment in a slowing global economy. The streaming giants — such as Netflix, Peacock, and Disney+ — not only are embracing ad-supported subscriptions, but also analysts purport that many companies will be investing in targeted advertising. On the surface, targeted ads seem an invasive tactic that could backfire, considering it requires businesses to extract hyper-personal data from their customers. However, the last decade has proven that consumers are more than willing to concede their information and privacy to save a few bucks or receive a free service.