Despite the current US administration trying to bail them out, the latest data suggest that investors are increasingly turning sour on some of the largest ESG funds today. Americans ostensibly like to make money in the stock market without worrying about wokeness and politics impacting their investment decisions. But while some critics are happy that this might be the demise of environmental, social, and governance investing, Wall Street might be adopting the Fight Club rule: The first rule of sustainable investing is that you never talk about sustainable investing.

Outflows of ESG Funds

According to Bloomberg exchange-traded fund (ETF) contributor Eric Balchunas, ESG ETFs are experiencing substantial outflows. After reaching its zenith in 2020, thanks to an injection of easy money by the US government and the Federal Reserve, the sector has been on a downward trend. For example, the iShares ESG Aware MSCI USA ETF (ESGU), which is one of the largest ESG-focused investment vehicles around, “saw a record smashing $4b in outflows” on March 17 and then another $1 billion on March 20. Balchunas added: “The bomb out of ESGU on Friday is a big blow to the ESG ETF Category in that it really adds to the ongoing reversal in flows, which tends to go hand in hand with narrative.”

As Liberty Nation recently reported, President Joe Biden bailed out ESG funds by vetoing legislation that would reverse a Labor Department rule that permitted fiduciaries to integrate ESG criteria into retirement plan fiduciaries’ investment decisions. In addition, the data show that ESG ETFs need to catch up on some of the non-woke alternatives.

Indeed, the bubble in ESG funds may have burst a while ago. But now that they have received mainstream attention from conservatives and libertarians, a funeral could soon be scheduled.

Goodbye, Small Banks?

If the Eccles Building, the Treasury Department, and the Federal Deposit Insurance Corporation (FDIC) are bailing out uninsured depositors at the big banks or financial institutions that are considered systemic risks if they fail, why bother holding money at small or community banks? Unfortunately, this is what many Americans are wondering, prompting them to take out their deposits and run.

New central bank data confirm that bank customers withdrew a collective $98.4 billion from accounts for the week ending March 15, which occurred around the time of the Silicon Valley Bank and Signature Bank failures. Fed statistics show that smaller banks suffered $120 billion in outflows, and larger companies enjoyed a $67 billion jump in inflows.

Jerome Powell (Photo by Chen Mengtong/China News Service/VCG via Getty Images)

Interestingly enough, US deposits have been on a downward trajectory over the last 12 months, plummeting approximately $582 billion. In total, US deposits stand at more than $17.5 trillion.

This comes days after Fed Chair Jerome Powell told reporters that deposit flows “have stabilized over the past week” after the institution employed “powerful actions” to support the banking system. “These actions demonstrate that all depositors’ savings in the banking system are safe,” the Fed Chair stated at the post-Federal Open Market Committee (FOMC) meeting press conference. “So what I’m saying is you’ve seen that we have the tools to protect depositors when there’s a threat of serious harm to the economy,” Powell said. “Or to the financial system. And we’re prepared to use those tools. And I think depositors should assume that their deposits are safe and secure.”

The End of Tightening?

It has not even been a year since the Federal Reserve began reducing its enormous pandemic-era $8.965 trillion balance sheet. In the days following the collapse of SVB and Signature, the Eccles Building added roughly $300 billion to its balance sheet. One week later, the US central bank threw another $100 billion into the ledger, lifting the total back to above $8.73 trillion. This has been an exceptional reversal in the institution’s inflation-fighting quantitative tightening (QT) initiative.

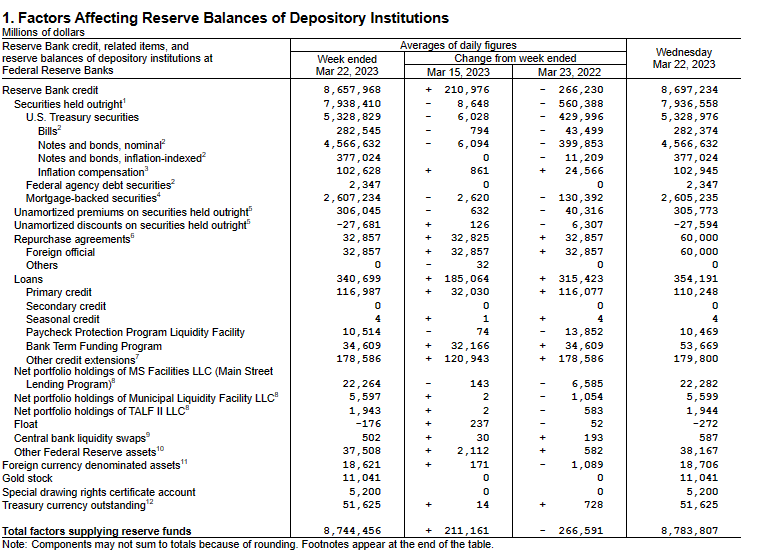

Here are some of the notable factors affecting the reserve balances of depository institutions for the week ending March 22:

Here are some of the notable factors affecting the reserve balances of depository institutions for the week ending March 22:

- US Treasury securities holdings were relatively unchanged.

- Mortgage-backed securities fell by nearly $2 billion.

- The Fed’s Bank Term Funding Program (BTFP) surged more than $34 billion.

- “Other credit extensions” soared close to $179 billion.

Powell addressed concerns that this is a form of quantitative easing (QE) during the latest powwow with business reporters, explaining that this is not an adjustment to the Fed’s monetary policy stance since the balance sheet explosion has been a result of emergency lending. Sure, this QE or QT controversy may be up for debate, but once the FOMC votes for one more rate hike, it is safe to say that the entity has officially hit the pause button on QT.