A nationwide power crunch and sky-high prices have prompted China to reinvest heavily into coal, much to the chagrin of the green-focus economies worldwide. Despite promises of slashing its emissions and investing in renewable energy sources, Beijing has been placing vast amounts of coal in its Christmas stocking, potentially humiliating participating members at the 26th UN Climate Change Conference of the Parties (COP26) next month.

China Ditches Green Ambitions

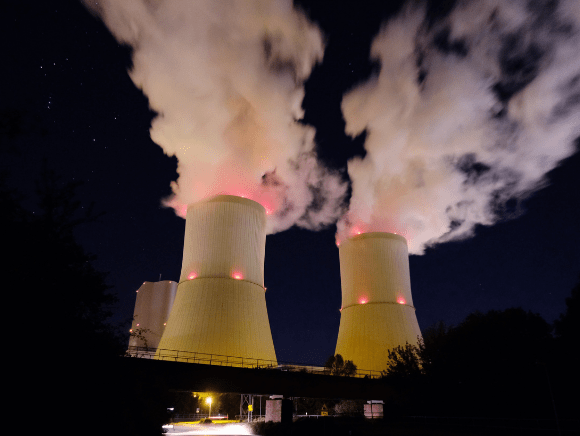

In recent weeks, China has announced efforts to increase coal production, with many parts of the nation facing rolling blackouts. Miners are also taking advantage of record-high prices, leading these companies, many with state ties, to help power the grid and feed demand to the rest of the world.

In a recent statement following a meeting of the country’s National Energy Commission, Chinese Premier Li Keqiang emphasized how important it is to maintain regular energy supplies. A decline in power has resulted in nearly two-dozen provinces facing an energy crisis as many factories have temporarily shut down operations and mobile networks experiencing outages.

In a recent statement following a meeting of the country’s National Energy Commission, Chinese Premier Li Keqiang emphasized how important it is to maintain regular energy supplies. A decline in power has resulted in nearly two-dozen provinces facing an energy crisis as many factories have temporarily shut down operations and mobile networks experiencing outages.

“Energy security should be the premise on which a modern energy system is built and the capacity for energy self-supply should be enhanced,” Beijing noted. “Given the predominant place of coal in the country’s energy and resource endowment, it is important to optimize the layout for the coal production capacity, build advanced coal-fired power plants as appropriate in line with development needs, and continue to phase out outdated coal plants in an orderly fashion.”

But here is the kicker from Beijing: “Domestic oil and gas exploration will be intensified.” Today, approximately half of the nation’s power supply comes from coal, even though President Xi Jinping has routinely assured the globe that the world’s second-largest economy would be relying more on solar and wind technologies.

Bitcoin Goes to Wall Street

Investors, say hello to America’s first Bitcoin futures exchange-traded fund (ETF). The ProShares Bitcoin Strategy ETF, which offers traders exposure to the cryptocurrency’s futures contracts rather than the spot market, will begin trading under “BITO” as early as Oct. 18. The Securities and Exchange Commission (SEC) has yet to give its formal seal of approval, but the investment fund’s announcement gave the impression that the federal agency would not be acting as a roadblock to the ETF’s presence on the New York Stock Exchange.

For years, cryptocurrency advocates have long pushed for a Bitcoin-related ETF in the financial markets. As a result, many companies have applied for crypto-focused ETFs, such as Invesco, only to be railroaded by the U.S. government. But it shows the demand on Wall Street for a more institutionalized version of the virtual token rather than purchasing Bitcoin and other digital currencies on exchanges and trading platforms.

Still, the news gave Bitcoin’s valuation another push. As the world’s largest cryptocurrency topped $61,000 on the information. If there is one thing investors have hoped for in the sector, it’s been certainty. With the Federal Reserve confirming it will not ban Bitcoin and the SEC potentially applying insurance benefits for banks holding crypto, Bitcoin could finally realize those outlandish forecasts of $100,000.

Abenomics Stinks. Yeah, Yeah.

Japan’s worst-kept secret had been the failure of Abenomics, the economic agenda of former Prime Minister Shinzo Abe. But now, the nation’s new prime minister, Fumio Kishida, essentially conceded that the policy prescription had been terrible for the world’s third-largest economy. Kishida, the successor to Yoshihide Suga, who served in the role faster than drinking a cup of sake, vowed to move on from the neoliberal doctrine.

Speaking in an interview with the Financial Times, the Japanese prime minister revealed he will concentrate on narrowing the gap between the affluent and the impecunious and reverse trickle-down economics by instituting reforms that reverse the Darwin approach to policymaking. He told the business newspaper:

“Abenomics clearly delivered results in terms of gross domestic product, corporate earnings and employment. But it failed to reach the point of creating a ‘virtuous cycle.’ I want to achieve a virtuous economic cycle by raising the incomes of not just a certain segment, but a broader range of people to trigger consumption. I believe that’s the key to how the new form of capitalism is going to be different from the past.

Everyone just considers regulatory reform in terms of market fundamentalism, competition and survival of the fittest. That’s the problem with our past thinking on regulatory reform.”

This might sound beautiful to conservative and liberal critics of Abenomics, but his other comments, such as facilitating greater collaboration between the private sector and state and raising taxes, might suggest that Tokyo could be embracing socialism. Of course, no mention of the new administration possibly tackling the quadrillion-yen debt or unwinding the Bank of Japan’s balance sheet that accounts for 130% of the gross domestic product (GDP).

Will Kishida try more of the exact Keynesian mechanisms that have been disappointments across the globe, or will Kishidanomics be the panacea Japan needed all along? Just as dynamite sushi rolls are Tokyo’s most incredible culinary delights, the new prime minister will stumble like his predecessors.s

~ Read more from Andrew Moran.