President Joe Biden did not receive a cup of good cheer on Dec. 15, except for perhaps kicking the fiscal can down the road by averting a government shutdown. The US economy considerably weakened in November as a plethora of data measurements were released, which comes soon after the Federal Reserve raised interest rates and warned that the country still had a long way to go until the inflation challenge was resolved. Suffice it to say, Santa Claus might not be visiting the White House this year.

The Joe Biden Boom Fades?

Oh, the humanity! The US economy was dealt a significant blow in November as the house of cards came tumbling down. Was this the beginning of the end for the Biden boom? A look at the November data may answer this question heading into 2023.

Oh, the humanity! The US economy was dealt a significant blow in November as the house of cards came tumbling down. Was this the beginning of the end for the Biden boom? A look at the November data may answer this question heading into 2023.

Retail sales tumbled 0.6%, worse than economists’ expectations of -0.1%. This was the worst reading of 2022, as consumers were a bit more careful with their dollars and cents amid higher inflation and rising interest rates. It may also lend credence to the suggestion that the record Black Friday extravaganza was largely driven by higher prices than ebullient shoppers. On an annualized basis, retail sales eased to 6.5%.

The manufacturing sector emphasized concerns that the United States might be on the cusp of another recession in the Biden years. The New York Empire State Manufacturing Index and the Philadelphia Fed Manufacturing Index clocked in at -11.2 and -13.8, respectively. Industrial and manufacturing output tumbled by 0.2% and 0.6%, respectively. Capacity utilization slipped to 79.7%. The figures were so bad that the Atlanta Fed Bank lowered its GDPNow model estimate from 3.2% to 2.8% for the fourth quarter.

Like anything else in studying economic data, it is critical to determine if this is part of a long-term trend or a blip on the radar. While the signs point to a slowdown in multiple sectors and industries as the Fed’s rate hikes venture throughout the system, the United States has held on tight. But more data over the next eight weeks should confirm that a recession – severe or short and shallow – is on the horizon.

Fed Chair Jerome Powell did warn that the American people should brace for the end of the boom and welcome an era of slower economic growth. This was reiterated in the central bank’s Survey of Economic Projections (SEP), which forecasted abysmal GDP expansion rates of 0.5% in 2023 and below 2% in 2024 and 2025. Next year, as the Eccles Building continues to pursue a path of restrictive policy – decelerating the increase in the money supply through higher interest rates – it should be riveting to determine how the national economy will stand without the training wheels.

Fed Chair Jerome Powell did warn that the American people should brace for the end of the boom and welcome an era of slower economic growth. This was reiterated in the central bank’s Survey of Economic Projections (SEP), which forecasted abysmal GDP expansion rates of 0.5% in 2023 and below 2% in 2024 and 2025. Next year, as the Eccles Building continues to pursue a path of restrictive policy – decelerating the increase in the money supply through higher interest rates – it should be riveting to determine how the national economy will stand without the training wheels.

All of this led to one of the worst days in the stock market this year, as the leading benchmark indexes hemorrhaged red ink and added to their substantial 2022 losses.

‘A Great Trajectory’

Speaking in an interview with MSNBC on Dec. 14, Sen. Debbie Stabenow (D-MI) argued that the 7.1% consumer price index (CPI) in November suggested that the nation is on a great trajectory. Perhaps she will champion canceling the Inflation Reduction Act now! But, in all seriousness, politicians may need to realize why price inflation is coming down – and it has nothing to do with President Joe Biden.

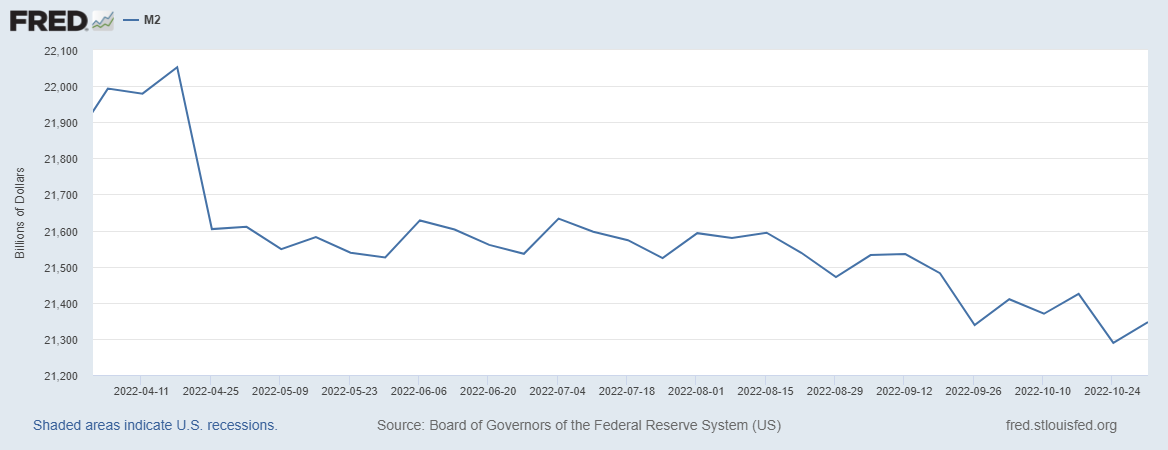

M2 money supply

The biggest thing is that less money is being pumped into the economy. The total M2 money supply is at a one-year low, while the expansion rate has slowed to a pre-pandemic pace. Although the damage has been done by eroding Americans’ purchasing power, the pain has not diminished. It is comparable to what Bela Lugosi tells Boris Karloff in 1934’s Black Cat: “That’s what I’m going to do to you now – fare the skin from your body… slowly… bit by bit!”

The next critical development in this inflation-busting crusade has been falling demand. Sure, consumer spending is robust – fueled by credit cards and less saving – but the various purchasing managers’ indexes (PMIs), which highlight the direction of economic sectors, show plummeting demand, be it export orders or new order growth. When this transpires, the market responds by slashing prices to resuscitate consumption. Of course, there is always the risk of recession since two-thirds of the US economy is driven by the consumer. Indeed, this is the endgame for the Federal Reserve: cooling down the economy to restore price stability.

Buddy, Can You Spare Two Percent?

Will the Fed return to its 2% target inflation rate? The SEP is planning 2024 to be the year it happens. The Fed has been wrong before, and it might be wrong again, considering that there is still an abundance of long-term inflationary pressures persistent throughout the US and global economies. The transition to a green economy, higher energy prices, weather conditions that can impact the sensitive commodities market, labor shortages, and even higher borrowing costs. The president can keep claiming that his landmark, slimmed-down Build Back Better plan can be the panacea to the nation’s ailments, but is it true? Early forecasts suggest it will not since it is a giant taxpayer-funded and deficit-financed check to the renewable industry. Sure, inflation has peaked, but a volatile CPI or personal consumption expenditure (PCE) price index – the Fed’s favorite inflation gauge – might be the new normal in this post-crisis world.