The coronavirus pandemic turned out to be one of the greatest wealth schemes in US history, from the trillions in newly created money to the extra trillions in fiscal stimulus efforts. As the years go by, new reports revealed that COVID relief was a terrific opportunity for fraudsters to take advantage of the system. But it also highlighted just how poorly managed these government programs were by the bureaucrats. So, how much did it cost taxpayers this time? The numbers are still being crunched.

COVID Relief Fraud

The Small Business Administration (SBA) is estimated to have lost more than $200 billion in “potentially fraudulent” COVID relief payments, according to a new report from the SBA’s Office of the Inspector General (OIG). The findings noted that 17% of all COVID-related payments the SBA completed could have ended up in the bank accounts of “potentially fraudulent actors.” Because the OIG’s work is not complete, the report notes that these figures could be revised over time. Still, as of May 2023, there have been about 1,000 indictments and more than 500 convictions based on the SBA OIG’s investigations.

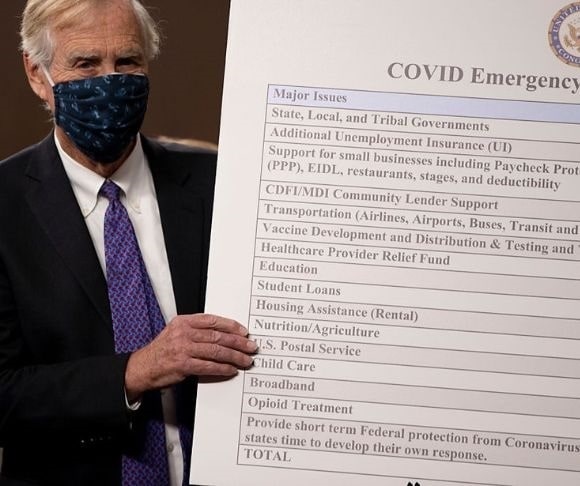

During the COVID-19 public health crisis, the SBA disbursed approximately $1.2 trillion. The OIG noted that the Small Business Administration completed 14 years’ worth of lending in just two weeks at the beginning of pandemic-era assistance programs, such as the Paycheck Protection Program.

“The agency weakened or removed the controls necessary to prevent fraudsters from easily gaining access to these programs and provide assurance that only eligible entities received funds,” the report stated. “However, the allure of ‘easy money’ in this pay and chase environment attracted an overwhelming number of fraudsters to the programs. OIG’s continuing reviews pertaining to oversight of SBA’s pandemic response have identified multiple weaknesses in controls that allowed fraudsters to take advantage of the economic crisis and divert funding intended for deserving, eligible American small business owners.”

Scammers used various methods to extract dollars from Uncle Sam: elaborate telemarketing schemes, disposable email addresses, national kickback programs, fictitious or stolen identities, and multiple applications. In one instance, a US Army soldier scammed the system 150 times and secured $3 million from the US government. The OIG noted that there had been concern about COVID relief fraud as early as May 2020. But many of the measures that were employed came “after much of the damage had already been done.”

Moving forward, the SBA’s OIG presented several recommendations to improve internal controls:

- Establish or strengthen controls to confirm loan deposits are made to legitimate bank accounts for eligible borrowers.

- Partner with the Treasury Department to produce a technical solution to utilize its Do Not Pay portal.

- Obtain photo identification of the applicant.

- Verify the applicant maintains a legitimate business through tax returns.

- Install a “Rule of Two,” mandating two people approach every loan application.

The Pandemic Grift

The Pandemic Grift

Was the coronavirus pandemic policy response the greatest grift in US history? This is what many experts are calling it.

Now that the once-in-a-century public health crisis is well in the rear-view mirror, there have been many revelations that there had been a plethora of COVID relief fraud cases nationwide. A recently published Associated Press analysis shows that grifters plundered more than $280 billion from the federal government in pandemic funding. This was in addition to the roughly $123 billion that was misspent or wasted. So far, the US government has charged about 2,200 defendants with coronavirus-related fraud crimes. Thousands of other investigations are taking place. The newswire reported:

“Fraudsters used the Social Security numbers of dead people and federal prisoners to get unemployment checks. Cheaters collected those benefits in multiple states. And federal loan applicants weren’t cross-checked against a Treasury Department database that would have raised red flags about sketchy borrowers. Criminals and gangs grabbed the money. But so did a U.S. soldier in Georgia, the pastors of a defunct church in Texas, a former state lawmaker in Missouri and a roofing contractor in Montana.”

From the Government and Here to Help

Money is too important to be left up to the government. During the coronavirus pandemic, Washington spent more than $4 trillion. Of course, this is in addition to state and local government efforts, as well as the Federal Reserve’s money-printing endeavors. It was almost inevitable that there would be waste, fraud, and mismanagement. This is the government’s track record. In the coming years, there will be more probes, reports, and estimates of how much taxpayer money was lost. In the next crisis, nothing will be learned, and it will continue to be more financial chaos. It is the nature of the beast.