Anyone who has combed through the data, crunched the numbers with their Marchant Figurematic 10ADX calculators, and watched politicians kick the can down the road would not be surprised by the latest news: Social Security is running out of money. It turns out that an already fragile retirement scheme had been fiscally decimated by the COVID-19 public health crisis, resulting in doomsday prognostications and seniors sitting on the edge of their seats in anticipation of what happens to their benefits checks. So, what do the numbers say about this black hole that will swallow a substantial portion of America’s finances?

Social Insecurity in Washington

(Photo By Craig F. Walker / The Denver Post)

According to an annual report from the Old-Age and Survivors Insurance (OASI) Trust Fund, the program that pays retirees is forecast to run out of money by the end of 2033. Study authors projected that tax revenue would cover only 76% of the scheduled benefits afterward. The Disability Insurance Trust Fund is only funded through 2057, eight years earlier than last year’s estimate. Medicare is still expected to be out of cash in three years.

The Social Security and Medicare Boards of Trustees explained that they adjusted their projections to consider the global health crisis and the coronavirus-induced economic downturn. As a result, the federal government’s payroll and income tax revenues to fund these schemes were substantially hammered in 2020.

“The finances of both programs have been significantly affected by the pandemic and the recession of 2020,” the trustees said in the report. “At this time, there is no consensus on what the lasting effects of the COVID-19 pandemic on the long-term experience might be, if any. The Trustees will continue to monitor developments and modify the projections in later reports.”

In a recent press briefing, senior administration officials noted that the significant increase in deaths among American seniors allowed the programs’ costs to come in lower than initially anticipated. However, the Treasury Department warned that work productivity and the gross domestic product (GDP) are assumed to be 1% lower, which will harm the long-term components of Social Security and Medicare.

Treasury Secretary Janet Yellen attempted to assuage the gloomy paper, assuring everyone that the “Biden-Harris Administration is committed to safeguarding these programs and ensuring they continue to deliver economic security and health care to older Americans.” Indeed, during the 2020 election cycle, President Joe Biden promised not to cut Social Security and proposed a series of reforms to guarantee its survival.

But will Republican or Democrat policymakers possess the temerity to make tough decisions? Political observers aver that’s unlikely, considering it is too dangerous to touch for desperate lawmakers too frightened to risk losing their seats. Whatever the case may be, the recent trends point to one conclusion: Social Security is on the brink of insolvency – and it may be too late to do anything about its impending demise.

Trends of Concern

Contrary to public belief, the money workers have contributed to Social Security is not sitting in a safe deposit box waiting to be consumed in the winter years. Instead, the system relies on the current generation of employees to pay today’s retirees. This is why many libertarian and conservative economists often quip that the FDR program is a Ponzi scheme waiting to buckle under the pressure. And this is what is transpiring at the moment.

Contrary to public belief, the money workers have contributed to Social Security is not sitting in a safe deposit box waiting to be consumed in the winter years. Instead, the system relies on the current generation of employees to pay today’s retirees. This is why many libertarian and conservative economists often quip that the FDR program is a Ponzi scheme waiting to buckle under the pressure. And this is what is transpiring at the moment.

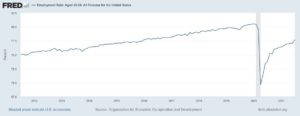

Thousands of Baby Boomers are retiring every day. The problem? There is a paucity of younger people entering the workforce to offset the ballooning costs. According to the Federal Reserve, the employment rate for Americans in their prime working years (25 to 54) is at a nine-year low. Plus, the working-age (15 to 64) population in the United States is at a six-year low.

Moreover, to further compound problems, U.S. life expectancy is rising, and birth rates are falling.

Moreover, to further compound problems, U.S. life expectancy is rising, and birth rates are falling.

Using Census Bureau data, the Social Security Administration estimates that the number of Americans 65 or older will exceed 79 million by 2035, up from the present figure of 54 million. At the same time, Centers for Disease Control and Prevention (CDC) data show that the number of births in the U.S. tumbled by 4% last year, sending the birth rate to “below replacement levels,” which means more people die in America each year day than are being born.

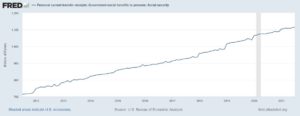

Here is one more new development that could hemorrhage the frail system: inflation. Liberty Nation reported in July that retirees could witness the largest increase in Social Security payments in 40 years because of skyrocketing inflation. The non-partisan advocacy group, The Senior Citizens League, predicted that the cost-of-living adjustment, or COLA, for 2022 could be 6.1% higher. For a cash-strapped entitlement endeavor, where would the money come from anyway?

Here is one more new development that could hemorrhage the frail system: inflation. Liberty Nation reported in July that retirees could witness the largest increase in Social Security payments in 40 years because of skyrocketing inflation. The non-partisan advocacy group, The Senior Citizens League, predicted that the cost-of-living adjustment, or COLA, for 2022 could be 6.1% higher. For a cash-strapped entitlement endeavor, where would the money come from anyway?

The Political Fallout

Republicans and Democrats routinely pay lip service to the financial troubles at the Social Security Administration. In every mid-term election or presidential contest, incumbents and serious contenders from both parties promise to make changes that will achieve long-term health while paying out current benefits. Once elected, the file is put back in the cabinet and ignored until the next electoral battle. Finally, the politicians will be forced to make drastic changes to Social Security because, based on federal law, benefit checks for retirees would be slashed by approximately 20% across the board. This would trigger immense political fallout. But would retirees be willing to make sacrifices when the day of reckoning arrives or depend on Congress to tell them what they want to hear?

~

Read more from Andrew Moran.