Is America’s energy crisis manufactured by the White House? The case that the current administration is purposely exacerbating the nation’s energy woes to install a green agenda is becoming increasingly prevalent after the federal government put the kibosh on new oil and gas lease sales in the country’s key producing areas. What might have been initially a policy of incompetence has metastasized into a campaign of arrogance and disdain for millions of struggling Americans in today’s cost-of-living crisis.

What Did Biden Do Now?

The Department of the Interior announced on the night of May 11 that it would not move ahead with planned oil and gas lease sales in Alaska’s Cook Inlet and the Gulf of Mexico. The department noted that there was a paucity of interest in the Cook Inlet lease sale, and the two planned leases in the Gulf of Mexico will not proceed because of contradictory court rulings.

“Due to lack of industry interest in leasing in the area, the Department will not move forward with the proposed Cook Inlet OCS oil and gas lease sale 258,” an Interior spokesperson said in a statement. “The Department also will not move forward with lease sales 259 and 261 in the Gulf of Mexico region, as a result of delays due to factors including conflicting court rulings that impacted work on these proposed lease sales.”

Since the administration’s chief tactic has been to blame everyone else for today’s panoply of economic problems, what is the truth and reality behind these cancellations? Is it another instance of the progressives’ Greenmageddon crusade that will result in less energy for the US and the world?

Alaska

By canceling the lease sale up north, the US government will prevent up to one million acres of drilling. This is the fourth time since 2007 that Alaskan leases have been tossed in the trash bin. In 2007, 2008, and 2011, the Bureau of Ocean Energy Management (BOEM) gave up on these lease sales amid a lack of interest from the industry.

(Photo by: Joe Sohm/Visions of America/Universal Images Group via Getty Images)

At a time when crude oil prices are above $100 per barrel, are energy firms not interested in tapping into even more petroleum products? The lack of enthusiasm is not necessarily because oil and gas companies want to starve the public of energy. Instead, it has more to do with the regulatory regime in the United States.

The first issue is that the green lobby has created tremendous headaches for the sector, essentially promising that they would go through any legal hurdle to prevent these companies from producing. Many environmentalists and related organizations are worried about belugas and other imperiled marine life. This happened under former President Donald Trump, who opened the state’s Arctic Wildlife Refuge for drilling. The lease sale only garnered the attention of three bidders, spotlighting concerns to do with green activists and Environmental, Social, and Governance (ESG) investors. Why bother going through immense costs and litigation challenges again?

Now, about those ESG investment funds: Despite falling behind fossil fuels on Wall Street, ESG shareholders control all the power these days, mainly because of the financial sector’s desire to appear green and friendly toward Mother Nature. Therefore, it is harder to attract capital for crude drilling, making it risky and costly to initiate these energy projects.

In today’s market, everyone will come up with any excuse not to drill for oil and natural gas. This trend will be difficult to maintain when Europe is importing more oil and liquefied natural gas (LNG) to keep the lights on as it kicks its Russian habit.

Mexico

The Gulf of Mexico has seen a growing number of oil platforms – a renaissance, if you will. Although energy analysts do not think Gulf oil production will be enough to resolve today’s soaring prices and satisfy immense demand volumes, it contradicts the White House’s assertion that energy firms are sitting idly by, twiddling their thumbs, and watching the volatile futures market.

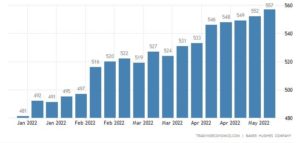

Gulf producers are gradually seeing output return to the pre-pandemic level of two million barrels per day. Energy consulting firm Wood Mackenzie forecasts that crude production could increase to 2.3 million barrels a day. Plus, the number of active US rigs drilling for oil has been steadily rising this year, nearing 560, according to the weekly Baker Hughes rig count.

Gulf producers are gradually seeing output return to the pre-pandemic level of two million barrels per day. Energy consulting firm Wood Mackenzie forecasts that crude production could increase to 2.3 million barrels a day. Plus, the number of active US rigs drilling for oil has been steadily rising this year, nearing 560, according to the weekly Baker Hughes rig count.

However, with more leases getting suspended or halted, industry experts project that Gulf output could be cut in half in less than 20 years. If there is continued regulatory volatility, investments could diminish.

“We’re sitting in a situation where it’s been coming up on two years without the issuance of offshore leases, likely to be three or four,” said Erik Milito, the president of the National Ocean Industries Association (NOIA), a group that represents offshore oil and wind industries. “You’ve got this tone and tenor that in many respects has had a chill on the investment community and on companies,” he added.

Drill, Baby, Drill

Oil and gas producers want to engage in some good old-fashioned exploration and production. Or, as the hip kids say these days, E&P. The problem is that, as is typically the case, the government is standing in their way. Big Oil and mom-and-pop drillers know they are backed in the corner, enduring the wrath of the federal government, the environmental lobby, the ESG community, and renewables sector. The situation could intensify if the US government approves the NOPEC bill, a piece of legislation that allows lawsuits against the Organization of the Petroleum Exporting Countries (OPEC) for allegations of market manipulation. If OPEC members choose to avoid lawsuit risks in the US and Europe, they will ship their products to Asia, leaving the West to rely on solar panels and windmills during frigid winters and hot summers. At this point, a severe energy crisis – a blend of high prices and scarcity – in America is self-inflicted damage.