US housing affordability is not what it once was. Scouring social media yields scores of frustrated young people unable to achieve the American Dream of homeownership, let alone the basic necessity of putting a roof over their heads without breaking the bank. It should be inconceivable to imagine that the cost to buy or rent a residential property would be out of reach for large portions of the population. How did this happen? Blame the government.

Housing Affordability in the US

According to the National Association of Realtors (NAR), existing home sales tumbled 2% in September, totaling 3.96 million units. Existing home sales are also down more than 15% compared to the same time a year ago. This represented the fourth straight decline in transactions, the tenth monthly drop in the last 12 months, and the lowest level since October 2010. In addition, the total housing inventory clocked in at 1.13 million units, down 8.1% from the same period a year ago. Unsold stocks stood at 3.4 months, up from 3.2 months in September 2022 (this measures the number of months it would take to exhaust current supply at the present rate of sales activity). The median existing-home price rose nearly 3% year-over-year to $394,300.

Market analysts are paying close attention to these statistics because they reveal a concerning trend: The current crop of homeowners is not erecting for-sale signs on front lawns. Can anyone blame them?

This past summer, a Redfin analysis found that 92% of property owners maintain a 30-year mortgage rate of below 6%, and more than one-quarter enjoy a 3% interest rate. Indeed, there is little incentive for families to sell their house and move to a more expensive abode at a higher mortgage rate, which is now at around 8% – and climbing!

“As has been the case throughout this year, limited inventory and low housing affordability continue to hamper home sales. The Federal Reserve simply cannot keep raising interest rates in light of softening inflation and weakening job gains,” said NAR Chief Economist Lawrence Yun in a statement. “For the third straight month, home prices are up from a year ago, confirming the pressing need for more housing supply.”

The crux of the issue is that when the Eccles Building slashed interest rates to nearly zero, Treasury yields also plummeted close to 0%. This sent mortgage rates crashing to below 3% during the coronavirus pandemic, the lowest on record. Homebuyers, flush with checks and savings from fiscal and monetary stimulus efforts, stormed the housing market and began scooping up detached properties, townhomes, and condominium suites, thanks to a once-in-a-lifetime opportunity.

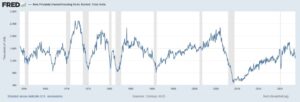

Of course, real estate inventories were already dangerously soft before the public health crisis, so ultra-low interest rates exacerbated the situation. Construction for new privately owned housing units never recovered from the subprime mortgage meltdown nearly 20 years ago. Housing starts were on an upward trajectory following the first wave of the respiratory illness and heading into April 2022, but they have since declined again, coinciding with the US central bank’s tightening campaign.

Scapegoating Corporate America

Scapegoating Corporate America

Last year, reports went viral of BlackRock and other investment titans buying single-family homes across the country, limiting the supply of houses for the typical family. Presidential candidate Robert F. Kennedy, Jr. thought this was such a dire development that he proposed Uncle Sam start guaranteeing homes for the public by co-signing loans and mandating the reduction of mortgage rates to 3%. This is an economically unsound solution since it would make properties more expensive by artificially boosting demand without addressing supply. Plus, were the lessons of the global financial crisis not learned?

But while the idea of Larry Fink becoming America’s chief landlord is concerning, this represents only a fraction of prospective homebuyers’ problems.

What is the Solution?

Industry experts purport two solutions to US housing affordability challenges: Slash interest rates and build more homes. But that’s easier said than done for a variety of reasons. First, inflation is re-accelerating, so any meaningful rate cuts could threaten to eradicate any gains the Fed has made to date. Second, it has become a challenging time for the construction industry, from higher borrowing costs to labor shortages to more expensive raw materials. Additionally, municipal zoning laws and excessive red tape have disincentivized the creation of new humble abodes.

Ultimately, there is no short-term fix for adult Generation Zers, forcing them to pay outlandish monthly rents (the national average is above $2,000), find roommates, or live in cramped shoeboxes in the sky. The silver lining is that at least America is not Canada, a hellacious real estate landscape where people rent beds in rooms with three other people in a basement.