It has been 15 months since the Federal Reserve kicked off its quantitative tightening campaign, a monetary policy that raises interest rates from historically low territory and trims the $9 trillion balance sheet. In March 2022, economists and market analysts priced in the apocalypse: a collapsing economy, tanking stocks, and the point of no return. Instead, in June 2023, the US has been the little engine that could, recording modest gains and lending credence to Fed Chair Jerome Powell’s “soft landing” mantra. So, is the tightening cycle over, and is the era of easy money upon us? Not yet.

What Did the Federal Reserve Do?

After ten consecutive rate hikes, the Federal Open Market Committee (FOMC) overwhelmingly agreed to leave the benchmark fed funds rate (FFR) unchanged at a target range of 5% and 5.25%. After seeing the consumer price index and the producer price index come down considerably in the latest Bureau of Labor Statistics reports, officials wanted to take a breather, stop and smell the expensive roses, and assess the landscape. Whatever you say, according to Powell, this was not a skip! That said, despite the rate pause, this does not mean the central bank’s work is done.

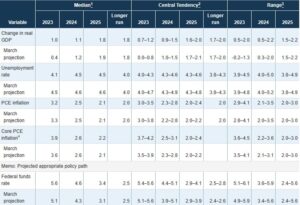

The rate-setting committee signaled that two more rate hikes are planned for this year, with the futures market anticipating a quarter-point increase at the July FOMC powwow. The latest Survey of Economic Projections (SEP), a measurement of what Fed officials expect, revealed that the median policy rate is forecast to reach 5.6% by the year’s end, up from the March prediction of 5.1%. The SEP also revised the 2024 and 2025 estimates higher to 4.6% and 3.4%, respectively.

But interest rates were not the only components to be changed. SEP figures also highlighted an upward revision in real GDP for 2023, from 0.4% to 1.1%, and core PCE inflation from 3.6% to 3.9% this year. But the unemployment rate was adjusted lower, from 4.5% to 4.1% by the end of the year.

Meanwhile, the Fed will continue reducing its holdings of Treasurys and mortgage-backed securities.

Meanwhile, the Fed will continue reducing its holdings of Treasurys and mortgage-backed securities.

“Recent indicators suggest that economic activity has continued to expand at a modest pace. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated,” the FOMC said in a statement. “The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.”

Financial markets were mixed following the announcement and during Powell’s post-FOMC meeting press conference, with investors struggling to gauge the situation. The leading benchmark indexes had crashed when the Fed revealed that two more rate hikes were planned for 2023 and that rate cuts might not happen for another couple of years. But traders pared these losses as the Eccles Building insisted that the end of the institution’s tightening campaign was inching ever so closer.

The US Treasury market was green across the board, with the benchmark ten-year yield picking up one basis point to nearly 3.81%. The widely watched one-month bill surged more than four basis points to 5.155%. In addition, the US Dollar Index (DXY), a measurement of the greenback against a basket of currencies, spiked after the FOMC announcement and then maintained the momentum in overnight trading to firm above 103.00.

What Now?

So, this might have been a fascinating Fed meeting for those who enjoy torturing themselves with monetary policy gobbledygook. But what does this mean for the average individual struggling to make ends meet? Suffice it to say, the lives of businesses and consumers will be the same tomorrow as they were yesterday, with inflation still above the central bank’s 2% target and borrowing costs trending higher.

Jerome Powell (Photo by Drew Angerer/Getty Images)

The good news from the press conference is that Powell and Co. are seeing disinflation trends in the goods sector and hinted that the labor market does not need to collapse to achieve the institution’s objective of restoring price stability. The bad news is that services inflation is sticky and stubborn, which the Eccles Building asserts originates from higher wages. Put simply, the Fed will keep raising interest rates and will leave them higher for longer.

A noteworthy point that several central bankers, from Fed Governor Philip Jefferson to Fed Governor Christopher Waller, make is that the US economy has not felt the full effects of the Fed’s 500-basis-point increase from the past year. Economics tells us that it usually takes between six and nine months for a major policy change to seep into the economy. In other words, the broader economy is only experiencing the brunt of a 3% FFR and has yet to endure the agony of a 5% terminal rate.

Recession

The first six months of 2023 have been a riveting tale in forecasting failures. In January, a hard landing was the expectation. In February, it was all soft-landing talk. In March, a financial crisis was on the horizon. In April, a credit crunch was the likely scenario. In May, it was anyone’s guess what would happen. In June, a soft landing is back on the table. Whatever the case, economists may need to step down from their ivory towers and look at the research that shows households are living paycheck to paycheck, facing the pressures of inflation and higher borrowing costs, and conceding that the US is already in a recession. Imagine, all this uncertainty could never have happened in the first place if the Federal Reserve turned off the printing presses in the spring of 2020 and normalized monetary policy. Or, at the very least, front-loaded its rate hikes in the fall of 2021. Instead, the fog of the Fed is making everyone’s head spin.