Three years ago, the Federal Reserve unleashed the mother of all quantitative easing (QE) bombs, slashing interest rates to nearly zero, buying government and corporate bonds, and printing trillions of dollars. The US central bank’s pandemic-era monetary stimulus and relief efforts initiated 40-year-high inflation. Despite the moral hazard and distortions that the Eccles Building has repeatedly manufactured, officials are now considering a permanent interventionist blueprint that would serve as the framework of how the institution responds to a distressed financial market. As legendary economist Ludwig von Mises wrote, “Intervention begets intervention.”

Federal Reserve Eternal Bailouts

Dallas Fed Bank President Lorie Logan delivered a March 3 speech at a Chicago Booth Initiative on Global Markets workshop, proposing that the central bank should design and implement a formal system of rescuing the financial markets when they are experiencing stress. She referenced bailout packages during the COVID-19 public health crisis as an example. “Central banks should rarely intervene to support the functioning of core markets, but when such interventions are needed, they must be effective,” she said. “At one level, intervening effectively should be straightforward. Central banks have powerful tools and, in principle, need only deploy them in sufficient size. But at another level, it is not at all straightforward to intervene in a way that ensures core markets continue to serve their crucial roles in the financial system.”

Interestingly enough, Logan began her speech warning that the US financial system “has become increasingly vulnerable to core market dysfunction,” particularly in the Treasury arena. Indeed, there has been a growing chorus of individuals – from US officials to market analysts – sounding alarm bells about potential chaos in Treasurys.

Meanwhile, Fed Governor Michelle Bowman echoed Logan’s remarks during the event, recommending that the institution employ “targeted purchases” of assets distressed by severe “liquidity strains.” At the same time, the Eccles Building must determine how to minimize its “footprint” and “restore market functioning.” Bowman added: “A further consideration is how to construct and communicate an exit strategy to reduce the enlarged balance sheet over time.”

But the Federal Reserve does not appear to share these officials’ concerns. The New York Fed penned a semi-annual monetary report that essentially concluded the financial system is flush with cash and that “financial vulnerabilities remain moderate overall.”

A Brief History of Crisis

While the federal government has caused many of the nation’s financial crises in the 20th and 21st centuries, the Fed has been the man behind the curtain, playing an instrumental role in facilitating these disasters caused by malinvestment and manipulation.

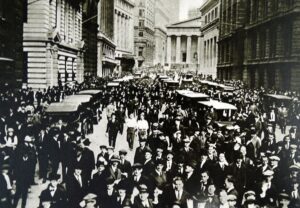

(Photo by: Universal History Archive/Universal Images Group via Getty Images)

The US central bank’s fingerprints were all over the Wall Street Crash of 1929, mainly fueling the credit expansion that ventured into time deposits (interest-bearing accounts that maintain maturities). As a result, the money supply exploded by more than 60% between 1921 and 1929. In addition, the Fed artificially lowered interest rates – the benchmark policy rate hardly cracked 5% during the Roaring Twenties – which led to enormous speculation and leverage on the stock market. Thanks to margin trading (buying equities with debt), this resulted in stocks being valued ten times their earnings.

When the US government established the Federal Deposit Insurance Corporation (FDIC), Washington effectively bailed out the financial institutions, allowing them to engage in reckless behavior threatening clients’ deposits. If something happened, Capitol Hill would swoop in and give customers up to $250,000. Since the banks knew they would be bailed out, they could participate in gambling – and still can.

In the 1980s, the Savings and Loan Crisis dominated the US economy, resulting in the collapse of one-third of the more than 3,200 banks in the country. But what caused the S&L debacle, which cost taxpayers $124 billion by the end of 2004? The FDIC. In the 1930s, federal deposit insurance was given to S&L entities, meaning that all of these companies were provided the same insurance premium rate, no matter how unsound they might have been. In the free market, this would not be the case. Many critics today argue that the deregulation campaign under former President Ronald Reagan was primarily the cause. However, these public policy reforms did not do enough because they still did not pay higher deposit insurance rates, so the efforts continued to foster increased risk. Why does this matter to the Fed? The central bank monetized the crisis by loading up on 15- and 30-year fixed-rate mortgages.

The housing bubble resulted from terrible years-long White House, congressional, Fed, and bank policy. Without diving too much into economic gobbledygook, the events could be summarized in this manner: The Democrat- and Republican-controlled Oval Offices demanded that everyone had a right to own a home. Congress approved millions of dollars in subsidies to first-time homebuyers with insufficient down payments. The Fed kept rates low for too long and injected $200 billion through open-market operations. The banks allowed the fractional-reserve system to run amok. By 2010, Fed Chair Ben Bernanke and Treasury Secretaries Henry Paulson and Timothy Geithner had handed out multi-billion-dollar bailout packages to Wall Street in the name of helping Main Street, which both taxpayers and the printing press funded.

Indeed, bad laws beget bad laws.

(Photo by Beata Zawrzel/NurPhoto via Getty Images)

Then there was the coronavirus pandemic. Despite denying initial pleas to bail out participants on the New York Stock Exchange, the Fed came to everyone’s rescue, bringing a bag of goodies in the form of slashing interest rates, acquiring Treasury and corporate bonds, and lending to securities firms. In a 12-month span, 40% of all US dollars ever created in the nation’s history were printed. As a result, Washington approved massive spending, armchair and institutional traders poured money into stocks, and the Everything Bubble was formed. And people still wonder why there is elevated inflation!

Moral Hazard

Why do these events matter? These instances – and there are many more – highlighted that politicians and bankers could act in irresponsible ways because they know the Fed, whether a Republican or Democrat chairs the century-old establishment, will intervene, run the printing presses, and drop this freshly created money from helicopters. Sure, the adults in charge should know better, but if they become addicted to free money, the dealers will keep the junkies hooked. Ultimately, in the field of economics, many of these situations were born from what is known as a moral hazard: individuals or organizations that are incentivized to engage in risk because they will not endure the total costs of these behaviors.