Eminent economist Milton Friedman famously said about inflation: “It is always and everywhere, a monetary phenomenon. It’s always and everywhere, a result of too much money, of a more rapid increase in the quantity of money than in output.” Suffice it to say, when the Federal Reserve has printed too much money and at a faster pace than production, the economy will inevitably endure a case of inflation. And yet, according to a new paper by the central bank, the phenomenon has been “difficult to predict.”

Inflation and the Fed

Fed economists recently published a paper titled “Global Inflation Uncertainty and Its Economic Effects.” The Eccles Building staff contended that the path of inflation since the beginning of the coronavirus pandemic “has been historically and objectively difficult to predict,” adding that US and foreign price pressures could threaten growth and present challenges to monetary policy.

“A message one could take from this is that, through the eyes of an econometrician with a rich set of predictors, inflation over the last two years was just objectively really hard to predict,” the paper stated. “In fact, more difficult to predict by far than any time in the last 60 years.”

It might be hard to believe that anyone could think a 40-year high consumer price index came out of nowhere. But, based on the newest Fed research paper and even the latest comments from Keynesian economist Paul Krugman, Ivory Tower experts believe that nobody could have expected inflation to skyrocket as much as it did. This is poppycock since a chorus of observers sounded alarm bells when the first CARES Act was approved. Others shrieked to the heavens when the American Rescue Plan was signed into law.

In March 2020, Liberty Nation wrote: “It is not out of the realm of possibility that the consumer economy could witness prices jump as much as 10% on the other side of the lockdown.” LN also warned when the Fed launched the mother of all bombs in monetary policymaking: “The consequences of containing the economic fallout will be severe, ranging from skyrocketing price inflation to astronomical government debt levels.”

Others, including a handful of lawmakers on Capitol Hill like Rep. Thomas Massie (R-KY), howled at the moon regarding the inflationary consequences of injecting trillions of dollars in liquidity into an economy that the federal government shut down. But what did they see that the talking heads did not?

Money Printer Go Brrr

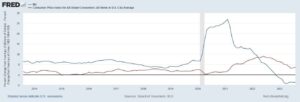

From the beginning of the COVID-19 public health crisis to July 2022, the Federal Reserve printed more than $6 trillion, lifting the nation’s money supply to nearly $22 trillion. In response to the central bank’s quantitative tightening efforts, the money stock has contracted by about $1 trillion. As more dollars were pumped into a closed economic landscape, too many bucks chased too few goods. In the process, consumers’ purchasing power was eroded since more units of currency were floating throughout the marketplace.

From the beginning of the COVID-19 public health crisis to July 2022, the Federal Reserve printed more than $6 trillion, lifting the nation’s money supply to nearly $22 trillion. In response to the central bank’s quantitative tightening efforts, the money stock has contracted by about $1 trillion. As more dollars were pumped into a closed economic landscape, too many bucks chased too few goods. In the process, consumers’ purchasing power was eroded since more units of currency were floating throughout the marketplace.

As the chart highlights, there is a compelling pattern between the volume of cash in circulation and the CPI. So, for example, it is unsurprising that the renewed growth in the money supply this past spring was followed by a reacceleration of inflation in the last few months.

This is not some conspiracy theory emanating from the Austrian School of Economics, either. The St. Louis Fed Bank notes: “Inflation is caused when the money supply in an economy grows at a faster rate than the economy’s ability to produce goods and services.” So, progressives can blame so-called greedflation, President Joe Biden can scapegoat Russian President Vladimir Putin, and desperate Democrats can pin it all on former President Donald Trump. Despite these efforts to gaslight the public, basic economics will tell you that the printing press fueled the inflation mayhem.

What’s Next for Inflation?

The rumors of inflation’s death have been greatly exaggerated. Contrary to what White House officials have been saying for the past 12 months, inflation is not falling – it is still growing. Instead of rising at a 9.1% year-over-year pace, the annual inflation rate is growing at a 3.8% clip. The chief concern among monetary policymakers, at least according to Fed Chair Jerome Powell during his post-Federal Open Market Committee meeting press conference, is that inflation will be an ebb-and-flow affair. This is something that LN has discussed before, a scenario much like in the 1980s and 1990s when inflation kept coming back every time it appeared that an elevated CPI had been defeated.

The rumors of inflation’s death have been greatly exaggerated. Contrary to what White House officials have been saying for the past 12 months, inflation is not falling – it is still growing. Instead of rising at a 9.1% year-over-year pace, the annual inflation rate is growing at a 3.8% clip. The chief concern among monetary policymakers, at least according to Fed Chair Jerome Powell during his post-Federal Open Market Committee meeting press conference, is that inflation will be an ebb-and-flow affair. This is something that LN has discussed before, a scenario much like in the 1980s and 1990s when inflation kept coming back every time it appeared that an elevated CPI had been defeated.

Is there a solution? The Fed thinks it should keep raising interest rates. Democrats believe Washington needs to spend more. Republican presidential candidates want to unleash American energy and cut red tape. The easiest solution is to turn off the printing press and allow all the pandemic-era excess liquidity to dry up. But it is easier to kick the can down the road than to make hard choices.