Editor’s note: In Part 1 of a two-part series, Andrew Moran interviews economist Daniel Mitchell on the Democrats’ wishful thinking that spending trillions more on social programs will bring down the deficit.

President Joe Biden and Democrats are spending more to fight higher consumer and producer prices and slash the federal deficit. House Speaker Nancy Pelosi (D-CA) and her merry band of free-spending policymakers are adamantly dismissing suggestions that approving trillions of dollars in new and continued spending has contributed to four-decade-high inflation and the more than $30 trillion – and counting – national debt. In fact, according to the White House, it is quite the opposite: Washington needs to pass the multi-trillion-dollar Build Back Better (BBB) agenda to curb the consumer price index (CPI) and reduce the deficit. But everything emanating from the Democratic Party is a Keynesian case of wishful thinking, says Daniel J. Mitchell, an eminent economist and celebrated author.

The Keynesian Invasion

Are politicians incompetent or mendacious? Well, perhaps a little bit from column A and a little bit from column B. Put simply, they are acolytes of Keynesianism, a theory that purports greater spending and intervention, be it fiscal stimulus or monetary expansion, can spark economic growth.

Despite trillions of dollars being spent in Biden’s first year in office, the federal deficit plummeted by about $1 trillion, the biggest single-year decrease in the nation’s history. On the surface, this might appear that Bidenomics has led to fiscal prudence within the corridors of power. However, after you dig through the cosmetics, you will find that the imbalance decline occurred in spite of the Oval Office’s aggressive expansion of the size and scope of the federal government.

Indeed, the most comprehensive factor is that many COVID-related short-term-emergency, stimulus, and relief programs expired because they were one-time endeavors. Like everything else coming from this administration, the latest statements from the House Democratic Caucus Issues Conference are misleading and lack important context, critics say.

“All that’s happened with fiscal policy in the United States is we had this giant sort of pig through the python emergency spending for the pandemic and, as that spending has sort of traveled through the python, all of a sudden, there’s now less spending,” Mitchell told Liberty Nation. “But it’s not because government has gotten smaller. It’s just because this huge one-time orgy of new spending has finally petered out.”

And this is everything that is wrong with economic policymaking in the nation’s capital.

In this in-depth interview with LN, Mitchell explained that the central tenet of Keynesian economics is on full display in the Swamp, “this notion that you’re sort of priming the pump of the economy.” However, according to the founder the Center for Freedom and Prosperity, the chief problem is that the United States and other advanced economies have experimented with Keynesian economics, and “it didn’t work.”

“It’s never worked, and yet the excuse is always the same, ‘Ah, if only we spent more,’ we would’ve gotten this magical pump priming effect where you create this virtuous cycle of people spending more, spending more, and somehow you wind up, even though the government’s spending money, you wind up somehow making the economy so strong that it generates enough tax revenue that you offset the new spending,” he stated.

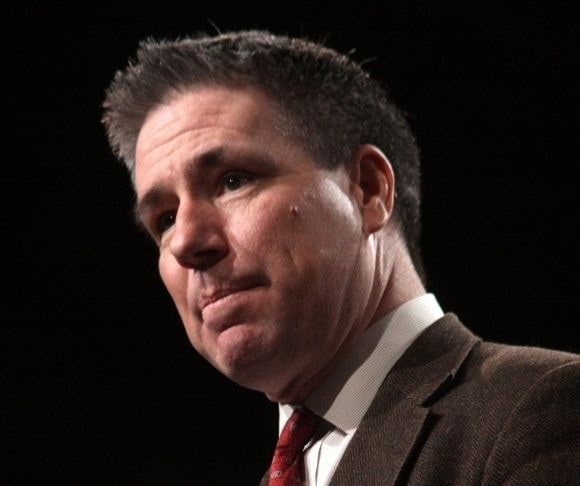

Nancy Pelosi

Unfortunately, elected officials fail to learn from history, even when these same prominent individuals have lived through it. Mitchell averred that Pelosi made these same claims more than a decade ago when she championed then-President Barack Obama’s stimulus package, arguing that jobless benefits would boost economic growth.

Today, Pelosi is howling to the moon again and attempting to convince the American people that giving the go-ahead to trillions in deficit-financed spending will lead to post-pandemic gains, a reduction in inflation, and cleaning up the red ink spilling from Uncle Sam’s public purse. But while any layman might view this as defying common sense, there is some method to this madness, explained Mitchell.

As LN reported at the height of BBB talks and deficit forecasts late last year, Democrats had concealed the true cost of their plan by injecting sunset clauses into the legislation. Pelosi and her subordinates informed the public that all this new entitlement spending would be funded for one to six years, eventually coming to an end. This allowed the president to diminish the projected cost by a vast amount. Anyone with a modicum of comprehension of how the federal government operates knows that “nothing is more permanent than a temporary government program.”

This is why the Committee for a Responsible Federal Budget (CRFB) noted that proposed programs inside the BBB would cost nearly $5 trillion over the next ten years.

“It’s utter nonsense,” Mitchell bluntly stated. “Everyone knows the game that they’re playing, but the scorekeepers at the congressional budget office, they are legally limited to look at what the language of the legislation actually says. And so, even though everyone knows all these expiration dates are nothing but camouflage, the congressional budget office has to pretend they’re real.”

In the end, although the deficit fell, the national debt is still expected to increase.

On the Road to Greece?

Greece ‘s sovereign debt crisis became a cautionary tale for both spendthrift advanced and developing markets. It was several years of income losses, destitution, political upheaval, and even a humanitarian crisis when Greece’s financial conditions substantially deteriorated after entering the European Union in the 1980s, resulting in a Greek tragedy a la Euripides, Aeschylus, or Sophocles.

‘s sovereign debt crisis became a cautionary tale for both spendthrift advanced and developing markets. It was several years of income losses, destitution, political upheaval, and even a humanitarian crisis when Greece’s financial conditions substantially deteriorated after entering the European Union in the 1980s, resulting in a Greek tragedy a la Euripides, Aeschylus, or Sophocles.

Could America ever turn into Greece? The consensus among non-partisan economists is that the United States is headed off a fiscal cliff, and the disastrous consequences could be exacerbated if many of the welfare-state provisions inside BBB are approved and permanently installed for future generations to routinely bail out in higher taxes, more borrowing, and accelerated printing.

“Instead of becoming Greece at 60 miles an hour, we would become Greece at 75 miles an hour,” noted Mitchell. “We’re traveling at too fast a rate of speed in the wrong direction, and Biden wants to step on the accelerator.”

Part two of this in-depth interview discusses the Federal Reserve raising interest rates and who is counting the dollars and cents in Washington.

~ Read more from Andrew Moran.