President Joe Biden and his administration have employed a social media strategy that compares Bidenomics to MAGAnomics, suggesting that his economic doctrine is the superior alternative to former President Donald Trump and his brand of America First Republicans. Liberty Nation has compared the records of these philosophies, with the real estate billionaire mogul enjoying a stark advantage based on the numbers. But while Trump added trillions to the national debt in his time in the White House, it appears that Biden is looking to outdo his predecessor.

Bidenomics and the National Debt

According to the Treasury Department, the national debt recorded a historic milestone by topping $33 trillion for the first time in the nation’s history. This means it took the federal government three months to add $1 trillion to the debt. To put this into context, it took the nation about 200 years to reach its first trillion.

But while this is a tragic instance of fiscal irresponsibility, the actual headline is how much interest the United States is paying on all of this debt. By the time the current fiscal year comes to an end, annual interest payments will exceed $1 trillion. In fact, daily debt-servicing payments have doubled in the past 12 months to $2 billion. These costs are now Washington’s second largest budgetary item, sitting just behind Social Security.

Treasury Secretary Janet Yellen is unconcerned about this because the interest-to-GDP ratio is below the long-term average of 2%. However, the number she cites is from 2022, meaning that the current figure is likely north of what was reported last year due to the Federal Reserve’s quantitative tightening efforts since then. In addition, the White House forecasts the measurement will climb to nearly 2.9% by 2024, and the Congressional Budget Office predicts it will skyrocket to close to 7% by 2053.

Unfortunately, because these numbers are astronomical and appear to be the new normal, it can feel like the American people are numb to the ballooning national debt and interest payments. But the public will eventually feel the pain when demand for Treasury securities diminishes, tax revenues tumble, and Congress needs to prioritize spending.

Got Stagflation?

Is the US economy coming to a standstill? It is hard to believe when the gross domestic product growth rate is expected to be about 5% in the third quarter, according to the Federal Reserve Bank of Atlanta. But a plethora of measurements suggest that a climate of stagflation – a blend of higher inflation and anemic expansion – is upon the world’s largest economy.

The latest data point comes from S&P Global and its purchasing managers’ indexes (PMIs), which are barometers on the general trend of a sector or economic landscape.

The latest data point comes from S&P Global and its purchasing managers’ indexes (PMIs), which are barometers on the general trend of a sector or economic landscape.

The services PMI slowed to 50.2 in September, down from 50.5 in August and below the consensus estimate of 50.6. Anything below 50 indicates contraction, so the industry appears to be heading this way after four consecutive months of sliding business activity. Analysts note that a decrease in new business, fueled by high inflation and rising interest rates, and a drop in new export orders were the chief contributors to this month’s slowdown.

Chris Williamson, the chief business economist at S&P Global Market Intelligence, wrote in the report:

“The survey price data meanwhile indicate stubborn stickiness of inflation, consistent with CPI running around the 3% level in the months ahead, with higher oil prices presenting some upside risks to inflation. Wage growth also remains a widespread driver of inflation, and employment growth ticked higher in September to add to signs of labor market strength. However, with backlogs of work falling at a marked rate, and future output expectations slipping lower, there are question marks as to how long companies will continue to boost payroll numbers at the current rate.”

Meanwhile, manufacturing activity continued to shrink in September, clocking in at a better-than-expected pace of 48.9, up from 47.9 in the previous month. The composite PMI also edged down to 50.1 from 50.2.

Where’s the Beef?

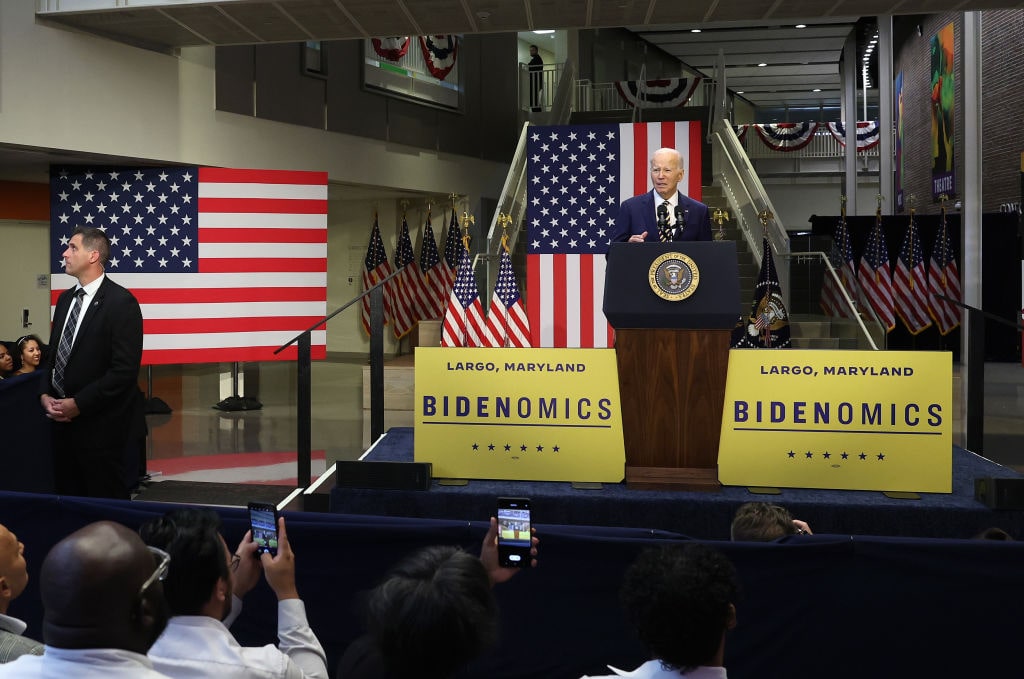

(Photo by Kevin Dietsch/Getty Images)

For the past year, Liberty Nation has warned about the reacceleration of beef prices. Despite a deflationary effect seen in this food category in late 2022 due to farmers exhausting their inventories and flooding the market with cheap meat, ranchers now do not possess enough supply to satisfy demand. This upward trend in beef prices has been seen in the last few consumer price index reports, swelling 1.2% in August and 2.4% in July. On an annualized basis, beef and veal have risen to 6.3%.

But the financial markets are signaling that higher costs are coming for butchers and carnivores. Year-to-date, live cattle futures have soared about 20% on the Chicago Mercantile Exchange. Conditions are unlikely to improve, particularly as energy prices, from gasoline to diesel, are going through the roof.

If shoppers are planning to transition to other proteins, good luck! Chicken prices surged more than 2% last month. Pork spiked 2.2%, while fish and seafood jumped nearly 1%. Well, maybe it is time to feast on eggs as they have crashed following their spike earlier this year.