Could the United States return to the days of the Obama economy? The baseline scenario for Wall Street heading into 2023 is a recession. Many signs indicate an economic downturn next year: The Federal Reserve’s M2 money-supply growth is below pre-pandemic levels, the manufacturing and housing sectors are in a recession, companies’ forward guidance is bleak, and consumers are taking on more debt while slashing their savings rate. Whether it is shallow or short, 2023 could be a year of great change for the US; even the central bank has abandoned its soft-landing talk. But what comes after could be critical, particularly if the Democrats retain power in 2024.

Reviving the Obama Economy

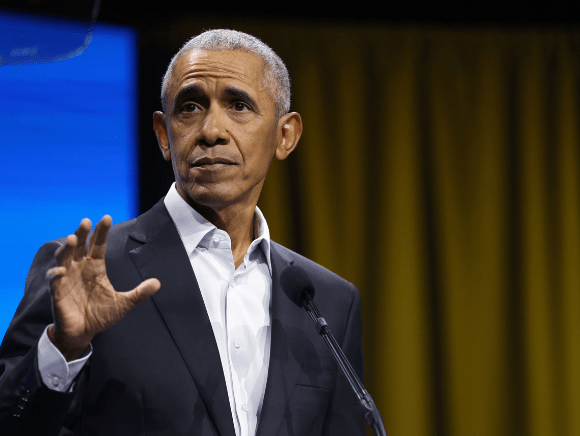

Eminent economist Milton Friedman famously purported that “the worse the recession, the stronger the recovery.” This did not apply to the 44th president, who struggled on nearly every economic front in his eight years in the White House. But do not tell this to the left-leaning revisionists who will likely assess the situation differently. Leftists have regularly engaged in revisionism regarding former President Barack Obama’s economy. He possessed the third-worst recovery record in US history while leaving the nation more in debt than when he arrived. Sure, Obama was a cool guy who played basketball and was adored by celebrities everywhere. But this does not change the fact that the Obama economy was dreadful.

This was confirmed by the Congressional Research Service (CRS) in Obama’s final few months in office. The report noted that the pace of US economic growth since 2009 had been slower than the previous ten expansions. Let’s take a look at some of the key measurements that the experts use to make a determination on the success or failure of a president’s handling of the economic landscape.

This was confirmed by the Congressional Research Service (CRS) in Obama’s final few months in office. The report noted that the pace of US economic growth since 2009 had been slower than the previous ten expansions. Let’s take a look at some of the key measurements that the experts use to make a determination on the success or failure of a president’s handling of the economic landscape.

First, the gross domestic product (GDP) never exceeded 3% in any year of Obama’s two terms. His worst was -2.6% in 2009 and his best was 2.71% in 2015. In his final year in office, the GDP growth rate was just 1.67%. Second, on the labor front, it took Obama six years to achieve full employment, which is generally defined as a jobless rate of around 5%. In 2009 and 2010, the unemployment figure was above 9%. The workforce gauge did not slide below 5% until 2016 when it averaged 4.87% for the year. Third, the Institute for Supply Management’s Manufacturing Purchasing Managers’ Index (PMI) could hardly stay in expansion territory, as the figure was regularly below the 50 threshold – anything below 50 indicates contraction.

But why was the Obama recovery so poor? There were many reasons: higher taxes, excessive federal spending, government jobs programs, and overregulation. As a result, his overall economic record ranked just ahead of Presidents Herbert Hoover and Andrew Johnson.

Now, why does any of this matter, with Bidenomics the law of the land? The nation could emulate this environment again after the next recession. It could be some blend of stagnating economic growth, high volumes of public and private debt, and elevated inflation mixed with higher interest rates.

(Photo by Jakub Porzycki/NurPhoto via Getty Images)

The Post-Recession Economy

Is it a certainty that the US will slip into its second recession under President Biden? Perhaps. But the real danger might be what happens after consecutive quarters of negative GDP growth.

While this had been a problem leading up to the coronavirus pandemic, astronomical amounts of debt embraced by the US government, households, and corporations should be a cause for concern. In the US, the total public- and private-sector debt as a share of the GDP is north of 400%. When interest rates were slashed to zero, the credit market was booming as everyone overborrowed to buy stocks, keep businesses open, or flood the economy with liquidity. Now that rates are rising to levels unseen since the 2008 financial crisis, it is going to be challenging to service this debt.

Is credit necessarily odious? Not if it is applied correctly, mainly in the form of using the injection of capital to purchase a residential property or invest in capital equipment. Unfortunately, many parties are relying on credit to keep their heads above water. What might have once been a tool to facilitate long-term economic activity has metastasized into a sustenance method.

For the government, Republicans and Democrats have approved trillions in deficit-financed spending that were not complemented by budget cuts – an addiction supported by the Federal Reserve.

Lastly, zombie companies could return to prominence in the coming years. During the Great Recession and the COVID-induced meltdown, insolvent firms were bailed out through ZIRPs, quantitative easing, and fiscal stimulus. Many green-focused firms could further survive thanks to the billions in goodies coming out of the Inflation Reduction Act. They were revived under easing conditions, but now that the marketplace is tightening its belt, these overleveraged entities will be forced to face the music, be it with higher interest payments or by declaring insolvency.

In the backdrop to all this madness is an erosion of Americans’ purchasing power. For two years, the country endured a cost-of-living crisis. While the consumer price index (CPI) likely peaked this past summer at 9.1%, the question is: When will the Federal Reserve return inflation to its 2% target? Until then, inflation will eviscerate wage gains as it is entrenched throughout the US economy. No wonder that half the country is living paycheck to paycheck.

In the backdrop to all this madness is an erosion of Americans’ purchasing power. For two years, the country endured a cost-of-living crisis. While the consumer price index (CPI) likely peaked this past summer at 9.1%, the question is: When will the Federal Reserve return inflation to its 2% target? Until then, inflation will eviscerate wage gains as it is entrenched throughout the US economy. No wonder that half the country is living paycheck to paycheck.

Stagflation’s the Name

Stagflation – a period of stagnating GDP growth and high inflation – is an ugly word. In some circumstances, it could be worse than a recession since the economy is merely lingering and failing to advance past GO. When Trump arrived in Washington, the United States received a jolt that bolstered the national economy. Of course, the coronavirus pandemic changed everything, and now it will be an uphill battle for Republicans and Democrats, corporations and consumers to return to the pre-pandemic days. Perhaps the next recession will be short and sweet or dragged out for an extended period. Unfortunately, based on all the latest data and trends, the US may witness a sequel to Obamanomics.