The U.S. labor market started and ended 2021 on a low note as jobs fell short of market estimates. Is the Omicron variant triggering a slowdown in the hiring process, or is this an isolated incident in the long road ahead to a full economic recovery? Like any off-the-cuff interaction between President Joe Biden and the mainstream media, the employment situation does not make any sense, from The Great Resignation to record job openings.

In December, the U.S. economy added 199,000 jobs, short of the market consensus of 400,000, according to the Bureau of Labor Statistics (BLS). This is down from the upwardly revised 249,000 in November. The unemployment rate fell to 3.9% last month, down from 4.2% in the previous month. However, if the BLS’ U-6 unemployment rate is utilized, which includes short-term discouraged workers and individuals forced to work part-time, the figure is around 8%.

In December, the U.S. economy added 199,000 jobs, short of the market consensus of 400,000, according to the Bureau of Labor Statistics (BLS). This is down from the upwardly revised 249,000 in November. The unemployment rate fell to 3.9% last month, down from 4.2% in the previous month. However, if the BLS’ U-6 unemployment rate is utilized, which includes short-term discouraged workers and individuals forced to work part-time, the figure is around 8%.

BLS data also show that the labor force participation rate was unchanged at 61.9%. Moreover, average hourly earnings rose 0.6% month-over-month to $31.31, while average weekly hours were flat 34.7.

So, where were the jobs? Once again, the labor report was led by gains in leisure and hospitality. BLS figures highlight that the sector added 53,000, followed by professional and business services, with 43,000. Here is a look at the rest of the employment update:

- Manufacturing: 26,000

- Construction: 22,000

- Transportation and warehousing: 18,700

- Wholesale: 13,700

- Education and health care: 10,000

Government shed 12,000 positions, the retail trade lost 2,100, and the utilities sector dropped 200 jobs.

Knock on Wood

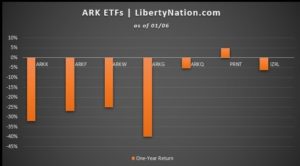

Cathie Wood, the founder and CEO of Ark Investor and the Wall Street darling of 2020, is already in the hole – and it has only been one trading week into the new year. While she had a terrific 2020, like most other investment funds, she has failed to light the financial world on fire again. Is Wood a flash in the pan? The answer to that may lie in the performance data of her exchange-traded funds (ETFs).

Right out of the 2022 gate in the U.S. stock market, the ARK Fintech Innovation ETF has slumped nearly 10%, the ARK Space Exploration and Innovation ETF has tumbled about 4%, and the ARK Genomic Revolution ETF has fallen more than 10%. But these numbers are comparable to how these ETFs have performed over the last year, with only one ETF mustering a positive return: The 3D Printing ETF has recorded a one-year gain of 5%.

Right out of the 2022 gate in the U.S. stock market, the ARK Fintech Innovation ETF has slumped nearly 10%, the ARK Space Exploration and Innovation ETF has tumbled about 4%, and the ARK Genomic Revolution ETF has fallen more than 10%. But these numbers are comparable to how these ETFs have performed over the last year, with only one ETF mustering a positive return: The 3D Printing ETF has recorded a one-year gain of 5%.

But what happened? The highly popular ARK investments were some of the top-performing funds of 2020, soaring an average of 150%. Since their peak in early 2021, these equity vehicles have been declining faster than President Biden’s approval rating. Todd Rosenbluth, head of ETF and mutual fund research at CFRA, said in a recent research note:

“Loyal investors to the ARK strategies hoped 2022 would be more like 2020 and not a repeat of 2021. But they are being reminded that past performance success is not indicative of future results and are being forced to decide if the risk is worth the reward in a rising rate environment.”

Will 2022 eventually be better? Some market experts believe that Wood’s stocks are not low enough. It makes sense: inflation is high, the Federal Reserve is accelerating its tapering, and the pandemic bubble will eventually deflate without all that easy money.

What Wood Investors Do?

(Photo by Robert Nickelsberg/Getty Images)

Lumber had a roller coaster ride in 2021. At one point, prices had reached an all-time of $1,616 per thousand board feet, skyrocketing 323%. Soon after, a sharp correction occurred, falling 74 to around $420. Will 2022 be a repeat? It might be too earlier, but there are signs that a sequel is in the works.

Lumber prices are soaring once again, touching their best levels in seven months. The rally is being driven by flooding in Western Canada, surging consumer demand, and an intensifying supply chain crisis. Should lumber sustain its upward trajectory, it could add to the cost of building a typical new single-family home by approximately $20,000. In addition, industry observers warn that sky-high prices could hurt repair and renovation demand since buyers might defer their purchases and DIY projects.

That said, some experts contend that prices will likely stabilize in the coming months as supply-chain challenges dissipate. Still, the cost to acquire lumber could remain at historically high levels for much of 2022. Can any corner of the marketplace achieve any respite this year? Well, only if you eat potatoes.

~ Read more from Andrew Moran.