If you thought the US economy was in horrid shape, you might not be paying enough attention to what is transpiring across the pond in Europe. From skyrocketing energy prices to weakening economic growth, Europe’s financial crisis is almost inevitable. For Russian President Vladimir Putin, it is mission accomplished. The culpability for a guaranteed recession rests entirely with the central bankers engineering a hard crash when a soft landing may have been possible a year ago. But this is a chicken and an egg problem: Will the US economy catch Europe’s bad case of influenza, or will the United States make everyone else ill? Either way, winter is coming – figuratively and literally.

US Economy v. European Economy

Technically, the US economy slipped into a recession following back-to-back quarters of negative gross domestic product (GDP) growth rates. While the eurozone and the United Kingdom have yet to post comparable data, the tone of public policymakers has drastically shifted. The Bank of England (BoE) proclaimed that the United Kingdom might already be in a recession, and European Central Bank (ECB) head Christine Lagarde thinks the risks are rising exponentially.

Technically, the US economy slipped into a recession following back-to-back quarters of negative gross domestic product (GDP) growth rates. While the eurozone and the United Kingdom have yet to post comparable data, the tone of public policymakers has drastically shifted. The Bank of England (BoE) proclaimed that the United Kingdom might already be in a recession, and European Central Bank (ECB) head Christine Lagarde thinks the risks are rising exponentially.

Indeed, the data on both sides of the Atlantic Ocean cannot elicit even a modicum of confidence in businesses and consumers. In the world’s largest economy, many aspects of the economic landscape are getting decimated faster than the 2022 Boston Red Sox roster. From housing figures to purchasing managers’ index (PMI) prints, the United States is slamming the brakes, although the labor market continues to sizzle. Moreover, inflation is still broadly elevated, coming in at a higher-than-expected annualized rate of 8.3% in August. Overall, the Federal Reserve Bank of Atlanta’s GDPNow model shows a third-quarter economy on the cusp of another quarterly decline.

Despite the downward trajectory of the US economy, things are just a little worse in Europe. Consumer confidence has collapsed, inflation expectations have skyrocketed, the August consumer price index (CPI) rose to 9.1%, retail sales contracted year-over-year in July, and the PMIs fell into contraction territory. So far, the eurozone April-June GDP remains in slight expansion mode. In England, the data are about the same, with a deteriorating real estate market, weakening PMIs, a 9.9% annual inflation rate in August, and lower-than-expected industrial and manufacturing production. As a result, the GDP is about flat.

The financial markets are in bad shape in both North America and Europe, while the currency situation has been mixed. The US Dollar Index (DXY), which gauges the greenback against a basket of currencies, has garnered some recognition in the global financial markets. Year-to-date, the euro has lost 14% against the greenback, while the British pound fell into a bear market (-20%) compared to the buck. The US Dollar Index (DXY), which gauges a George Washington against a basket of currencies, has spiked 18% on the year.

Ultimately, the economic landscape in these markets could be summarized as: The United States has endured a year-long cold, Europe was just diagnosed with a bad case of influenza, and the United Kingdom has a terrible cold that could metastasize into the flu without a hot cup of tea and a Coronation Street marathon. Of course, the health of these three patients may depend on what the Fed, ECB, and BoE do moving forward: rip off the Band-Aid or keep doping up the convalescent.

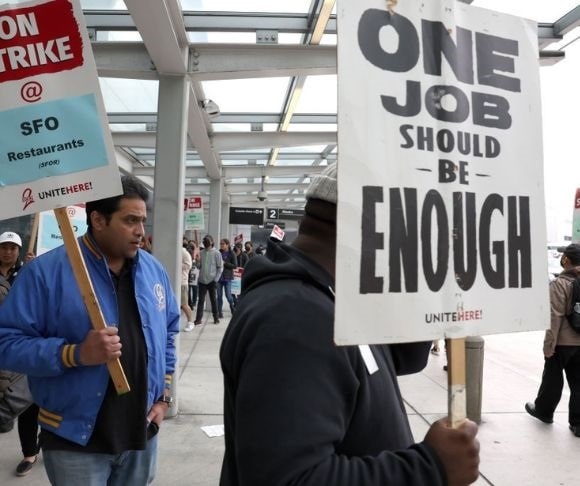

Pound of Flesh for a Dollar a Day

(Photo by Matt Cardy/Getty Images)

Liberty Nation recently discussed the advantages and disadvantages of a weaker Chinese economy. The conclusion was that the United States would primarily benefit from big trouble in little China. So, what about the situations in the United Kingdom and the 27-member trade bloc? The situation is a little bit more complicated. The United States is friends with Europe and chums with Great Britain. America maintains a vested interest in determining Europe’s success, especially with Moscow trying to deliver knockout blows to the continent. President Joe Biden will bail out his pals on the other side of the Atlantic with crude oil and natural gas to prevent widespread freezing and a victory for the Kremlin.

The main factor in all of this is – surprisingly – foreign exchange rates, as the greenback has strengthened so much that it will cost the Europeans an arm and a leg to buy dollar-denominated American energy. On the one hand, a stronger buck bolsters US purchasing power in the international marketplace. On the other, most every advanced currency in the global economy, from the euro to the British pound to the Japanese yen, has cratered, making the dollar and Russian ruble the strongest currencies today.

In the end, nobody may be declared the victor in today’s geopolitical chess match. The only difference might be who has it worse. Pick your poison: Europe’s energy crisis, the UK’s sterling collapse, or America’s Bidenomics.