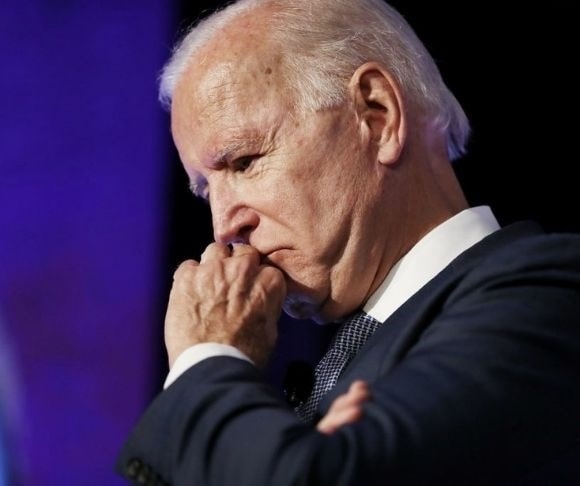

The last time inflation was this high in the United States, Ronald Reagan was president, kids were clamoring for the Odyssey 2 video game system, and Arnold Schwarzenegger graced audiences with his thespian skills in Conan the Barbarian. Indeed, a surging consumer price index (CPI) is running wild on President Joe Biden’s economy.

According to the Bureau of Labor Statistics (BLS), the annual inflation rate surged 7%, the highest level since June 1982 and matching the market forecast. The reading was up from the 6.8% gain in November. The core inflation rate, which removes the volatile energy and food sectors, climbed 5.5% year-over-year last month, slightly higher than the 5.4% jump in the previous month.

So, what was higher? Everything – although energy prices did show signs of easing, mainly because of the two-week selloff in crude oil and natural gas caused by concerns over the Omicron variant. Here is a snapshot of the chief indexes in the 12 months ending in December:

- Food: +6.3%

- Energy: +29.3%

- New vehicles: +11.8%

- Used cars and trucks: +37.3%

- Apparel: +5.8%

- Shelter: +4.1%

- Medical care services: +2.5%

Many market analysts believe this could be the peak of four-decade high consumer inflation. That said, the new consensus – on Wall Street and in Washington – is that inflation will remain elevated for much of the year. Ipek Ozkardeskaya, a senior analyst at Swissquote, stated in a research note:

“It has been a relief to see the US inflation not going above the expectations for once! The consumer price index in the US rose 7% y-o-y in December, the highest pace in four decades, BUT, the figure was in line with analyst expectations, and brought forward the idea that this could be the point we see a peak in the inflation levels and light at the end of the long and dark inflation tunnel.”

How About Those Producer Prices?

The producer price index (PPI) soared at an annualized pace of 9.7% in December, a little bit lower than the median projection of 9.7%. The cost of services swelled 0.5%, driven by higher margins for fuels and lubricants, vehicle warehousing, machinery, wholesaling, and food retailing. The good news was that prices for goods fell 0.4%, the first monthly decline since April 2022 due to falling gasoline, diesel, and food costs. However, the PPI may have already witnessed its zenith because monthly producer prices edged up just 0.2%.

Omicron infections, higher price inflation, shipping delays, and shoppers moving up their Christmas consumption led to a contraction in retail trade in December. New Census Bureau data show that retail sales slumped 1.9%, below economists’ expectations of 0%. The U.S. retail landscape posted declines across the board, including apparel, furniture, electronics, sporting goods, and general merchandise. Still, despite everything being hurled at retailers, from supply chain disruptions to labor shortages, the industry “delivered a positive holiday experience to pandemic-fatigued consumers and their families,” said National Retail Federation (NRF) CEO Matthew Shay in a statement. In total, November-December holiday sales totaled $886.7 billion.

Omicron infections, higher price inflation, shipping delays, and shoppers moving up their Christmas consumption led to a contraction in retail trade in December. New Census Bureau data show that retail sales slumped 1.9%, below economists’ expectations of 0%. The U.S. retail landscape posted declines across the board, including apparel, furniture, electronics, sporting goods, and general merchandise. Still, despite everything being hurled at retailers, from supply chain disruptions to labor shortages, the industry “delivered a positive holiday experience to pandemic-fatigued consumers and their families,” said National Retail Federation (NRF) CEO Matthew Shay in a statement. In total, November-December holiday sales totaled $886.7 billion.

Industrial, Manufacturing Output Falls

Production in the industrial and manufacturing sectors finished the year on a sour note, contracting 0.1% and 0.3%, respectively, in December. Recent Federal Reserve statistics show that industrial output fell amid a notable decline in factory, durables, utility, and non-durable activity. Aside from chemicals and non-metallic mineral products, most of the other subcategories posted losses. Industrial and manufacturing output expanded on a year-over-year basis at a less-than-expected 3.7% and 3.5% rate, respectively.

US Consumers Losing Patience With Bidenomics

In December, U.S. consumers showed some hope that the post-crisis economy could be turned around. Think again. The University of Michigan Consumer Sentiment Index dropped to 68.8 in January, down from 70.6 in the previous month and under the projection of 70. The premier consumer survey also highlighted consumer expectations plummeted to 65.9, while current economic conditions slid to 73.2. Their one- and five-year inflation expectations also rose to 4.9% and 3.1%, respectively. So, once again, consumers are bearish on the economy.

In the end, how did the financial markets respond to these figures? Despite the roller coaster ride in the last few sessions, the leading benchmark indexes finished the trading week in the red. The Dow Jones Industrial Average tumbled about 1.4%, the Nasdaq Composite Index decreased roughly 1.35%, and the S&P 500 shed 1.2%. The U.S. Dollar Index (DXY), which gauges the greenback against a basket of currencies, such as the euro and the Japanese yen, erased close to 0.5%

Now that the Federal Reserve confirmed that it could be raising interest rates multiple times this year, potentially unloading its more than $8 trillion balance sheet, Wall Street and the broader economy will need to go cold turkey from multi-trillion-dollar stimulus injections. But the sugar high that the United States has been on since the early days of the coronavirus pandemic will prove to be an intense habit too challenging to kick. Moreover, the post-pandemic economy has not turned out to be what officials and consumers anticipated, so it can only be sunshine and lollipops from here, right? Right?

~ Read more from Andrew Moran.