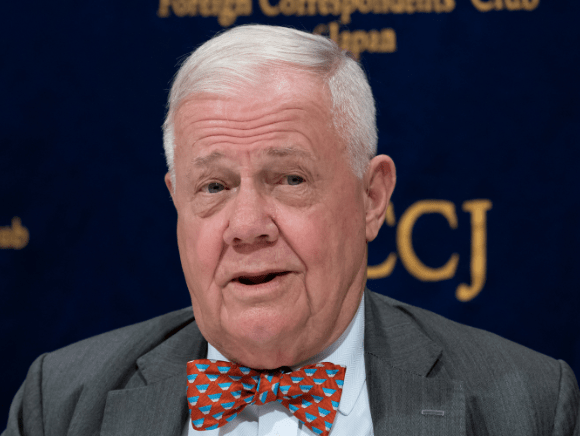

Jim Rogers, the legendary investor and co-founder of the Quantum Fund, has a message for the American people: More pain is to come. The US economy has met the technical definition of a recession – two consecutive quarters of negative economic growth. But don’t tell that to the White House or its allies in the mainstream media. Out of nowhere, the definition of a recession has been tossed into the trash receptacle as policymakers and economic minds sift through the haystack of data to find a needle of positive numbers, mainly in the labor market. However, even if the second quarter is revised higher and a recession is averted, Rogers does not think the worst is over.

Put simply, hold onto your Pepto Bismol.

Jim Rogers: ‘The Worst Is Not Over’

Speaking in an interview with Liberty Nation, Rogers was candid about his confidence – or lack thereof – in the Leviathan, noting that the government is always the last to know if the economy is in a recession. “In the last recession, we were in a recession and the government insisted we were not. They didn’t know what was going on. They rarely do,” Rogers told LN. “We probably are in a recession. But the worst is not over. We have worse to come before this is over.”

Before the 2008-2009 meltdown, Rogers was one of the few people to appear on CNBC, Fox Business, Bloomberg, and other business media outlets to sound the alarm about a coming financial crisis. At the time, many of the experts scoffed at this notion, with the hosts going on the defensive and pointing to a plethora of data suggesting that the United States was not about to slip into a severe economic downturn.

More than a decade ago, Rogers alluded to the massive increase in debt in both the public sector and the private economy. Since then, the debt has skyrocketed across the globe, Rogers noted. “The United States alone has gone up by trillions of dollars. Japan has more debt every day. I mean, it’s amazing how much debt has been piled up,” he purported. “So, the next recession has to be the worst in my lifetime. I’m not trying to scare anyone. I’m just stating a few facts.”

Federal Reserve Chair Jerome Powell, who claimed that inflation was transitory, has insisted that navigating a soft landing is still possible, although that path has “narrowed” in recent months. Despite achieving a so-called neutral rate of 2.5% at the July Federal Open Market Committee (FOMC) policy meeting, many people, including Jim Rogers, are skeptical that this will be accomplished and a recession will be averted. “The central banks around the world rarely know what’s going on. There have been a few good central bankers in the past,” he averred. “They’re bureaucrats and academics, and they’re trying to save their jobs. They don’t care about you and me. They care about saving their jobs.”

Rogers, who is currently residing and working in Singapore, enjoys an outside perspective of what is presently transpiring under President Joe Biden. His verdict on the US administration? Not good, telling LN that he has yet to see anything positive from Mr. Biden: “He said there was no recession, no inflation. Don’t worry. He kept telling us that. I mean, if you can tell me something that he has done and it is good for the world, I will consider it and maybe even retract.”

This Ain’t Over

(Photo by John Smith/VIEWpress)

The second-quarter GDP report was one of the most anticipated in modern times. It was meant to confirm Americans’ suspicions that the US is in the middle of a recession. But while some economists will dismiss it due to their political biases, the people know better. This is why the famous William F. Buckley would jest that he would rather be ruled by the first 100 people in the phone book than the entire Harvard University faculty.

The people are struggling. Be it soaring food prices or the higher cost of housing. Main Street is always the first to know if the economy is heading on a downward trend, faced with a 40-year high cost-of-living crisis. A recent Liberty Nation poll found that most respondents think the US is already in a recession. And, as Rogers noted, the government is the last to realize anything of importance. Well, except, perhaps, for a progressive’s preferred pronouns.

But the White House insists that the US economy is transitioning from accelerated post-pandemic gains to slow and steady growth. The data and public sentiment suggest otherwise. Perhaps everyone in the administration, from President Biden to Treasury Secretary Janet Yellen, is hoping for this whole situation to blow over and rescind into the night. However, as the legendary actor Charles Bronson would say in his Death Wish films, “This ain’t over.”