The 21st century was supposed to belong to China, a conquering red dragon that ascended to the top of the mountain by supplying the global economy with trillions of dollars in goods and services through cheap labor, subsidized manufacturing, and a devalued yuan. However, despite Beijing trying to suppress economic fundamentals like the three million Uyghurs confined to concentration camps, the laws of accounting and finance keep popping up and creating headaches for the Chinese Communist Party (CCP). From the 2015 stock market crash to the collapse of Evergrande to the post-crisis anemic growth, the last 20 years have proven that the fragile house of cards that the world’s second-largest economy is built on will come crashing down anytime there is a gust of wind. But can Wall Street bail out the Asian powerhouse?

Big Banks Making Big Yuan

(Photo Illustration by Sheldon Cooper/SOPA Images/LightRocket via Getty Images)

When former President Donald Trump signed a landmark trade agreement with the Chinese government, he opened the floodgates of capital into China. As part of the billionaire real estate mogul’s long list of grievances, he pushed the regime to allow more U.S. companies, particularly from Wall Street, to establish a greater presence in the country. While the agricultural side of the trade pact garnered much of the attention, the accelerated push of the big banks into China has certainly become a consequential initiative. Indeed, this has been a mixed bag for the United States, especially in relation to the tense geopolitical situation between the planet’s two most powerful nations.

This past summer, BlackRock became the first foreign asset manager to control a wholly-owned business in China’s $4.6 trillion mutual fund industry. In the fall, the Wall Street titan launched an equity fund in China, raising more than $1 billion from about 111,000 investors. Other major banks, such as Fidelity, JPMorgan Chase, and UBS, have established investment funds and attained stakes in Chinese companies and brokerage firms. Although the paper tiger is going through a slow-moving economic downturn, many of the international investment firms see opportunities, dismissing the myriad of red flags planted along the path to the country.

“If we look at these fundamentals, and you stretch over a longer period of time, I think we’re actually in a pretty good buying spot,” Howard Wang, head of Greater China equities at JPMorgan Asset Management, told CNBC last spring. “The time to position in the China market is right now,” said Lucy Liu, a portfolio manager for global emerging markets equities at BlackRock, at a November 2021 briefing. “There are certainly a host of challenges that China is facing right now — but we would push back quite vigorously on the sweeping statement that China is ‘uninvestable,’” said Timothy Moe, Goldman Sachs’ chief Asia-Pacific equity strategist, in an interview with the business news network in October.

It makes sense why some executives on The Street are terrified of hurting the CCP’s feelings. As Liberty Nation reported, JPMorgan Chase CEO Jamie Dimon angered the leadership with a joke about the bank lasting longer than the government, resulting in demands that the China Securities Regulatory Commission (CSRC) remove specific approval permits. Dimon groveled and apologized, following in the footsteps of other brands and celebrities.

So, while equity funds and Wall Street giants are poised to generate enormous revenues in a market of hundreds of millions of consumers and investors, they are also funding the CCP and supporting the People’s Liberation Army (PLA) and lending an indirect hand to the plethora of authoritarian measures employed against the public.

Investing in Communism

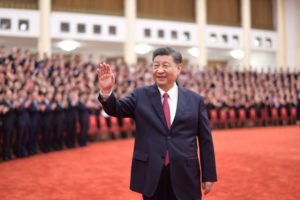

President Xi Jinping (Photo by Xie Huanchi/Xinhua via Getty Images)

President Xi Jinping and the CCP essentially run the Chinese economy. Be it state-owned enterprises or companies with connections to the CCP, corporations and small- and medium-sized businesses (SMBs) operate based on the whims of the central government. Depending on their size, Chinese entities, even if they offer little value to the overall marketplace, will be routinely bailed out through more lavish state subsidies, the liquidity provided by the People’s Bank of China (PBoC), or forced mergers with larger companies. This is Zombie Economics 101 and it is all about adding a modicum of growth to the gross domestic product (GDP) by any means necessary.

Whether it is a China clean energy exchange-traded fund (ETF) or a broad Chinese-focused mutual fund, investors are sending U.S. capital to these businesses. Two things have happened in recent years: investment banks increased their exposure to the Chinese economy, and the CCP has applied pressure on index providers to elevate their Chinese weighting (China accounts for about 40% representation in emerging market funds). Both developments have ensured everyone with access to the financial markets, be it retirement plans or passive funds, has financially supported a state that, according to the official line in Washington, is a national security threat.

What’s more, institutional investors and armchair traders could be funding organizations engaged in ubiquitous practices, such as mass surveillance of the population, or industries that ostensibly threaten the U.S., like weapons manufacturing for the infantry equipment utilized by the PLA. For example, the Thrift Savings Plan, which secures retirement investments for U.S. armed services members, had parked money into Aviation Industry Corporation, a government-owned supplier of Chinese military craft, before pulling out amid bad publicity.

“To put a finer point on it, if the big money managers had gotten their way, American military personnel would have been unwittingly helping to finance the building of planes that could one day be used to attack them or U.S. interests,” wrote Cliff Sims, the former U.S. Deputy Director of National Intelligence for Strategy and Communications, in an op-ed for Fox News.

Put simply, U.S. investors are funneling money to China that would be in direct opposition to the federal government’s economic and trade policy.

Is the Tide Turning?

From Silicon Valley to Wall Street, corporations have defended their actions by participating in moral relativism or pretending to be peacemakers. These institutions have been quick to denounce the United States system for every transgression after graduating from Wokeology 101. But they are typically silent on the plethora of human rights abuses committed across China. Corporate executives have told Congress that they operate within the confines of America’s foreign policy, and if lawmakers desire to institute restrictions on trade with China, then they would happily adhere to these requirements. Finally, their wishes could be coming true.

From Silicon Valley to Wall Street, corporations have defended their actions by participating in moral relativism or pretending to be peacemakers. These institutions have been quick to denounce the United States system for every transgression after graduating from Wokeology 101. But they are typically silent on the plethora of human rights abuses committed across China. Corporate executives have told Congress that they operate within the confines of America’s foreign policy, and if lawmakers desire to institute restrictions on trade with China, then they would happily adhere to these requirements. Finally, their wishes could be coming true.

In a September opinion piece published in The Wall Street Journal, Securities and Exchange Commission (SEC) head Gary Gensler wrote that the body could be “required to restrict trading in about 270 China-related companies by early 2024.” However, considering how China and its state-owned corporations exploit the powers of the Swamp through lobbying, shell companies, and Greenfield Investments, it would not be surprising if this edict were swept under the rug and buried in a barrel of fortune cookies.

Beijing is hanging on by a thread because the Chinese economy is facing a period of stagflation and could mirror the Lost Decade of the 1990s a la Japan. Should Corporate America pull back its massive bombardment of capital and transfer operations to regional neighbors, China would be in significant trouble, eventually prompting officials to modify their public policies. It would be similar to South Africa in the 1980s when the financial sector divested from the country over Apartheid. Based on the sentiments conveyed by the likes of Apple CEO Tim Cook, BlackRock CEO Larry Fink, or NBA Commission Adam Silver, the odds if divestment are about as low as Beijing accomplishing its COVID Zero strategy.

~ Read more from Andrew Moran.