All it took for the Federal Reserve and the White House to admit they were wrong was 30-year high inflation, skyrocketing producer prices, a global supply chain crisis, and an energy calamity. Nearly 12 months after declaring that inflation would not arrive on the shores of the United States, the two most powerful institutions in the world are finally pivoting and coming up with a series of excuses for why they earned a platinum sombrero. But their blindness to the economic problems gripping the nation in 2021 potentially validated the great William F. Buckley’s assertion that he would rather be ruled by the first 100 people in the Boston phone book than the Harvard faculty.

Transitory Retires from Fed Lexicon

Speaking in front of the Senate Banking Committee on Dec. 1, Fed Chair Jerome Powell, who was recently nominated for a second term, revealed that he anticipates inflation will continue running hot into the middle of next year. However, the central revelation from this semi-annual congressional appearance was his forceful retirement of the term “transitory.”

Although he noted that the central bank possesses a different definition of the word than the general public, Powell argued that it is time to dump the term into the trash bin. He told Sen. Pat Toomey (R-PA):

“So I think the word transitory has different meanings to different people. To many, it carries a time, a sense of short-lived. We tend to use it to mean that it won’t leave a permanent mark in the form of higher inflation. I think it’s probably a good time to retire that word and try to explain more clearly what we mean.”

Powell also assured lawmakers that the Eccles Building would not be sitting on the sidelines and twiddling its thumbs. Instead, he noted, the Fed will employ the appropriate measures to ensure inflation does not “climb indefinitely.” “We will use our tools to make sure that higher inflation does not become entrenched,” he stated.

Yellen’s Turn to Kibosh Transitory

Janet Yellen (Photo by Alex Wong/Getty Images)

Testifying in front of the House Financial Services Committee, Treasury Secretary Janet Yellen told legislators that President Joe Biden’s $1.9 trillion was a “small contributor” to the inflation problems paralyzing the United States today. However, she was quick to point out that the stimulus package, which included large stimulus checks that were pumped into the economy, did not overshoot demand and behave as a chief benefactor to the 6.2% CPI environment.

“It’s certainly true that the American Rescue Plan put money in people’s pockets … and contributed to strong demand in the U.S. economy, but if you look at the amount of inflation that we have, and its causes, that is at most a small contributor,” she said.

Yellen, too, echoed Powell’s recommendation “to retire the word transitory,” despite arguing for several months that inflation would be short-lived. “I can agree that that hasn’t been an apt description of what we are dealing with.” The former head of the Federal Reserve System added that the Omicron variant could “exacerbate supply chain and inflation problems.” But Yellen hopes that it is “not something that’s going to slow economic growth significantly.”

Yellen About the Powell Pivot

In economics, it is said that analysts should wait for a few months until public policy seeps into the economy and impacts the country. It has been several months since President Biden licked the back of postage stamps and mailed the stimulus checks to households nationwide. What has happened? Inflation is soaring, driven by the trillions of dollars in deficit-financed spending, and it is not showing any signs of slowing down.

But while critics who contended that inflation would become a permanent fixture of the economic recovery since the early days of the pandemic are vindicated, Powell and Yellen are shifting the goalposts. They now insist inflation will finally subside sometime in the middle or late 2022. The Treasury Secretary even recently suggested that inflation would reach its final curtain right before the mid-term elections. With a putrid record, can any serious person believe the latest prognostications?

But while critics who contended that inflation would become a permanent fixture of the economic recovery since the early days of the pandemic are vindicated, Powell and Yellen are shifting the goalposts. They now insist inflation will finally subside sometime in the middle or late 2022. The Treasury Secretary even recently suggested that inflation would reach its final curtain right before the mid-term elections. With a putrid record, can any serious person believe the latest prognostications?

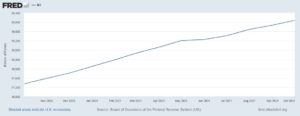

The U.S. government continues to spend trillions of dollars it does not have. The nation’s money supply is still growing, and interest rates may not be bound for liftoff for another several months. Meanwhile, the national debt, the federal deficit, and the government’s unfunded liabilities and expenditures swell. Indeed, the corridors of power are stuck between a rock and the printing press. The Biden administration and the central bank can either taper fiscal and monetary stimulus to combat inflation while threatening growth or keep firing on all cylinders to sustain growth and endure rampant inflation.

~ Read more from Andrew Moran.