What is going on with the US economy these days? For the second time this year, the United States has been slapped with a credit downgrade. The first occurred this past summer when Fitch Ratings blindsided the financial markets and the White House by cutting the long-term foreign-currency issue default rating from AAA to AA+, citing “expected fiscal deterioration over the next three years.” Moody’s has now entered the picture.

In the Moody’s for a Downgrade

Moody’s Investors Service trimmed its rating outlook on the US government to negative from stable. The agency attributed the downgrade to the country’s fiscal health and political polarization. Here is what the organization stated in its report:

“In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues. Moody’s expects that the US’ fiscal deficits will remain very large, significantly weakening debt affordability.

Continued political polarization within US Congress raises the risk that successive governments will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability.”

It was not all bad news, however, as Moody’s kept the long-term issuer and senior unsecure ratings of the US at AAA. Still, the current administration was unhappy with the decision, blaming “congressional Republican extremism and dysfunction” for this shift to a negative outlook. Deputy Treasury Secretary Wally Adeyemo also disagreed with the assessment because the US economy remains strong, and “Treasury securities are the world’s preeminent safe and liquid asset.”

It was not all bad news, however, as Moody’s kept the long-term issuer and senior unsecure ratings of the US at AAA. Still, the current administration was unhappy with the decision, blaming “congressional Republican extremism and dysfunction” for this shift to a negative outlook. Deputy Treasury Secretary Wally Adeyemo also disagreed with the assessment because the US economy remains strong, and “Treasury securities are the world’s preeminent safe and liquid asset.”

Treasury bonds were safe and liquid, but now, this corner of the global financial markets faces liquidity and demand challenges. Plus, the volatility in yields has led to growing concerns that these securities are not as secure as they were. Indeed, this week, the Treasury auctions for long-term duration bonds were disappointing.

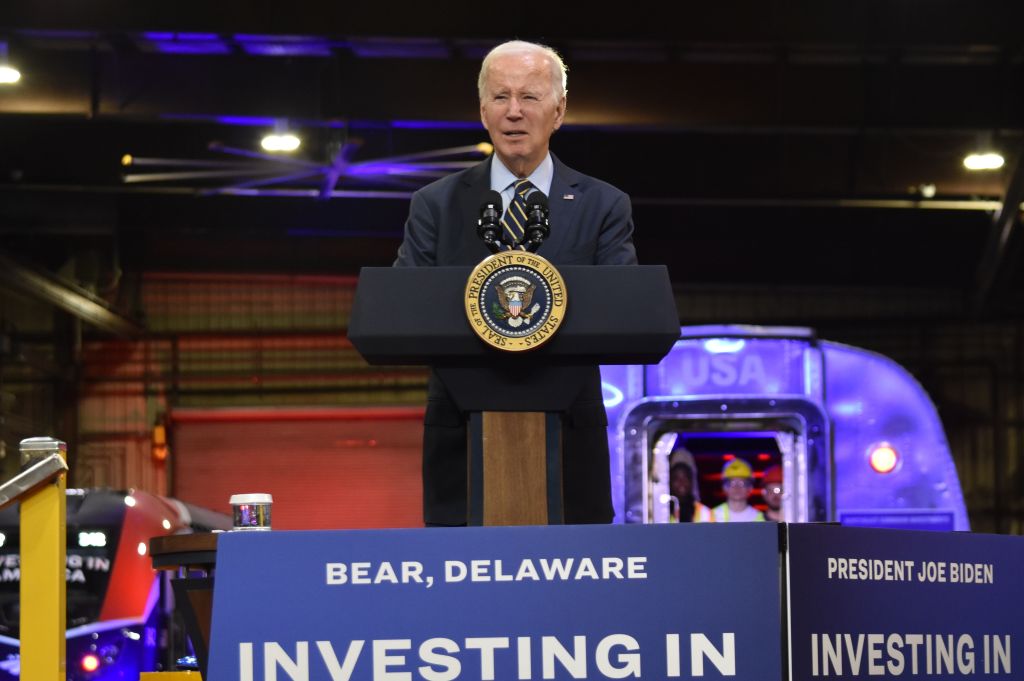

What the heck has Bidenomics done to the world’s largest economy?

Ray of Sunshine at Disney

Disney earnings beat market expectations in the fourth quarter, helping the media company record a weekly gain of around 3%, fueled by a November 9 rally of 6%. The woke titan posted a better-than-expected profit, continued growth at theme parks, and additional Disney+ subscribers. It also plans to expand its cost-cutting measures by an extra $2 billion to a target of $7.5 billion. Looking ahead, CEO Bob Iger aims to achieve sustainable profitability in Disney streaming, building ESPN into a digital sports platform, bolstering the output of its film studios, and “turbocharging growth in our parks and experiences business.”

Over the last 12 months, Disney shares have tumbled around 7%. What was once the premier stock on Wall Street has metastasized into a lackluster holding. Put simply, if you purchased the stock about ten years ago and held it since your return would be flat.

Vox’s Inflation Epiphany

The New York Times recently discovered that inflation affects the entire country and that prices have not fallen. The Gray Lady of New York conceded that “most prices have not fallen. Only their rate of increase has.” The newspaper may need to step aside because another publication has quite the analysis.

Vox, a left-leaning website, published a November 8 article titled “The problem isn’t inflation. It’s prices.” Huh? Indubitably. While the headline was probably one of the funniest of 2023, the news outlet continued: “The root of what’s going on here can feel obvious: blame inflation, which picked up in mid-2021 and throughout 2022. But that isn’t really the issue anymore, at least not at the current rate, because inflation is coming down. The actual problem here is prices.”

Now, if the piece had been an exploration of monetary inflation, the author would have been given some applause from the Austrian theorists, especially coming from a leftist web portal. The actual definition of inflation is the expansion of the money supply; the consequence is price inflation. Unfortunately, the reporter might have been attempting to do what the White House has done: Convince the public that the US economy is doing well – yes, another downgrade is terrific! – except for the whole higher prices thing. But the writer insists that the American people are wrong, asserting that “the economy is good, and people hate it.”

The article is comparable to the famous line from the 2004 film Collateral: “I shot him. The bullets and fall killed him.”