Fund managers are anticipating recession or stagflation. Consumer sentiment has collapsed. Inflation is being felt across the entire US economy. Businesses – large and small – are pessimistic about the present landscape. The red-hot labor market is beginning to be doused by the Federal Reserve. Every measurement of current economic conditions paints a negative picture of President Joe Biden’s America. Now, the cherry on top is a survey in Texas that has revealed what the state’s business leaders think about the current economy – and the responses are not pretty.

Born in Texas, Killed by Washington

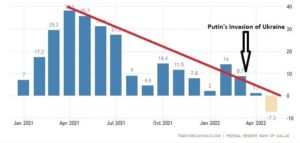

Results from the Fed Bank of Dallas’ Manufacturing Index, a gauge of general business activity for manufacturing in Texas, cratered to -17.7 in June. The reading was down from -7.3 in May and fell to the lowest level since May 2020. The overall survey was abysmal: A key measure of state manufacturing conditions plummeted to 2.3, new orders plunged to -7.3, the growth rate of orders weakened to -16.2, and capacity utilization eased to 1.2. Prices and wages continued trending higher, while business expectations were less optimistic than in previous months. The headline reading was the worst since the early days of the coronavirus pandemic and when Lehman Brothers folded more than a decade ago.

But while the numbers are enlightening to the views of the manufacturing sector in Texas, the comments were even more noteworthy. Survey respondent remarks emphasized over-regulation, widespread inflation pressures, foreign dependence, and concerns over the president’s energy policies.

One business leader is worried about still relying too much on Chinese goods and services, something that “will hurt us in the long run.” Another participant alluded to “Mexican manufacturers gaining more business in the US.” There is another belief that the crude oil industry could considerably weaken as “Biden is promoting a very caustic attitude toward the oil industry, which doesn’t help the country in any way.”

Here are some of the more notable statements made in the monthly study:

Here are some of the more notable statements made in the monthly study:

- “We’ll all be lucky to have a job with two more years of this disaster.”

- “You can’t ignore the economic fundamentals leading to a likely recession, and the administration is either stubborn or as paralyzed as a deer in headlights.”

- “Government overspending and transfer programs have inflated the money supply, while resulting in unchecked corruption and waste. We will be paying that bill for generations, and what a colossal waste of resources and missed opportunity.”

This type of sentiment is concentrated not only in the Lone Star State. The New York Empire State Manufacturing Index was in negative territory for the second consecutive month. The Philadelphia Fed Bank Manufacturing Index contracted in June to -3.3, below economists’ expectations of 5.5 growth. The Kansas City Fed Manufacturing Production Index hit subzero territory, falling to the lowest level since May 2020. Private-sector highlights of the manufacturing index are more mixed.

“Over 85 percent of firms reported delays in shipping and product availability as continued negative impacts on their business activity, with around half of firms not expecting any improvements in the next six months,” said Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, in a statement.

Recession or Stagflation – Pick Your Poison

(Photo by Spencer Platt/Getty Images)

The Fed Bank of Atlanta’s GDPNow model shows 0.3% growth in the second quarter. The Fed Bank of Philadelphia’s Survey of Professional Forecasters anticipates at least 2% expansion in the April-June period. Goldman Sachs, JPMorgan Chase, Nomura, and a panoply of Wall Street investment firms have increased their odds of a recession in 2022 or 2023. But others assert that stagflation – a blend of high inflation and stagnating growth – is a more plausible economic scenario, with billionaire Ray Dalio and economist Mohamed A. El-Erian opining that the Eccles Building’s policies will ultimately lead to a prolonged stagflation ecosystem.

But would a downturn by any other name still result in an unpleasant economy for millions of Americans? Many consumer and business surveys spotlighted an abundance of optimism about the US’ recovery from the COVID pandemic. The spending packages and shutdowns that once seemed so enticing now appear to have done little but degrade the nation’s financial health, even as it opened up for business once more. President Biden’s economic policies have done little to revive the floundering conditions. Unfortunately, the public’s perception of the economy is somewhat like the life span of supermarket fruit. It starts off vibrant, whetting the consumer’s appetite. However, after a few days sitting on a shelf with flies hovering around the produce, it becomes hideous and rots away, disgusting the connoisseur of apples, melons, and durians with their sight and smell. The US economy is rotten fruit that is supported by GMOs and pesticides supplied by Washington.