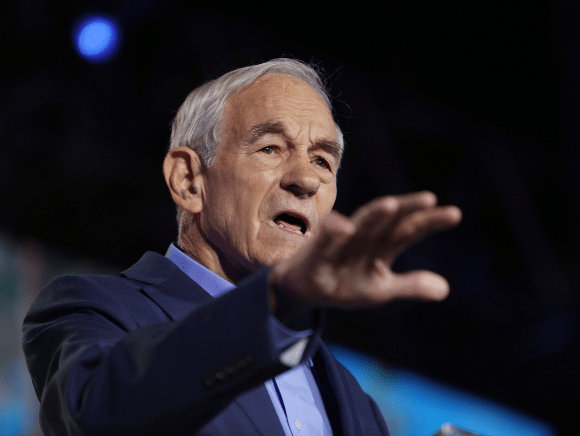

Editor’s Note: This is part one of a two-part series focusing on Liberty Nation’s exclusive interview with Dr. Ron Paul.

US consumer sentiment has collapsed to an all-time low and surveys suggest the American people anticipate inflation to be elevated for longer than was widely anticipated. Investors are fleeing equities on recession fears. The sizzling labor market is slowing down. The Washington establishment has lost all credibility – if it had any in the first place – by insisting that inflation was transitory. And yet, in spite of everything that has transpired over the last 18 months, White House Press Secretary, Karine Jean-Pierre, contends that “we are stronger economically than we have been in history.” This is part of the reason why three-time presidential candidate Ron Paul does not have any optimism that wisdom will come to Washington, D.C., anytime soon.

The Cause of Inflation? Bad Ideas

President Joe Biden and his team have tried to gaslight the country into believing that the economy was running strong, inflation was subdued, and a gallon of gasoline was the same price as ramen noodles at the dollar store before the military conflict in Eastern Europe. According to the current administration, the cost-of-living crisis did not occur until Russian President Vladimir Putin invaded Ukraine, igniting chaos in the global economy. This has been the go-to talking point for months, much like the 9,000 leases poppycock uttered from the lips of every White House official when discussing oil and gas prices.

President Joe Biden and his team have tried to gaslight the country into believing that the economy was running strong, inflation was subdued, and a gallon of gasoline was the same price as ramen noodles at the dollar store before the military conflict in Eastern Europe. According to the current administration, the cost-of-living crisis did not occur until Russian President Vladimir Putin invaded Ukraine, igniting chaos in the global economy. This has been the go-to talking point for months, much like the 9,000 leases poppycock uttered from the lips of every White House official when discussing oil and gas prices.

So, what has been the cause of an 8.6% consumer price index (CPI)? For Dr. Paul, it is about returning to the scene of the crime. In the wake of the coronavirus pandemic, the Federal Reserve unleashed its unprecedented quantitative easing (QE) program, a monetary blitzkrieg that printed trillions of dollars out of thin air and monetized US government debt, resulting in a bubble that offered short-term benefits but will manufacture long-term consequences that have yet to be realized, says Dr. Paul.

“And as long as people take it, people feel good about it, but eventually it gets out of whack,” Paul told Liberty Nation in a recent interview.

But what ramifications will 300 million Americans face, following two years of astronomical fiscal and monetary stimulus? The first is exceptional malinvestment – terribly allocated investments driven by artificially low interest rates and easy money policies – that will add to debt troubles. The second is more inflation, which could result in even more public policy blunders.

The US central bank promises that it can resolve four-decade-high inflation by raising interest rates while also navigating a soft landing. There are two issues with this prescription, notes the former Texas Republican Congressman: The Fed’s manipulation of rates and the many variables associated with soaring prices.

“If it were so simple as to say, the authorities that had debt and they doubled the money supply and therefore prices will go up and they’ll double, it doesn’t work that way,” Paul explained. “Sometimes the money sits around. Sometimes it goes into savings. Sometimes it goes overseas because there’s this human action involved; individuals make these decisions. And that’s why planned economies don’t work. They always fail because they can’t measure what people might do.”

He added that, with excessive money printing, such as what took place during the COVID-19 public health crisis, the government will eventually destroy the currency, which is an economic law that cannot be averted.

“Right now, I don’t have much optimism that there’ll be any wisdom come to Washington DC or to the central bank,” Paul averred. “They’re not gonna change their way. And that’s why I tell people they need to get prepared and understand what’s happening because this system is very precarious.”

Today, inflation is entrenched in the US economy, seeping into every segment of the marketplace. The debate unfolding on Wall Street is whether it has peaked or still has more room to grow. Moreover, can the Eccles Building return inflation to its 2% target rate? Unless the central bank adopts a different course of action and changes its tune, a resolution is unlikely because it is the ideological principles enshrined in the political monolith that is being etched into public policy, says Paul.

The solution, according to Dr. Paul, might be to look at the Constitution again and study economics at the beginning of the United States. He explained that the country had just endured runaway inflation, prompting the Founders to use gold and silver as legal tender rather than paper money. But Paul sees a challenge in the discourse over inflation and the sound money campaign espoused by many Austrian economists. “So, the battle is intellectual. It’s an ideological fight,” Paul says.

‘A Fake System’

‘A Fake System’

The corridors of power have been constructed on a fake system, be it in the universities or in public policymaking apparatuses where there is a paucity of competition. This is why the myriad of problems flooding the country will go unsolved because it is a hive mentality of central economic planning. It is most ubiquitous with the Federal Reserve, where Congress keeps championing the mendacious concept of independence. However, what this means, says Paul, is “they don’t want you to know anything about what really goes on.” With President Biden and Democrats in Congress aiming to make social justice and climate change part of the central bank’s mandates, Paul believes the Leviathan will only grow in size. Due to a lack of intellectual diversity, the American people can only prepare for the same failures in the nation’s capital for many more years to come.