The US is embroiled in another political theater of the absurd. This time it is the debt ceiling: Republicans are politely asking to enact spending reforms, Democrats are demanding to raise it, and former Labor Secretary Robert Reich is blaming everything on tax cuts. Like fellow Keynesian economist Paul Krugman, Reich is on a one-man crusade to advance the progressive cause while ignoring crucial data that would expose his mendacious assertions. His latest contention in a Substack article is that GOP-approved tax cuts have been the sole contributor to the $31 trillion national debt. Not only is this based on emotion rather than facts, but many other details in his piece are also questionable.

Robert Reich Blames Tax Cuts for Debt

After handwringing about “Republican efforts to hold America hostage by refusing to raise the debt ceiling,” he delved into the tax rates under former President Dwight Eisenhower. Many progressives, including Krugman and Sen. Bernie Sanders (I-VT), typically allude to this golden age of tax policy when the affluent were handed a tax bill of more than 90%. But the tax rate and actual amount paid are usually quite different.

After handwringing about “Republican efforts to hold America hostage by refusing to raise the debt ceiling,” he delved into the tax rates under former President Dwight Eisenhower. Many progressives, including Krugman and Sen. Bernie Sanders (I-VT), typically allude to this golden age of tax policy when the affluent were handed a tax bill of more than 90%. But the tax rate and actual amount paid are usually quite different.

So, there are a few things here to discuss. First, a 2012 Congressional Research Service (CRS) study revealed that the 91% tax rate was really 45% for the top 0.01%. Second, the tax code contained many loopholes and deductions, most of which were eradicated by 1986, such as the deduction for passive investment losses on real estate. Third, as a percentage of GDP, the federal government was not collecting any additional revenue.

Reich’s next point is that “the effective tax rate on wealthy Americans has plummeted,” courtesy of former Presidents Ronald Reagan, George W. Bush, and Donald Trump.

“Even as they’ve accumulated unprecedented wealth, today’s rich are now paying a lower tax rate than middle-class Americans. (The 400 richest American families paid a tax rate of just 3.4 percent between 2014 and 2018, while the rest of us paid an average tax rate of 13.3 percent.),” Reich wrote. “One of the biggest reasons the federal debt has exploded is that tax cuts on wealthier Americans have reduced government revenue.”

These figures elicit some questions. According to a White House report, the wealthiest 400 American families paid an 8.2% tax rate. A separate report by economists at the University of California at Berkeley suggests that the average effective tax rate paid by the richest 400 Americans was 23%. Perhaps Reich is alluding to the lowest number to win the argument. Even if his percentage were accurate, context does matter. Indeed, paying 3.4% on $1 billion is greater than paying 13.3% on $32,000 (the median US income as of 2019): $34 million compared to $4,256.

These figures elicit some questions. According to a White House report, the wealthiest 400 American families paid an 8.2% tax rate. A separate report by economists at the University of California at Berkeley suggests that the average effective tax rate paid by the richest 400 Americans was 23%. Perhaps Reich is alluding to the lowest number to win the argument. Even if his percentage were accurate, context does matter. Indeed, paying 3.4% on $1 billion is greater than paying 13.3% on $32,000 (the median US income as of 2019): $34 million compared to $4,256.

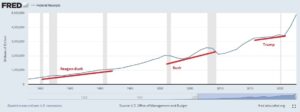

The heart of his analysis is that tax cuts under three presidents led to reduced government revenue. However, based on data from the Office of Management and Budget (OMB), federal receipts were higher by the time these three GOP presidents left office than when they arrived, and federal receipts as a percentage of gross domestic product (GDP) are higher now than during the 1950s paradise many leftists dream about.

Finally, Reich is correct to be concerned about rising interest payments on the national debt. Before the Federal Reserve started raising interest rates, White House budget projections showed that annual interest costs would soon be $1 trillion. As a percentage of GDP, the US government currently spends about 2% on interest, the highest in about two decades. It will top 3% in the next decade, although this figure will likely be much higher than the Treasury estimates. But he is blaming wealthy Americans for this mess rather than politicians in both parties who cannot grasp the concept of fiscal responsibility.

Robert Reich Photo by Win McNamee/Getty Images)

Washington enjoys record revenues, but officials have spent more than $6 trillion annually for three consecutive years, failing to record a balanced budget since 2001. Moreover, early predictions show that the federal government will spend another $6 trillion in the current fiscal year. If lawmakers cannot balance the budget and prevent higher interest payments with all-time high receipts, there is something wrong with the Swamp.

Greed

The left will lambast anyone, especially the affluent, for wanting to keep more of their money that can be used to build factories, invest in companies, and hire workers. According to stalwarts of leftism, it is greedy to refrain from handing over hard-earned dollars and cents to the state so politicians can waste these funds on gender initiatives in Pakistan, footwear in Ethiopia, cocaine for hamsters, and mismanaged entitlement programs. But, as legendary economist Thomas Sowell stated, “People who are forever ready to charge others with ‘greed’ never apply that word to the government.” Even if billionaires did not pay a cent on their assets, would they be justified considering the horrific track record of the Leviathan? Instead of begging and confiscating more every time there is an immense hole in the federal budget, progressives, activists, and bureaucrats should first encourage better management of taxpayer dollars before putting their hands out like Oliver Twist.