Hooray! After showing no signs of grinding to a halt, crude oil prices are finally coming down. West Texas Intermediate (WTI) and Brent contracts have crashed below $100 a barrel, leaving the commodity chasers holding the bag and begging that energy futures could resuscitate this ultra-bull run. So, what happened for fossil fuels to suddenly initiate a significant turnaround in a short period? The left will convey to the public that President Joe Biden’s vast intellect and tremendous policies contributed to this decline. But while this would be politically expedient for an unpopular administration, it is a bit more complicated than “Biden good.”

Oil, What’s Your Deal, Bruh?

Over the last week, WTI prices have crashed 23% on the New York Mercantile Exchange and Brent has slumped roughly the same on London’s ICE Futures exchange. Despite their epic losses, they are still up nearly 30% year-to-date. But the notable reversal has some scratching their heads at what is happening.

Hedge funds trimmed their net-bullish positions and took profits early. This trading decision led to the sharpest selloff since the early days of the pandemic when crude fell below zero for the first time in its history. This created a contagion effect for retail traders, many of whom began chasing the momentum and anticipated additional gains. When the red ink flooded their portfolios, they panicked and sold – the new adage for armchair investors is apparently buy high and sell low in this environment.

The phrase “buy the rumor, sell the news” has also been at play. Since the beginning of the invasion, all the speculative bets priced in the plethora of bad news, from America’s embargo on Russian oil to military escalation in Eastern Europe. As Liberty Nation recently noted, the financial markets are always front-running the globe.

The phrase “buy the rumor, sell the news” has also been at play. Since the beginning of the invasion, all the speculative bets priced in the plethora of bad news, from America’s embargo on Russian oil to military escalation in Eastern Europe. As Liberty Nation recently noted, the financial markets are always front-running the globe.

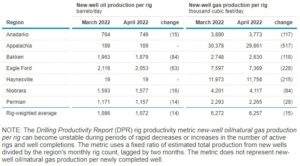

The US Energy Information Administration (EIA) dampened hopes of oil testing $150 after it published the Drilling Productivity Report. Study authors estimated that US shale production at several of the nation’s most prominent shale basins is poised for substantial output, with tens of thousands of barrels per day (bpd) being produced. But this is not a guarantee, says Julianne Geiger, a researcher for Oilprice.com:

“Regardless of the EIA’s estimate for additional crude oil next month, projecting U.S. shale oil production isn’t an exact science. For its February report, the EIA had forecast that March’s crude production would reach 8.707 million bpd in the seven most prolific basins covered by the report. Instead, March’s production reached only 8.591 million bpd, with production in the Permian undershooting EIA forecasts by 60,000 bpd.”

In recent days, there have been growing expectations that more oil-producing countries will begin turning on the taps to offset the removal of Moscow’s energy products. Right now, the world is monitoring a few locations to determine if operations are restarting: Venezuela, Iran, and Saudi Arabia.

The White House is speaking with President Nicolas Maduro about potentially lifting sanctions, a move that could allow Caracas to flood the global energy markets with oil. Despite mirroring the authoritarianism and brutality of President Vladimir Putin, it seems that it is permissible to buy crude from a different dictator in the impoverished South American socialist paradise.

Boris Johnson (Photo by Mark Cuthbert/UK Press via Getty Images)

British Prime Minister Boris Johnson is ostensibly on a goodwill tour in the Middle East, speaking with members of the Organization of Petroleum Exporting Countries (OPEC) to perhaps expand production. While Riyadh has offered to offset Moscow’s dismissal from the worldwide marketplace, it is unclear if the Kingdom would buck the cartel and start pumping out massive amounts of oil. But some traders are so optimistic that they are hitting the “sell” button on their WTI and Brent contracts.

After its March 15 meeting, OPEC did not seem ebullient on increasing production. The cartel noted that the Russia-Ukraine war could undercut crude demand, prompting the entity to reassess its forecasts. So, if OPEC and its allies, OPEC+, start injecting fresh supply into the markets, this could result in falling prices. And this is never a good thing for the group of 15 nations, especially as they attempt to recover from the financial crisis during the public health crisis.

India irked the commodity bulls and pleased the commodity bears by reportedly purchasing Russian crude at a considerable discount. Since the Kremlin has a smaller number of markets to sell to, the Indian government is, at the very least, mulling over oil-related transactions with Russia. But could this trigger a geopolitical fallout with the West?

China is locking down millions of people over outbreaks throughout the world’s second-largest economy. Beijing shuttered Shenzhen, a city located in Guangdong. This could lead to devastating consequences for both the energy market and the worldwide economy since it contains about one-fifth of arriving cargoes and maintains a gross domestic product of nearly $2 trillion. Reports are already coming out about increasing congestion at many seaports.

Iran will be consulting with Russia over the US nuclear deal. Iranian Foreign Minister Hossein Amir-Abdollahian is scheduled to travel to Moscow to discuss the agreement, something that the world is watching intensely. Should Tehran and Washington establish a deal, it could abolish sanctions and allow the energy heavyweight to flood the international energy markets with as much as 80 million barrels of oil.

Iran will be consulting with Russia over the US nuclear deal. Iranian Foreign Minister Hossein Amir-Abdollahian is scheduled to travel to Moscow to discuss the agreement, something that the world is watching intensely. Should Tehran and Washington establish a deal, it could abolish sanctions and allow the energy heavyweight to flood the international energy markets with as much as 80 million barrels of oil.

Poor Options Traders

Liberty Nation recently reported about options bets that oil would touch $200, while the Kremlin warned prices could hit $300. At this point, it seems unlikely, although the fundamentals are still relatively strong due to the supply-demand imbalance. What about inflation prospects? The easing of oil prices will help relieve inflationary pressures in the April Bureau of Labor Statistics (BLS) data, but the worsening supply chain crisis could offset this. Put simply, US motorists might enjoy some relief at the pump in the coming weeks or months, but this could be offset by swelling prices throughout the broader marketplace. Brother, can you spare a nickel?

~ Read more from Andrew Moran.