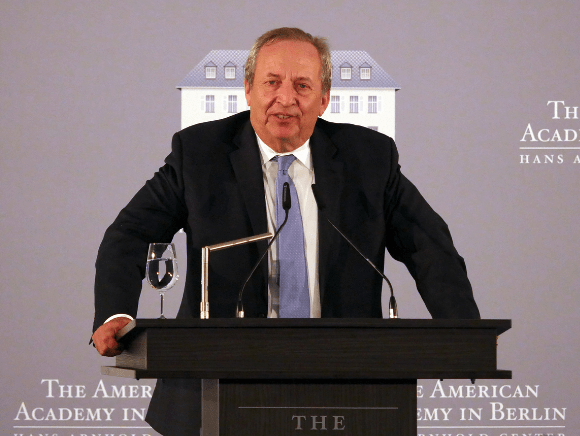

Some left-leaning economists have abandoned the Democratic Party in favor of economic principles. In recent months, one Democratic foot soldier that has been decent in critiquing Bidenomics is none other than former Treasury Secretary Larry Summers. Unfortunately, the good times did not roll with his latest suggestion to sanitize the economy of the foul stench emanating from the current administration. Summers asserted that the US would need to destroy millions of jobs and trigger higher joblessness to fight inflation and rescue the economy. “We need five years of unemployment above 5% to contain inflation — in other words, we need two years of 7.5% unemployment or five years of 6% unemployment or one year of 10% unemployment,” he said during a speech in London.

So, is there some truth to this wild supposition, or is this nothing more than Keynesian nonsense?

[substack align=”right”]Summers Time – When Keynesianism is Easing

The Federal Reserve has been trying to curb demand in a scarce global market by turning ultra-hawkish, raising interest rates by 75 basis points at the June Federal Open Market Committee (FOMC) policy meeting. The Fed is expected to pull the trigger on another three-quarter-point rate hike in July, with many market experts forecasting a 50-basis-point increase in September. Remember, despite this path toward neutrality, the real interest rate remains negative (inflation-adjusted).

This idea comes from the Phillips Curve, named after economist A.W. Phillips. It suggests that there is an inverse correlation between unemployment and inflation: low unemployment and high inflation; high unemployment and low inflation. Although this was refuted in the aftermath of the 1970s stagflation, as well as by legendary economist Milton Friedman, it is still held dear by many Keynesians.

The chief objective for the central planners is to trim economic activity, a move that would, in their minds, reduce rampant price inflation. As a result of this interventionism, many people would lose their jobs since business investment would slump, consumption would potentially fall, and global commerce would decrease. The layman would say this is a nasty reply to the problem the Leviathan manufactured.

Finally, the labor market tilted in favor of workers in the form of higher compensation and better employment terms. For some reason, the Keynesian statists believe it is time to halt these job trends rather than turn off the printing press inside the basement of the Eccles Building. A reality that the big government acolytes refuse to acknowledge is that sluggish economic activity will cause lower output. When this occurs, particularly in an environment where there is too much liquidity chasing too few goods, scarcity intensifies and prices rise. Remember, the smartest men and women keep saying consumers possess enough of a cushion from pandemic-era savings to endure the tightening!

Perhaps all of these post-pandemic actions emanate from a different philosophical understanding of how 8.6% inflation was born. While soaring food and energy costs dominate the headlines, the mainstream media typically misses what has happened since the early days of the COVID-19 public health crisis. The Federal Reserve injected $9 trillion into the economy, enabling the federal government to spend trillions of dollars in fiscal stimulus and relief efforts. Central banks and governments everywhere emulated this behavior, creating a situation whereby the international marketplace was flooded with astronomical amounts of new units of currency. This unprecedented injection of money led to the exceptional demand the world is witnessing today, straining inventories in every sector and leaving production unable to keep up.

Put simply, money creation was the cause, and higher prices are the effects.

Fed Chair Jerome Powell and Treasury Secretary Janet Yellen acknowledged that they got inflation wrong, underestimating the situation and using their better judgments. They also conceded that poor and middle-income households are going to go through pecuniary pain in the months and perhaps years to come. Indeed, inflation will remain high, debt will be expensive again, and a recession – maybe even worse than the 2008-2009 financial crisis – will make this a polluted ecosystem for quite a while.

The Powell Panacea?

Everything happening today could have been avoided if fiscal and monetary policymakers were a bit more conservative. Rather than firing off the mother of all stimulus and relief packages, the US central bank could have done one of two things: be patient or wind down the fourth round of quantitative easing (QE) once the financial markets stabilized. A Powell pivot would have mitigated much of today’s disastrous effects. Once again, every policy tool hurled from the nation’s capital has been a catastrophe, from coronavirus-related public health to climate change. But the politicians need to act busy to justify their positions.

Right now, the panacea would be to do the opposite of March 2020: dramatically raise interest rates, turn off the printing press, and sell the $9 trillion balance sheet. Instead, the world’s most powerful institution is slowly removing the band-aid rather than ripping it off in one fell swoop. If this is not an indictment of how treacherous the fiat money system is, then what would be in the future?