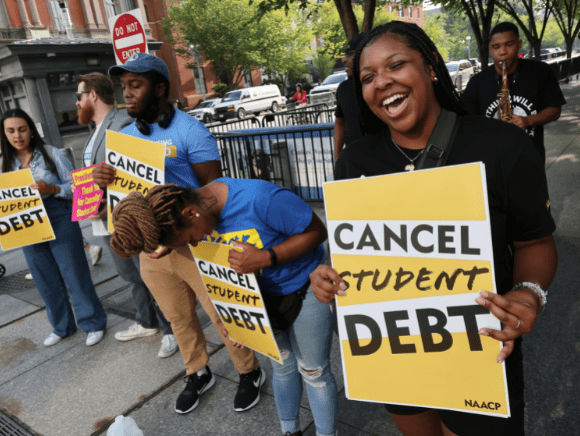

The mainstream media championed President Joe Biden’s student loan forgiveness program as a victory – and then silence. Little did they know that their offensive campaign to revive his ailing presidency ahead of the midterm elections would blow up in their faces. So far, this has been a boondoggle, which is par for the course for this administration. From costs to eligibility, the plan is not proceeding as expected. Could this hurt the Democrats in November? It might metastasize into a case of damned if you do and damned if you don’t for the White House.

The Student Loan Forgiveness Blunder

The first piece of bad news came when the Congressional Budget Office (CBO) released its latest estimates surrounding the cost of President Biden’s plan. According to the non-partisan budget watchdog, the price tag to cancel some debt and pause payments for tens of millions of Americans will be $400 billion. Here is what the CBO stated in its report:

The first piece of bad news came when the Congressional Budget Office (CBO) released its latest estimates surrounding the cost of President Biden’s plan. According to the non-partisan budget watchdog, the price tag to cancel some debt and pause payments for tens of millions of Americans will be $400 billion. Here is what the CBO stated in its report:

“The cost of outstanding student loans will increase by $20 billion because an action suspended payments, interest accrual, and involuntary collections from September 2022 to December 2022, the Congressional Budget Office estimates. That present-value cost is relative to the amounts in CBO’s May 2022 baseline projections.

After accounting for those suspensions, CBO estimates that the cost of student loans will increase by about an additional $400 billion in present value as a result of the action canceling up to $10,000 of debt issued on or before June 30, 2022, for borrowers with income below specified limits and an additional $10,000 for such borrowers who also received at least one Pell grant.”

The second development occurred when the Department of Education altered its online guidance regarding eligibility for the $10,000 student loan forgiveness. It previously stated that borrowers with Perkins loans and Federal Family Education Loans (FFEL) could consolidate them into direct federal loans and qualify for cancelation. As of Sept. 29, the rules were changed, and “borrowers with federal student loans not held by ED cannot obtain one-time debt relief by consolidating those loans into Direct Loans.” This would leave approximately 770,000 sitting on the sidelines.

Bidenflation: Oh, the Humanity!

Will the Federal Reserve ever get to declare “mission accomplished” in its inflation-busting assault? Perhaps, but that day has yet to arrive. Case in point, the central bank’s favorite inflation gauge came in hotter than expected, potentially leaving Chair Jerome Powell and his colleagues dejected, dismayed, and devastated.

Jerome Powell (Tom Williams/CQ-Roll Call, Inc via Getty Images)

According to the Bureau of Economic Analysis (BEA), the personal consumption expenditure (PCE) price index eased to an annualized rate of 6.2, down from 6.4%. However, on a month-over-month basis, it climbed 0.3% in August. In addition, the core PCE price index, which eliminates the volatile energy and food sectors, surged 0.6% month-over-month and advanced to 4.9% year-over-year.

The financial markets plummeted during the Sept. 30 trading session, as the leading benchmark indexes recorded sharp losses. The data reaffirmed the Eccles Building’s objective to raise interest rates, keep them there higher for longer, and refrain from pulling back prematurely. In other words, Powell is unlikely to pivot so he can resurrect price stability.

The Housing Recession Intensifies

You are a god among men if you purchased a home a year ago and locked in a mortgage rate at around 2%. However, if you recently bought a residential property and received a 6% interest rate, everyone will offer you their nearest and dearest sympathies.

Freddie Mac confirmed that the 30-year fixed-rate mortgage averaged 6.7% for the week ending Sept. 29, up 41 basis points from the previous week. In late September 2021, the 30-year rate was 3.01%. As the great Dean Martin famously sang, “Ain’t that a kick in the head.” Meanwhile, the 15-year FRM was 5.96%, up 52 basis points in a single week.

The significant jump in mortgage rates will add hundreds of dollars to the typical monthly payment for prospective homeowners, which could weigh on the broader US real estate market, says Sam Khater, the chief economist at Freddie Mac.

“The uncertainty and volatility in financial markets is heavily impacting mortgage rates,” he said in a statement. “Our survey indicates that the range of weekly rate quotes for the 30-year fixed-rate mortgage has more than doubled over the last year. This means that for the typical mortgage amount, a borrower who locked-in at the higher end of the range would pay several hundred dollars more than a borrower who locked-in at the lower end of the range. The large dispersion in rates means it has become even more important for homebuyers to shop around with different lenders.”

“The uncertainty and volatility in financial markets is heavily impacting mortgage rates,” he said in a statement. “Our survey indicates that the range of weekly rate quotes for the 30-year fixed-rate mortgage has more than doubled over the last year. This means that for the typical mortgage amount, a borrower who locked-in at the higher end of the range would pay several hundred dollars more than a borrower who locked-in at the lower end of the range. The large dispersion in rates means it has become even more important for homebuyers to shop around with different lenders.”

Last month, industry experts warned that the housing market slipped into a recession. With some of the latest data, it is difficult to dispute this call. In August, pending home sales tumbled 2%, while existing home sales slipped 0.4%. But new home sales shocked everyone by soaring by 28.8%. Still, the S&P/Case-Shiller Home Price had its biggest one-month decline on record, falling 0.8%. Moreover, according to the Mortgage Bankers Association (MBA), mortgage applications have declined for nine of the last 12 weeks.

Perhaps it will not be so bad because Chair Powell will one day swoop in, buy some suitable old-fashioned mortgage-backed securities, and add to the astronomical balance sheet!