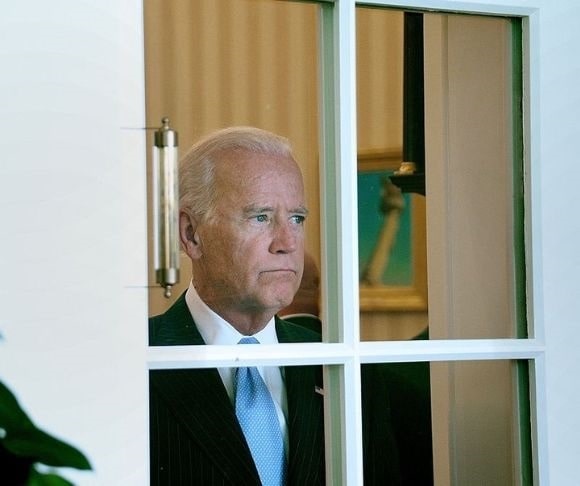

President Joe Biden and his administration have finally reached the seventh stage of grief after soaring inflation. The White House initially denied that any inflation would transpire in the wake of trillions in pandemic-related spending. This later became bargaining with the American people that any uptick in the consumer price index (CPI) would be transitory. Once the cost of living metastasized into a crisis, Biden passed the buck onto his counterpart in Russia. But now, he and a couple of his colleagues have finally admitted that Bidenomics contributed to today’s inflationary environment.

Biden His Time on Inflation Admission

The president recently took a victory lap by announcing that his government will be paying down the national debt for the first time in six years. The Treasury Department is expected to trim the more than $30 trillion national debt by $26 billion, or 0.00086%, in the next couple of months. But this will be offset by the Treasury’s expectation that it will need to borrow nearly $200 billion from private capital markets sometime in the fourth quarter. So, not only is the dollar amount chicken feed, but it will become irrelevant.

The president recently took a victory lap by announcing that his government will be paying down the national debt for the first time in six years. The Treasury Department is expected to trim the more than $30 trillion national debt by $26 billion, or 0.00086%, in the next couple of months. But this will be offset by the Treasury’s expectation that it will need to borrow nearly $200 billion from private capital markets sometime in the fourth quarter. So, not only is the dollar amount chicken feed, but it will become irrelevant.

The real story in all of this is in Biden’s statement and what he – or his team – said on Twitter. “The bottom line is that the deficit went up every year under my predecessor before the pandemic and during the pandemic. And it’s gone down both years since I’ve been here. Period,” he told reporters at a May 4 news conference.

While this is technically true, it is not because the president is a stalwart of fiscal conservatism. There are two main factors. The first is that the economy has been reopening, allowing people to return to work and letting consumers shop again. The second is that most of the costly coronavirus-related stimulus and emergency relief spending packages have expired. So, yes, the government’s finances will be somewhat better when tax revenue is normalizing, and crisis-induced spending is coming down. Only in Washington can politicians champion fiscal responsibility when debts and deficits are still enormously high and continually growing.

“Looking ahead, I have a plan to reduce the deficit even more, which will help reduce inflationary pressures and lower everyone’s costs,” Mr. Biden tweeted recently.

For so long, he abandoned any guilt about the 8.5% annual inflation rate, claiming that his American Rescue Plan (ARP) and other spending endeavors played little to no role in the cost-of-living crisis. However, because his administration might cut the deficit by a fraction of a percent, the president now thinks federal deficits add to inflation pressures. This is about as consistent as economist Paul Krugman claiming that budget deficits matter when Republicans are in charge, and budget deficits do not matter when Democrats are running the show.

Janet Yellen (Photo by Chip Somodevilla/Getty Images)

Treasury Secretary Janet Yellen recently spoke to The Wall Street Journal about the economy and inflation. She conceded that President Biden’s American Rescue Plan (ARP) played a role in inflation.

“So, look, inflation is a matter of demand and supply, and the spending that was undertaken in the American Rescue Plan did feed demand,” Yellen purported, adding that these exceptional spending efforts were “justified” in response to economic risks and an employment crisis.

Indeed, from the Federal Reserve Bank of San Francisco to the Heritage Foundation, many economic analyses have pointed out that injecting the economy with too much money that chased too few goods helped ignite this inflation bomb. The $1.9 trillion ARP might not have been 100% responsible for red-hot inflation, but it played a significant part in skyrocketing prices in nearly every market segment.

Econ 101

Inflation happens when the federal government, supported by the central bank, force-feeds the economy with a fierce and steady diet of money supply expansion that accelerates faster than the growth of goods and services the buck can purchase. The result? Higher prices, effectively eroding consumers’ purchasing power. The global economy is drowning in an ocean of units of currencies, be it dollars or euros. But there is no going back, which is something that Fed Chair Jerome Powell conceded during a recent International Monetary Fund (IMF) event. The cat’s in the bag, and the bag’s in the river. When even prominent Democrats, such as former Treasury Secretary Larry Summers and Obama-era economic adviser Steven Rattner, are informing the public about Biden’s immense spending being a culprit, it might be time to carve this era’s nickname in stone: Bidenflation.